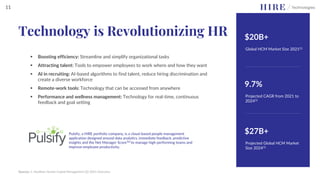

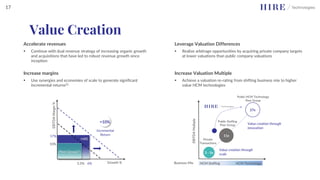

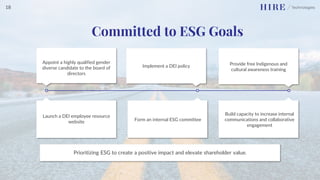

The investor presentation discusses HIRE Technologies Inc., which aims to create a portfolio of brands focused on shaping the future of human resources through technology. It highlights HIRE's mission, the opportunity in the growing and fragmented HR market, and its investment highlights including recurring revenue streams, organic growth, and acquisition upside. The presentation provides an overview of HIRE's core solutions in staffing, HR consulting, and SaaS, as well as its portfolio companies. It also discusses industry trends and the growing market for staffing, HR consulting, and HCM technology.