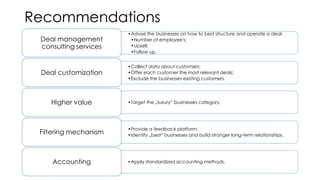

Groupon was established in 2008 as an advertising and marketing company that began in Chicago and operates in 500 markets across 44 countries. It works on a daily deals model, where it features discounted deals from local businesses. While it grew rapidly initially, its growth has declined in recent years. It has faced challenges including lack of customer loyalty, improper financial reporting, and intense competition. To address its problems, recommendations include offering customized deals, targeting higher-end merchants, implementing customer relationship management, and advising partner businesses on best practices.