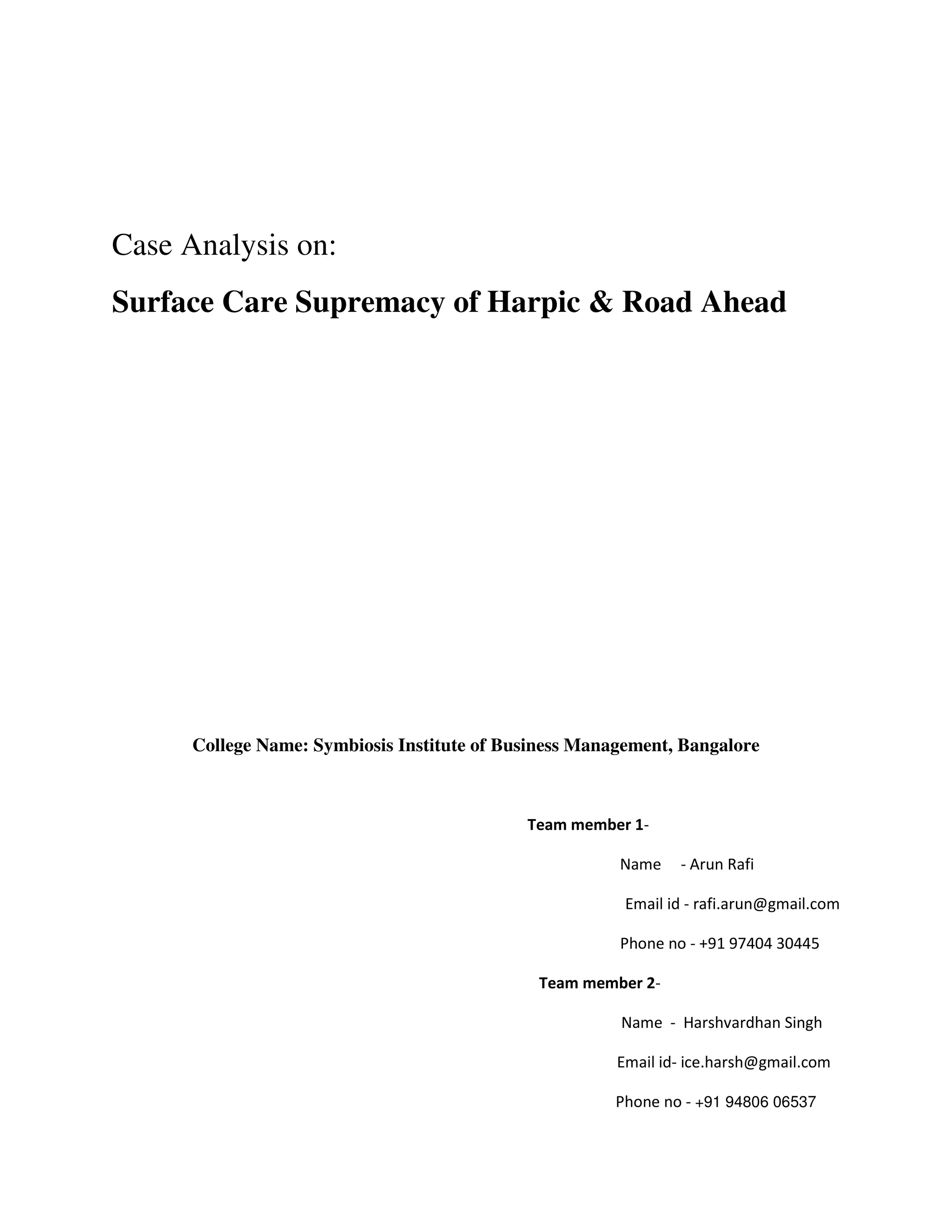

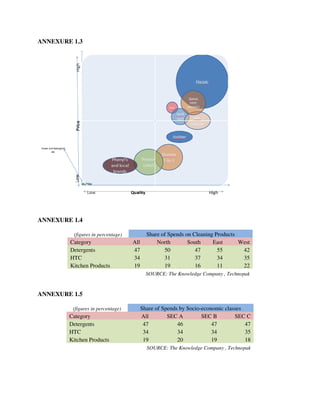

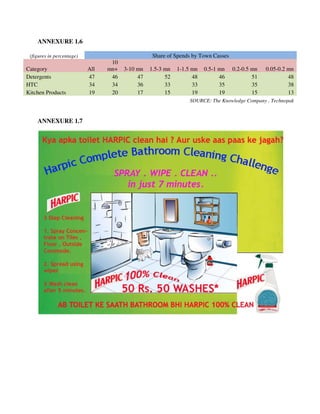

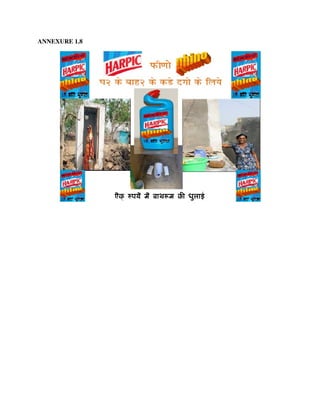

This document provides a case analysis of Harpic, the market leader in toilet cleaners in India. Harpic created the toilet cleaner category and had a peak market share of 86%, but now faces decreasing share and increased competition. The analysis seeks to understand Harpic's core brand values to inform future strategy. It examines how Harpic differentiated itself as a specialist toilet cleaner while competitors position more broadly. Understanding consumer perceptions and purchase drivers for different brands will help Harpic leverage its strengths and maintain leadership in the evolving category.