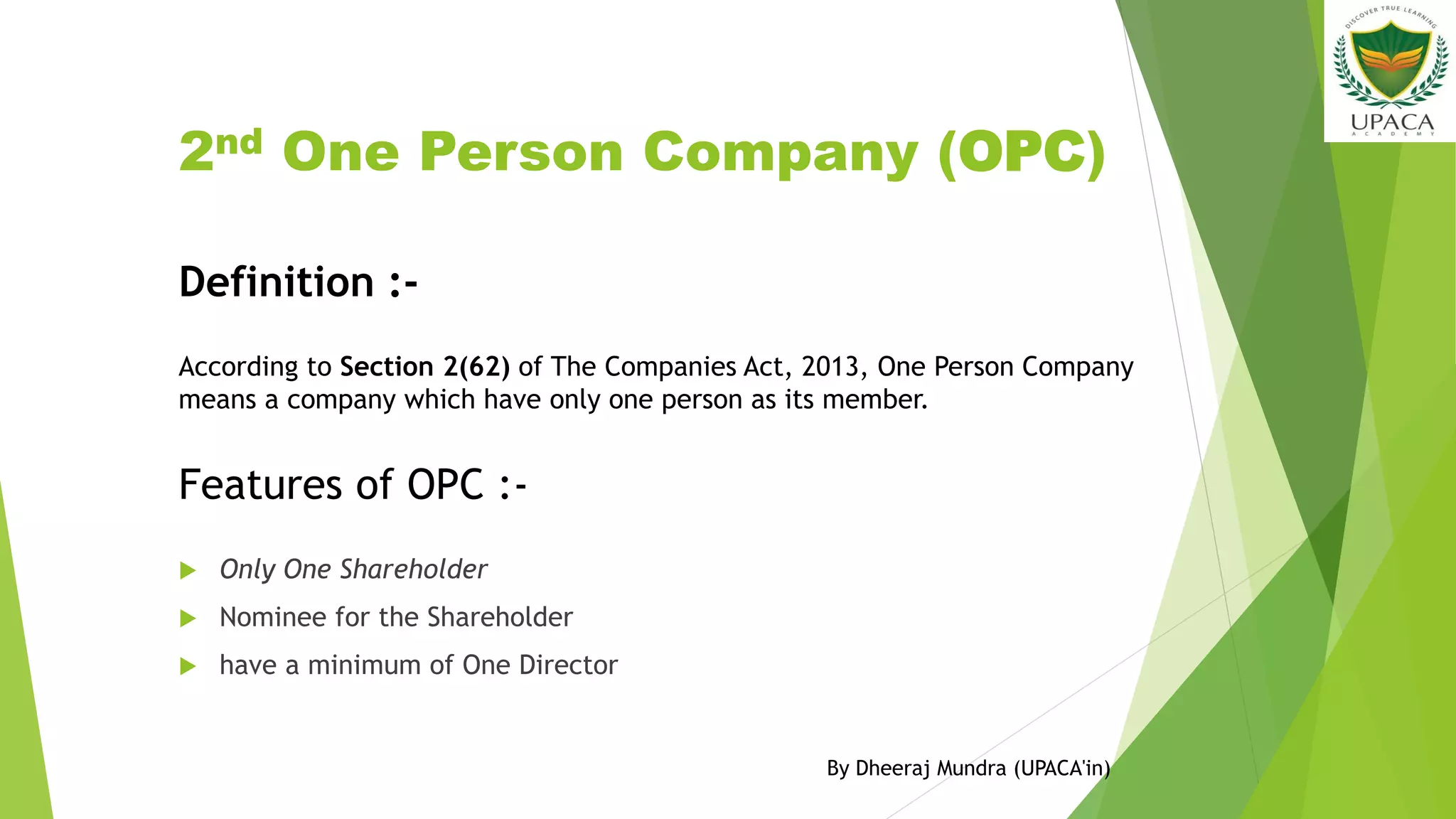

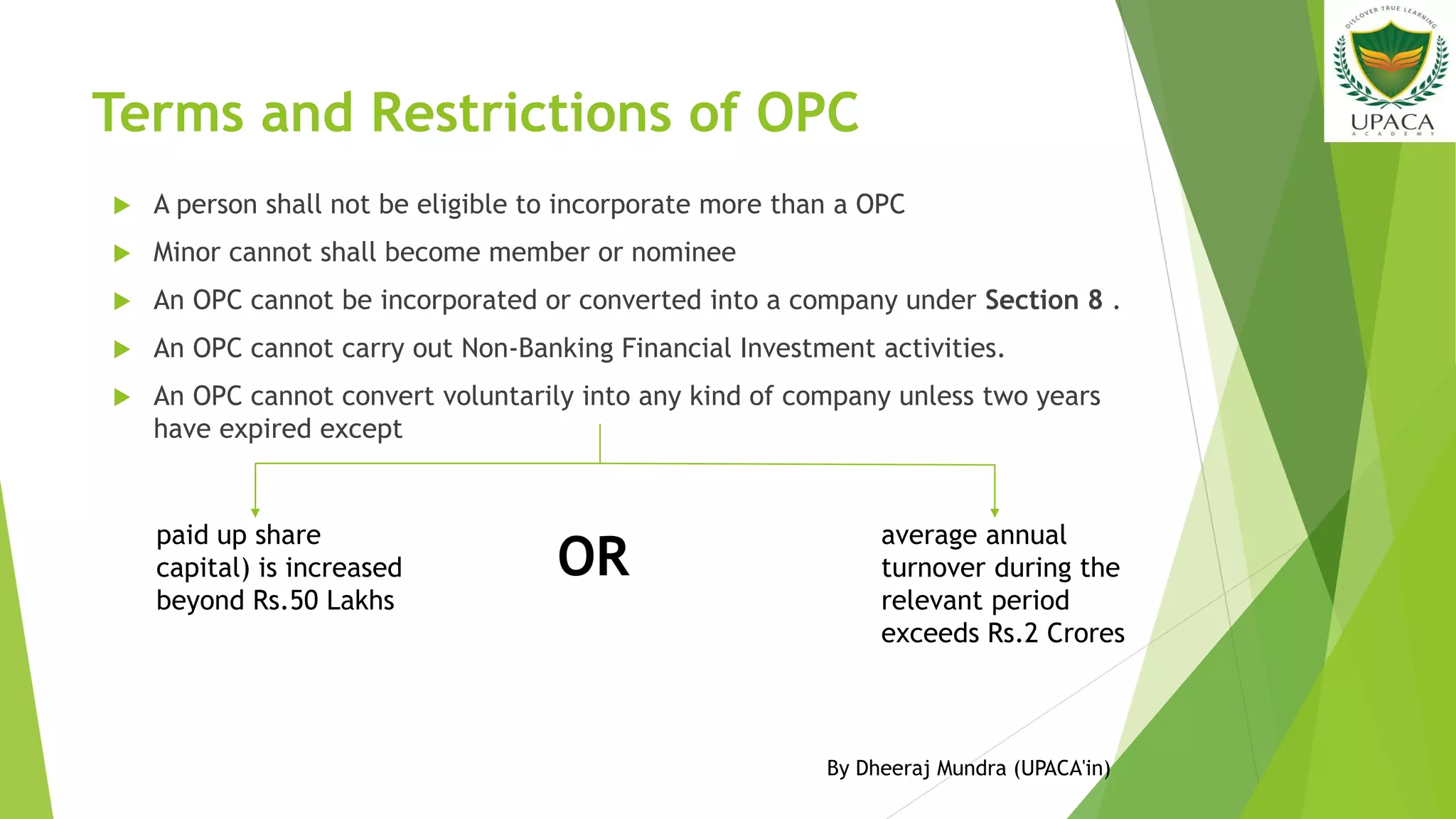

The document provides steps for creating a private or public company in India. It explains that a private company requires a minimum of 2 directors and 2 shareholders while a public company requires a minimum of 3 directors and 7 shareholders. It outlines the process which involves applying for director identification numbers and digital signature certificates, reserving a company name, drafting legal documents, filing forms electronically, paying fees, and receiving final approval and certificate of incorporation from the Registrar of Companies. A separate section provides details on incorporating a One Person Company which can only have one member and director.

![Steps to Incorporate One Person

Company (OPC)

Obtain Digital Signature Certificate [DSC] for the proposed Director(s).

Obtain Director Identification Number [DIN] for the proposed director(s).

Select suitable Company Name, and make an application to the Ministry of

Corporate Office for availability of name in form INC – 1.

After name approval, form INC-2 shall be filed for incorporation of the OPC

within 60 days of filing form INC-1 for incorporation of OPC.

Form DIR-12 shall be filed along with (linked) form INC-2 except when promoter

is the sole director of the OPC.

The company shall file form INC-22 within 30 days once form INC-2 is registered

in case the address of correspondence and registered office address are not

same.

By Dheeraj Mundra (UPACA'in)](https://image.slidesharecdn.com/howtocreateacompany-180509102951/75/How-to-create-a-company-19-2048.jpg)

![ Draft Memorandum of Association and Articles of Association [MOA & AOA].

Sign and file various documents including MOA & AOA with the Registrar of

Companies electronically.

Payment of Requisite fee to Ministry of Corporate Affairs and also Stamp

Duty.

Scrutiny of documents at Registrar of Companies [ROC].

Receipt of Certificate of Registration/Incorporation from ROC.

By Dheeraj Mundra (UPACA'in)](https://image.slidesharecdn.com/howtocreateacompany-180509102951/75/How-to-create-a-company-20-2048.jpg)