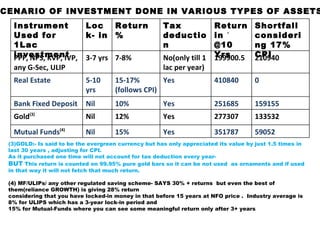

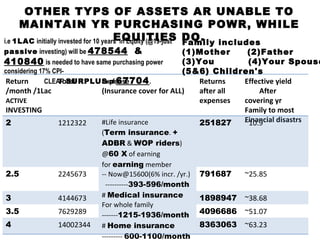

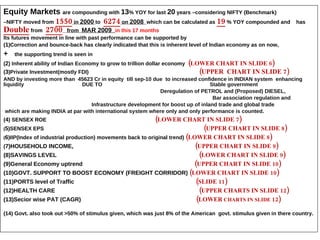

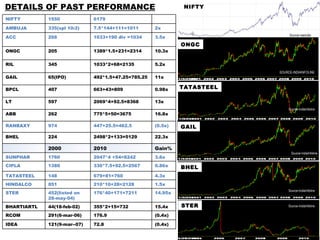

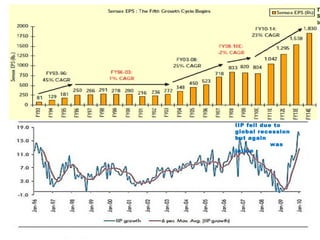

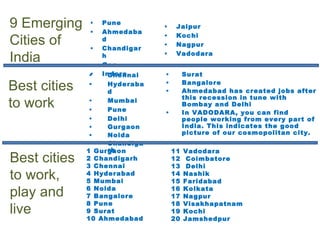

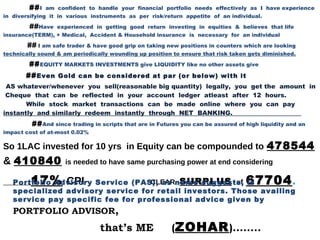

The document discusses various investment options and their returns over 10 years. It finds that investing 1 lakh in equities, which have grown at an average of 16.84% annually over the past 20 years, would result in a return of 4.78 lakhs after 10 years. This outperforms the 4.10 lakhs needed to maintain the same purchasing power adjusted for 17% inflation. Other assets like gold, real estate, and fixed deposits fail to maintain purchasing power over the long run compared to equities. The document advocates for investing in equities for long term growth and purchasing power protection.

![The burden of monitoring portfolio, on daily basis, is removed . As done by advisor(PAS). In PAS the advisor comes up with entry and exit levels by which you don’t miss upon any opportunity to make money. The monitoring of your portfolio provides timely advice for appropriate rebalancing of the portfolio in a volatile markets which optimizes returns. The flip side If the investor does not implement the advice given by the advisor on time, the investor may stand to lose (or gain) depending on the market situation. So, execution is the key and inaction (or unneeded action ) on part of investor may work both ways. ZOHAR BATTERYWALA 9429927829 [email_address] PAS PMS Investor does not pay any amount to invest. Investor has to pay money upfront. Client invests in his own name The investments are done in portfolio manager’s firm. Investor has total control on decisions as the advice is discretionary. Investor has no control on decision-making as it is non-discretionary Investor may accept or reject the advice of the advisor. Investor may or may not consult the advisor. Client can buy or sell securities as and when he decides. The portfolio manager may churn the portfolio often to earn more brokerage. Can select his own broker No such choice available.](https://image.slidesharecdn.com/generali-12914723204167-phpapp01/85/Generali-17-320.jpg)