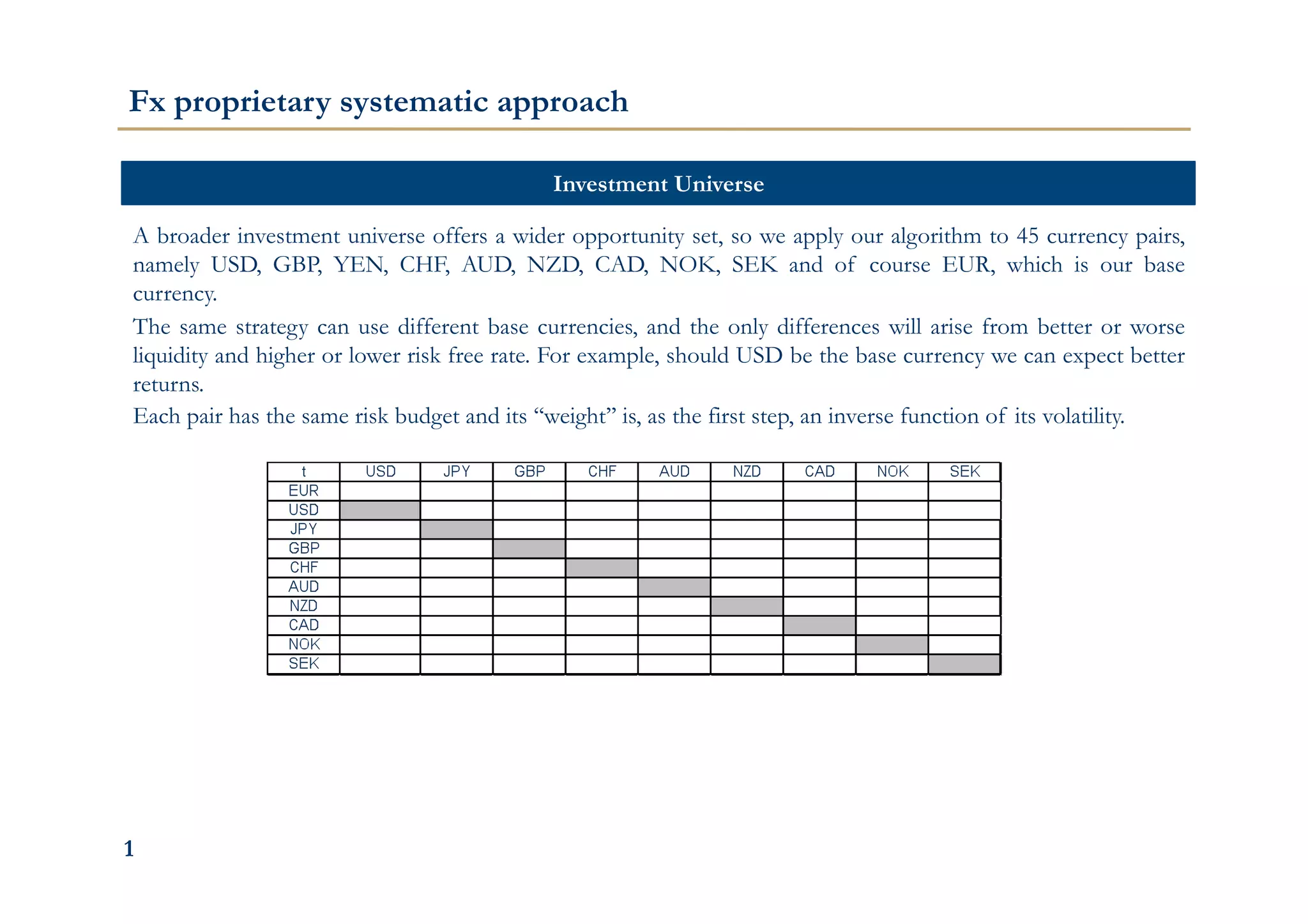

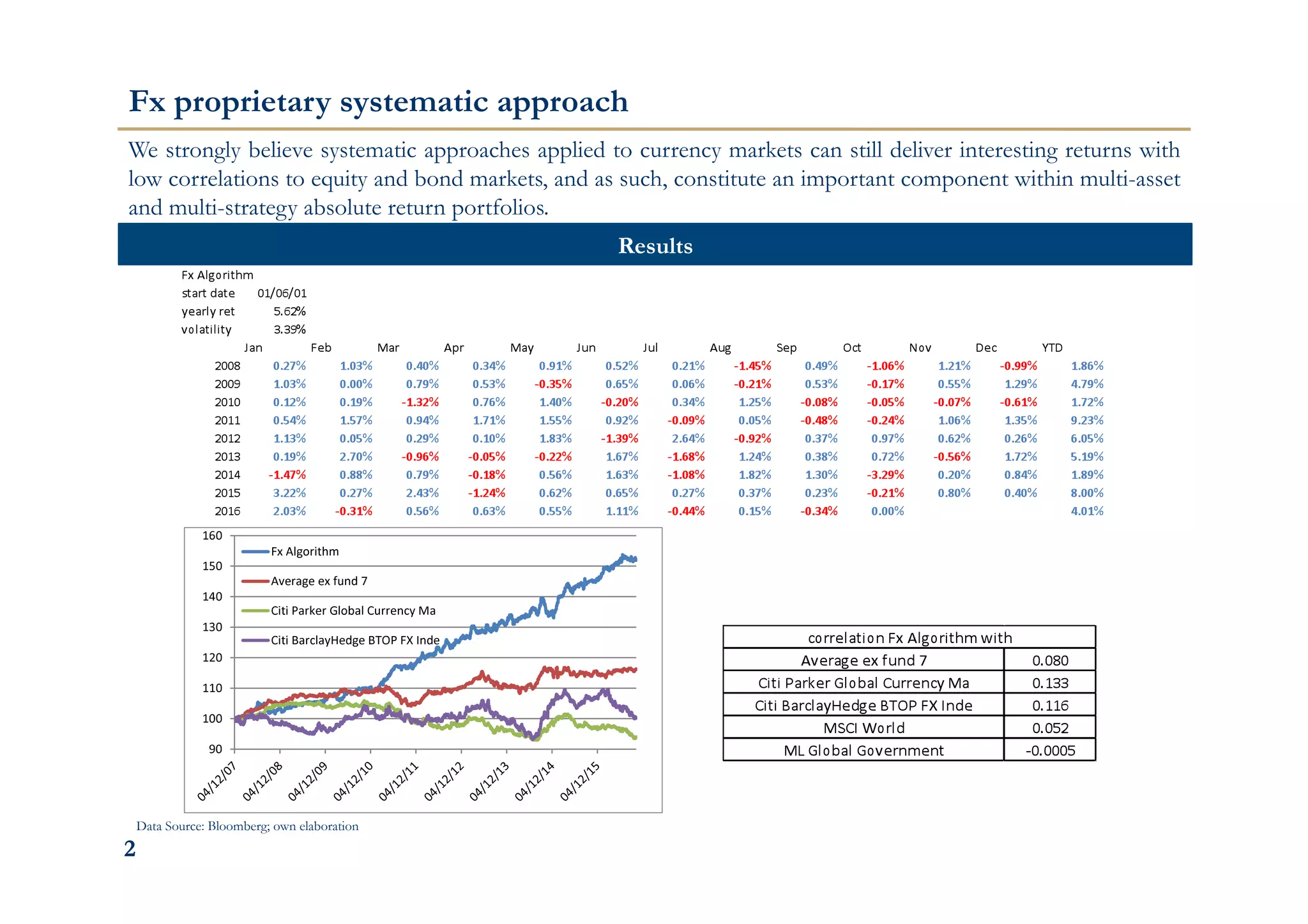

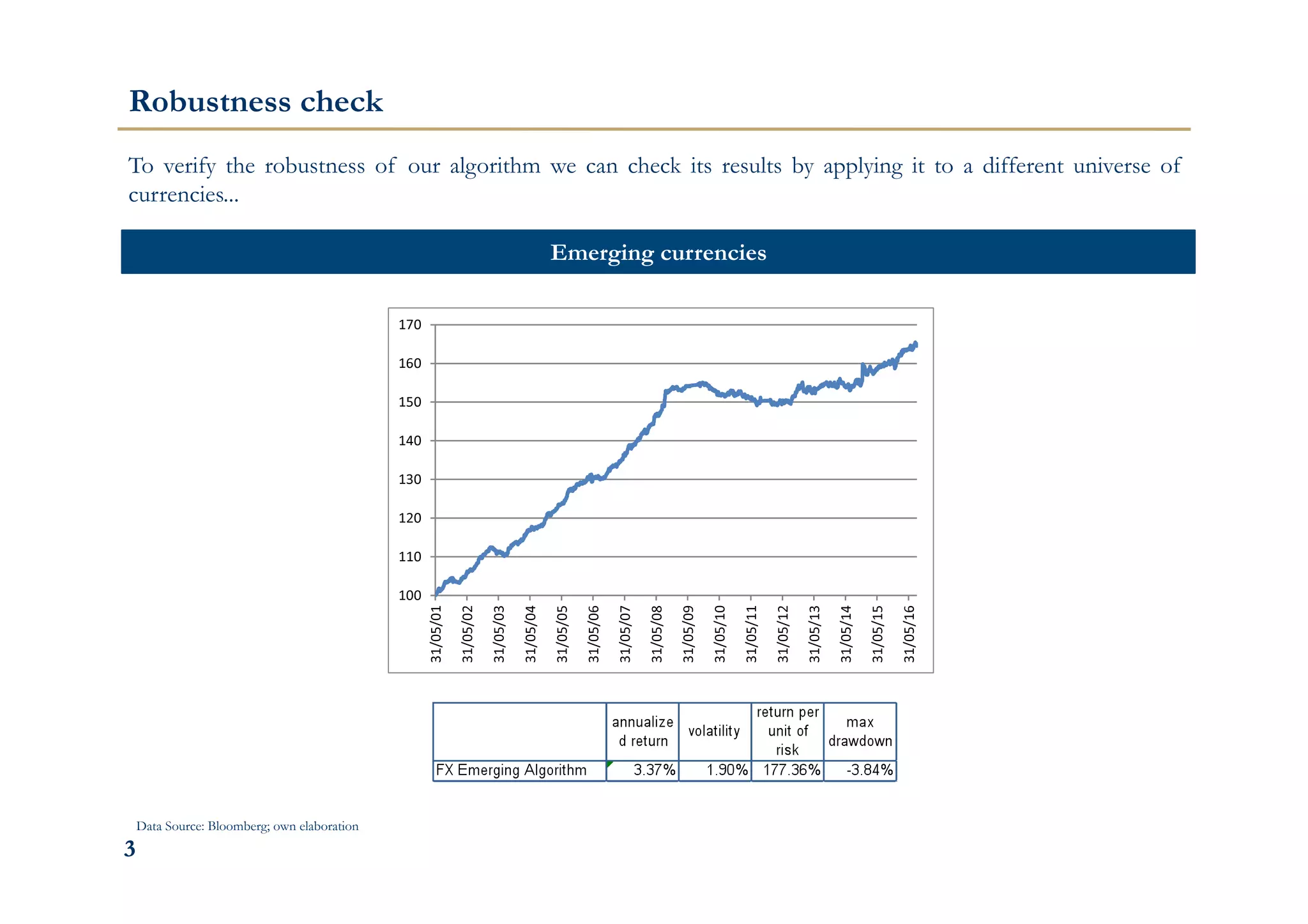

