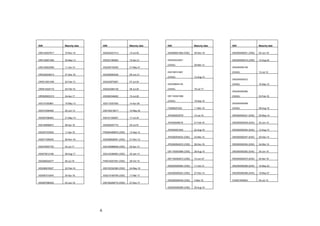

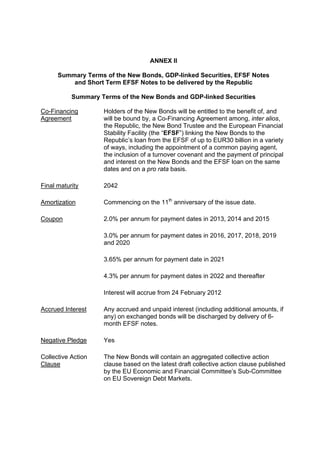

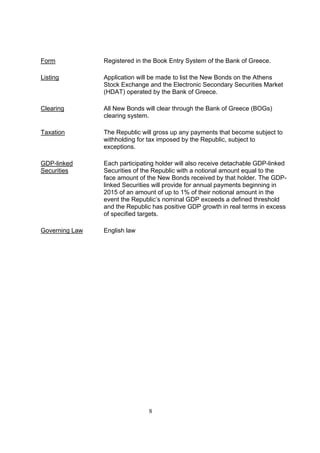

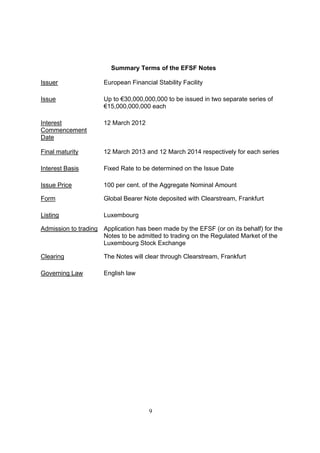

The Greek government approved terms to invite private bondholders to exchange approximately €206 billion in bonds for new bonds worth 31.5% of the existing amount, EFSF notes worth 15% of the existing amount, and GDP-linked securities. The exchange offers and consent solicitations are subject to participation thresholds of 75-90% and financing conditions. Deutsche Bank and HSBC were appointed as closing agents, while Bondholder Communications Group and Hellenic Exchanges will serve as information and tabulation agents.