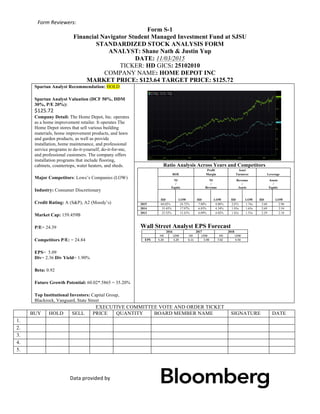

This document contains a stock analysis form for Home Depot (HD) conducted by analysts Shane Nath and Justin Yup on November 3, 2015. It provides details on HD such as its market price, target price, recommendation, valuation, competitors, financial ratios, and Wall Street analyst earnings forecasts. It also includes an executive committee vote and order ticket, likely for an investment fund class project.