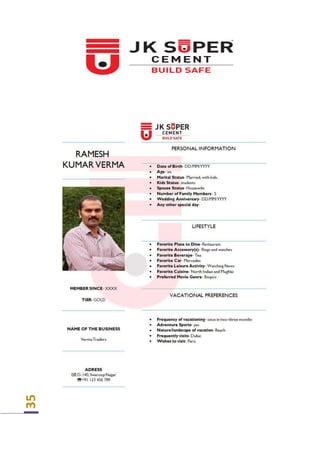

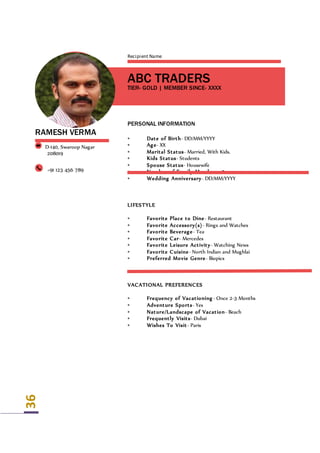

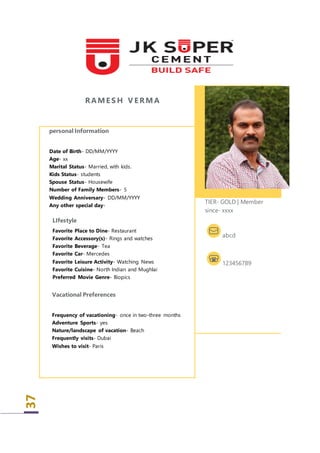

This document is a summer training report submitted by Himani Shukla for her post graduate diploma in management. The report analyzes the role of loyalty programs in communication for cement company JK Cement Ltd. During her 8-week internship, she studied JK Cement's loyalty programs for dealers called Samridhi and for contractors called JK ke Shoorveer. She contacted 36 dealers who were part of the Samridhi program to understand the role of communication in designing loyalty programs and how communication can help increase sales. In the report, she provides an industry analysis of the cement sector in India, an overview of JK Cement, details of her project work contacting dealers, findings from discussions with dealers, and recommendations.