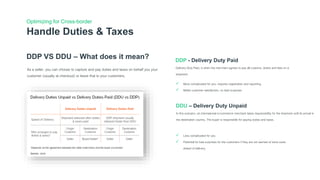

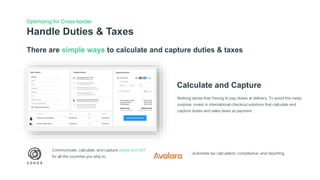

The document discusses the importance of effectively handling duties and taxes for international shipping, emphasizing the negative surprises that can arise for customers when these are not addressed. It explains the concepts of import duties and taxes, the significance of HS codes for customs clearance, and the options of Delivery Duty Paid (DDP) versus Delivery Duty Unpaid (DDU) for merchants. It recommends utilizing international checkout solutions to automate the calculation and collection of duties and taxes at the time of payment to enhance customer satisfaction.