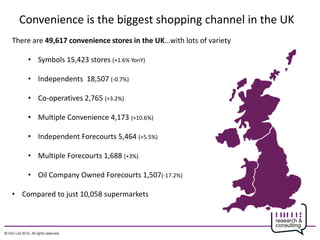

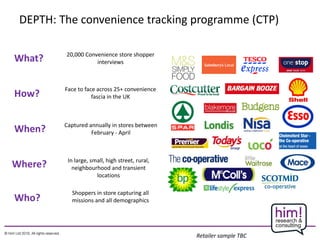

This document discusses potential impacts of changes to Sunday trading regulations in the UK. It provides statistics on the size and breakdown of the convenience store industry. Research findings suggest only 30% of shoppers welcome the changes, and most retailers view it negatively as it could reduce staff hours and numbers. Experts argue it will not increase overall sales but simply shift them between stores. The document outlines research solutions from him! to provide insights into shopper and retailer behaviors and perspectives around convenience shopping.