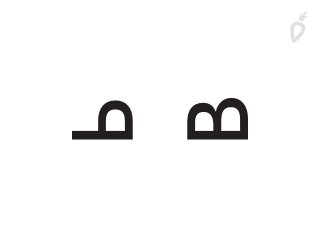

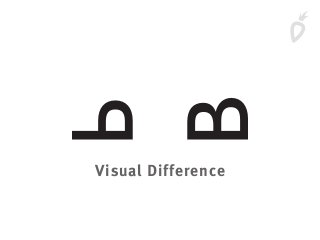

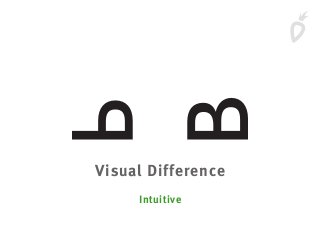

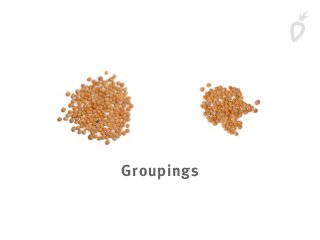

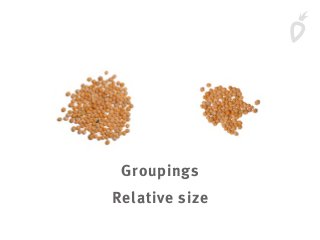

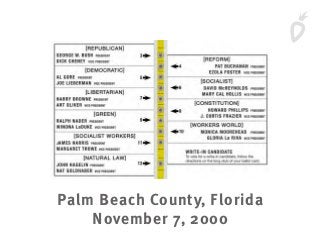

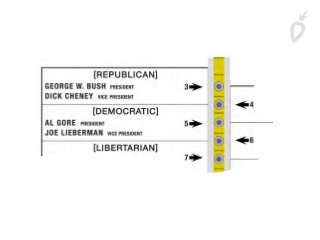

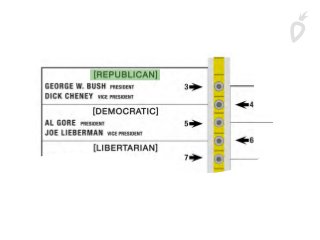

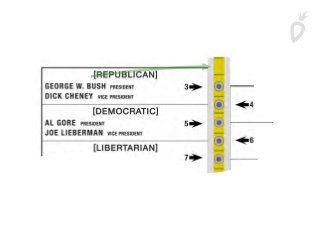

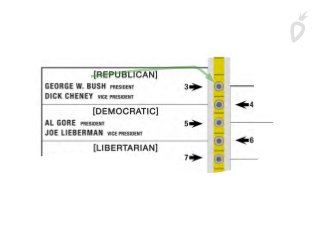

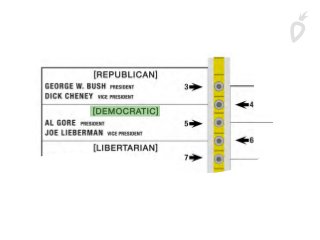

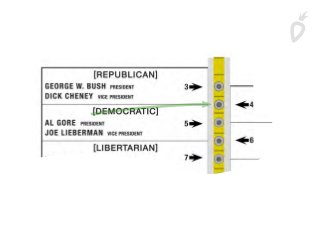

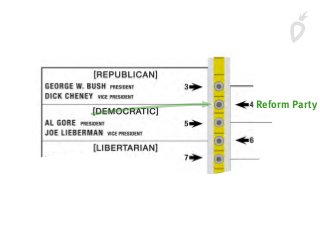

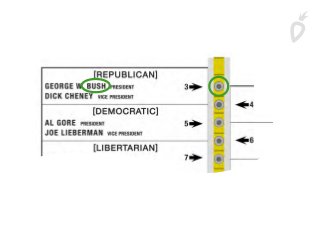

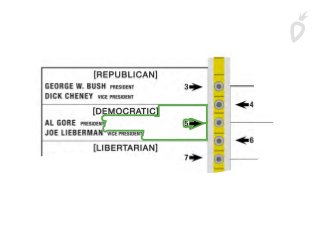

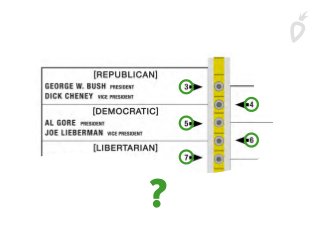

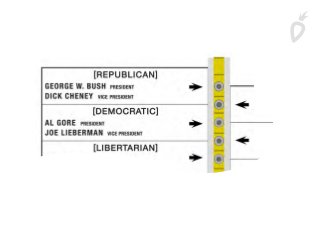

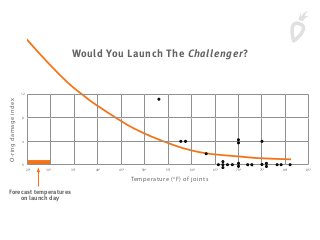

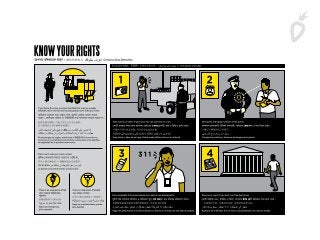

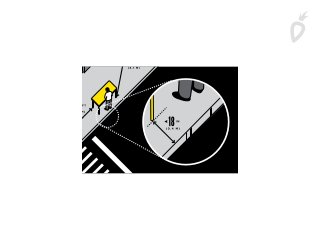

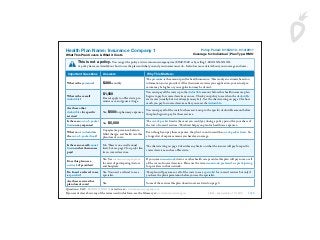

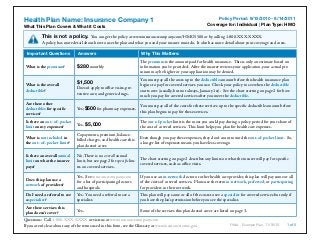

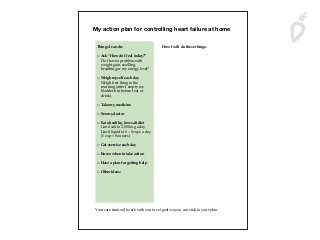

The document discusses the importance of visual cues in plain language writing, illustrated by various examples such as ballot designs, product labeling, and drug administration errors in operating rooms. It emphasizes how effective use of visual cues can improve understanding and minimize mistakes. Additionally, it includes specific instructions for participating in a directed share program, detailing the process for requesting and paying for shares.