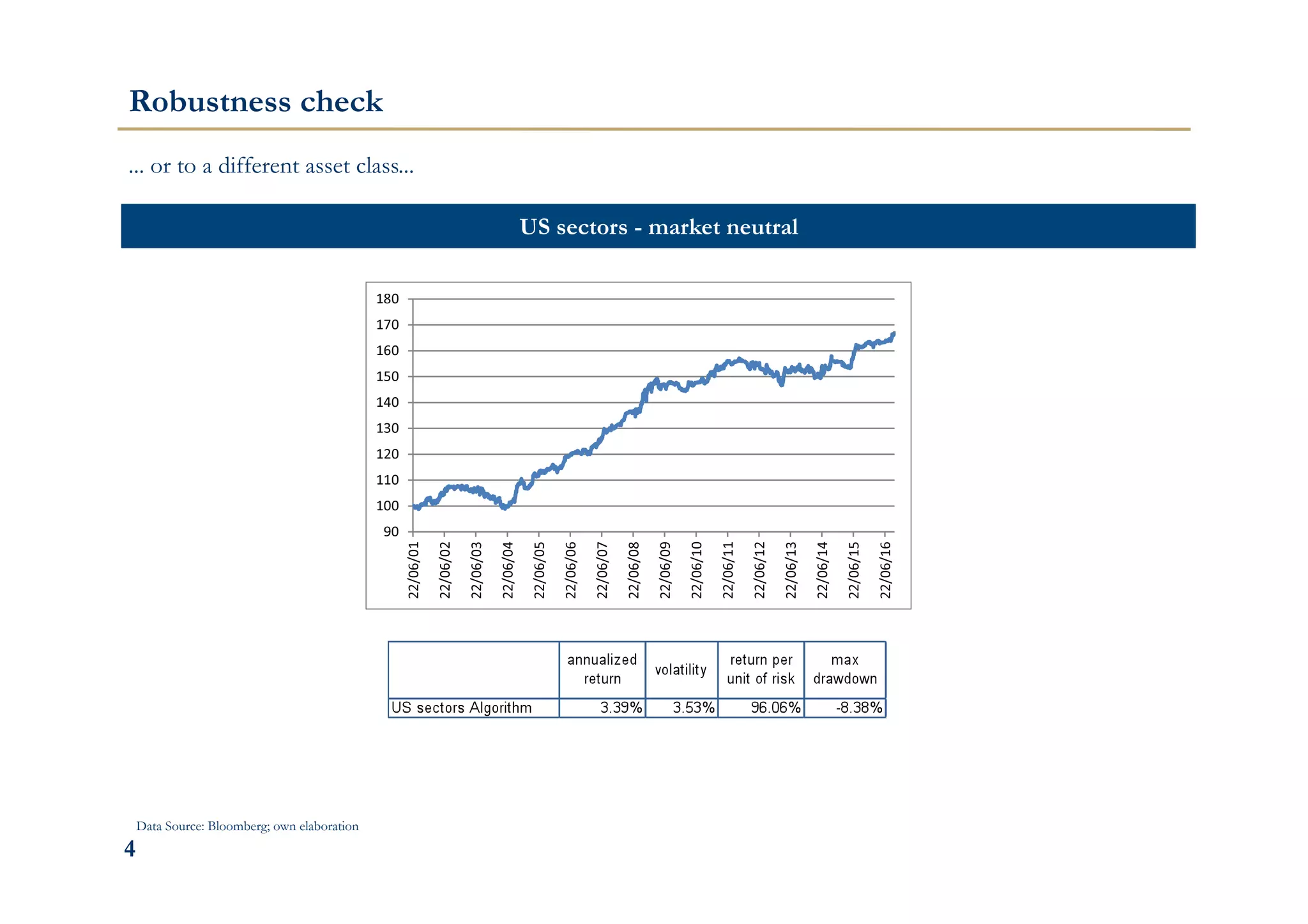

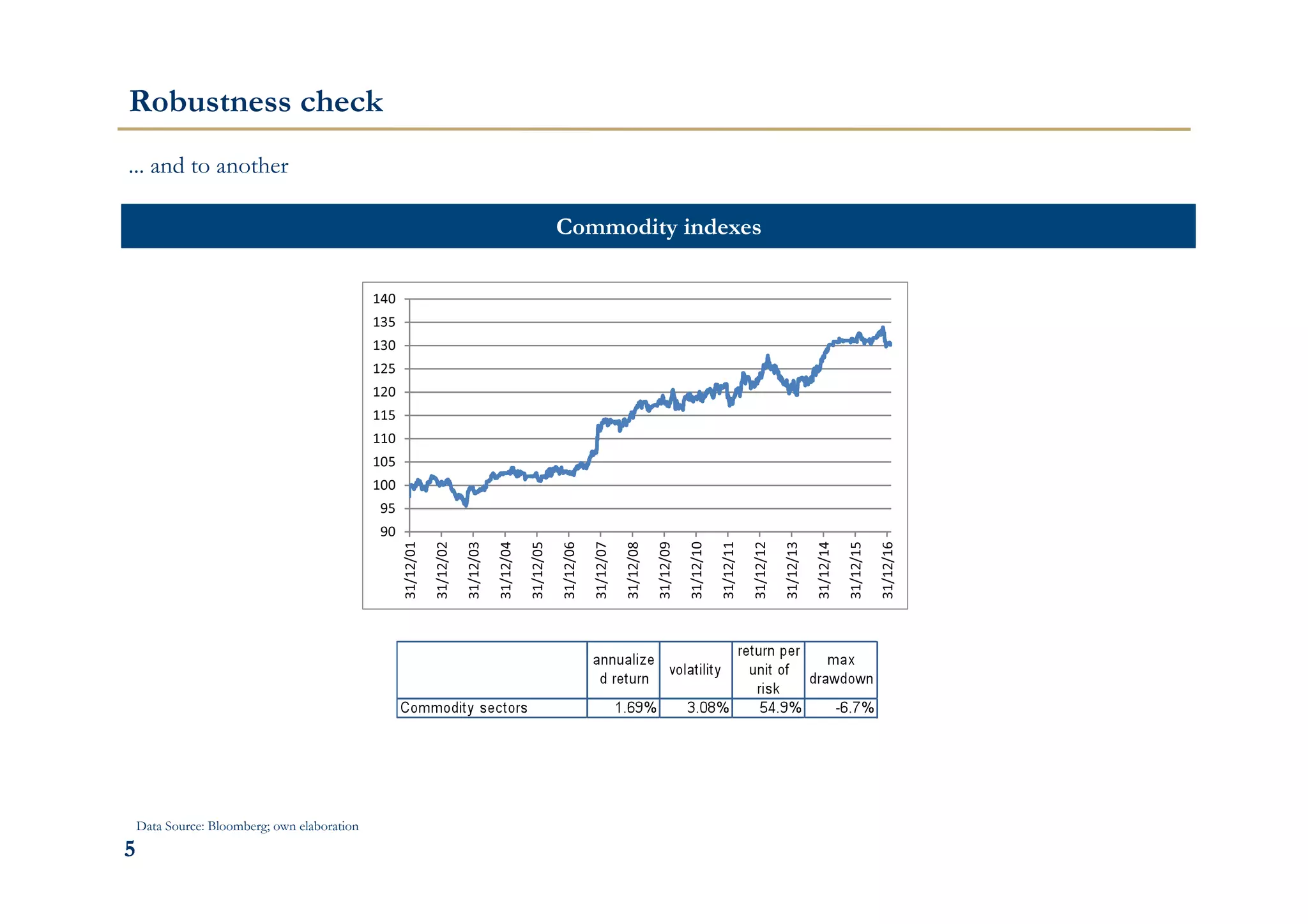

The document discusses a currency trading algorithm that is applied to 45 different currency pairs using the euro as the base currency. It explains that using a broader set of currencies provides more investment opportunities. The strategy aims to allocate funds to each currency pair based on its volatility, with less volatile currencies receiving higher allocations. Testing the algorithm on different currency sets and asset classes helps verify its robustness.