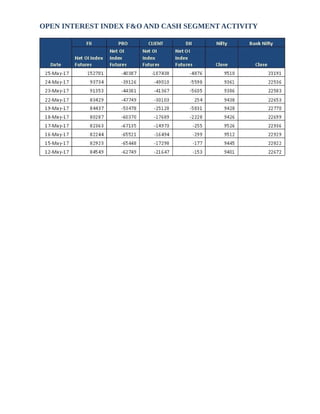

The document discusses recent technical trends in the Nifty 50 and Bank Nifty futures markets. It provides analysis of key index levels and technical indicators. It notes that Nifty erased early gains to end flat last week due to political turmoil in the US and Brazil. It also discusses recent FII positions and GST developments that are impacting the markets. Technical analysis suggests levels to watch for potential support and resistance in both indexes in the coming trading sessions.