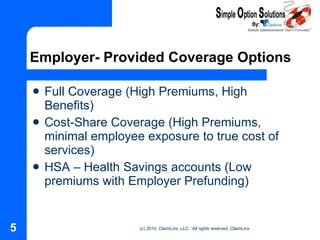

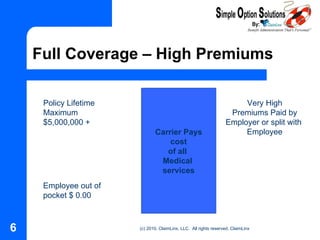

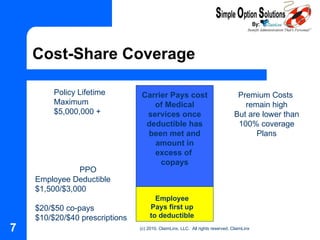

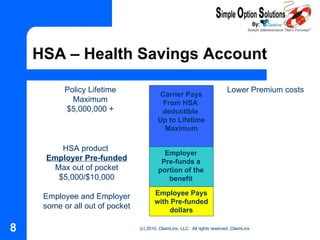

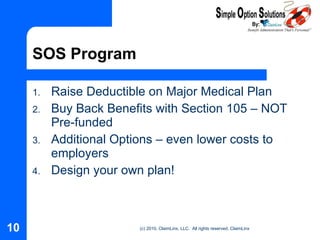

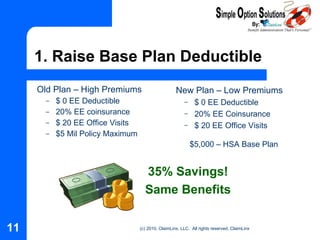

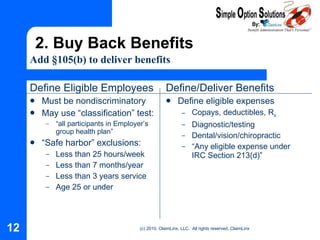

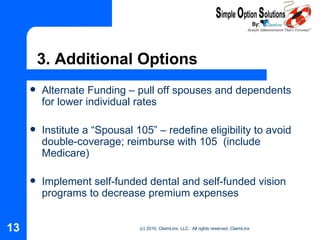

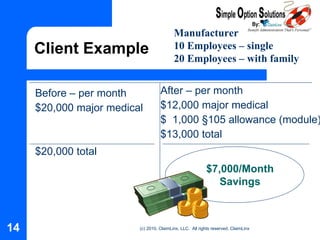

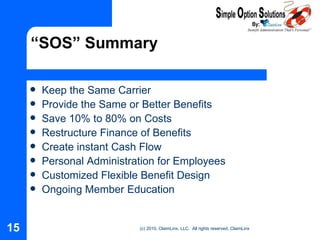

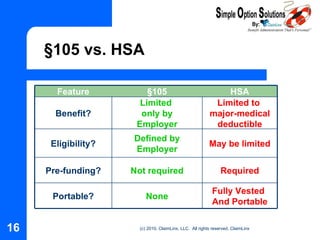

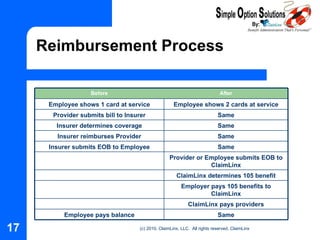

The document discusses options for reducing the high costs of health care in the United States. It proposes a "Simple Option Solution" (SOS) that involves raising deductibles on major medical plans and using Section 105 to buy back benefits, saving employers 10-80% on costs while providing the same or better benefits. Key aspects of the SOS include customizing finance and administration of benefits, providing ongoing member education, and services from ClaimLinx like claims analysis, consulting, and customer support.