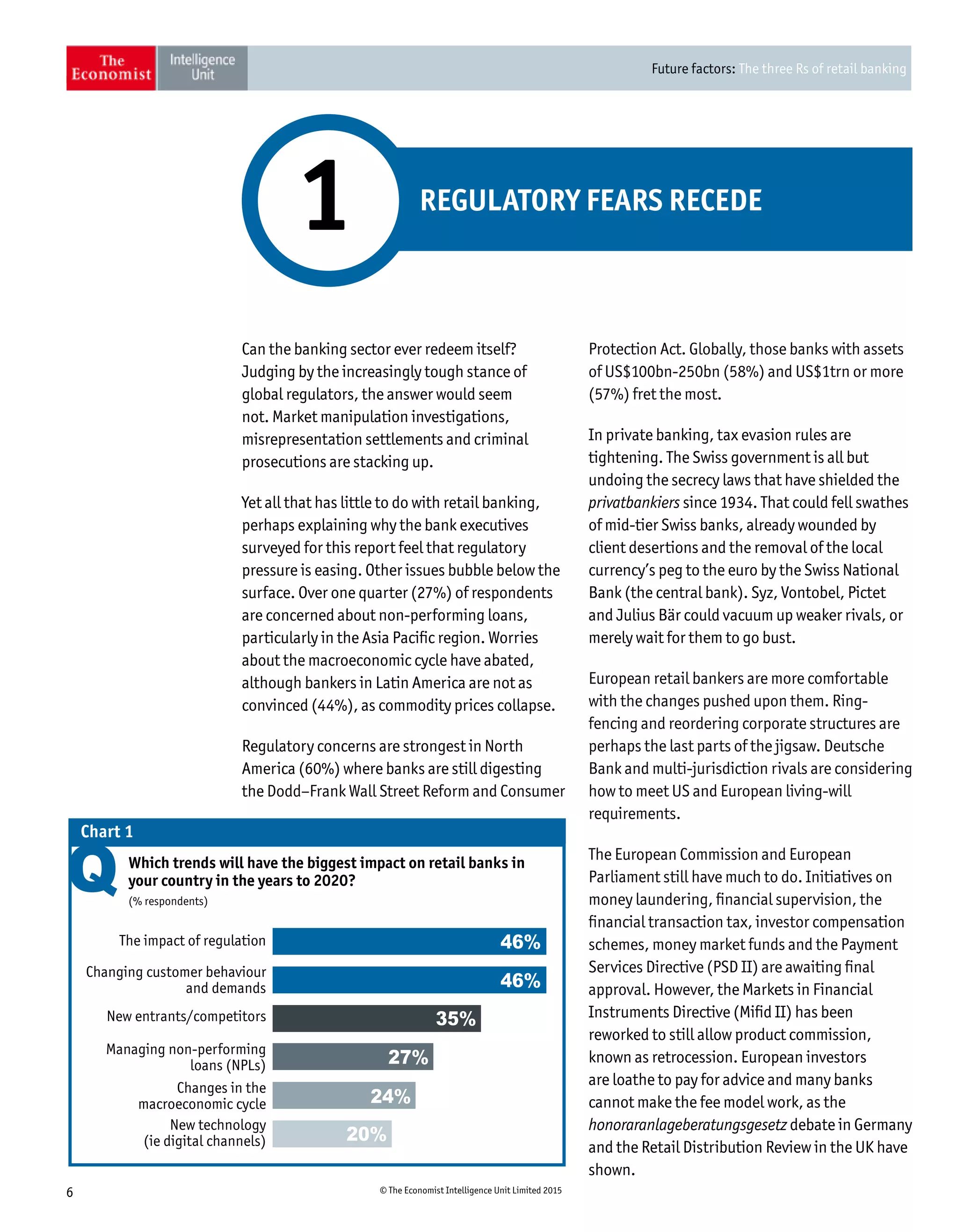

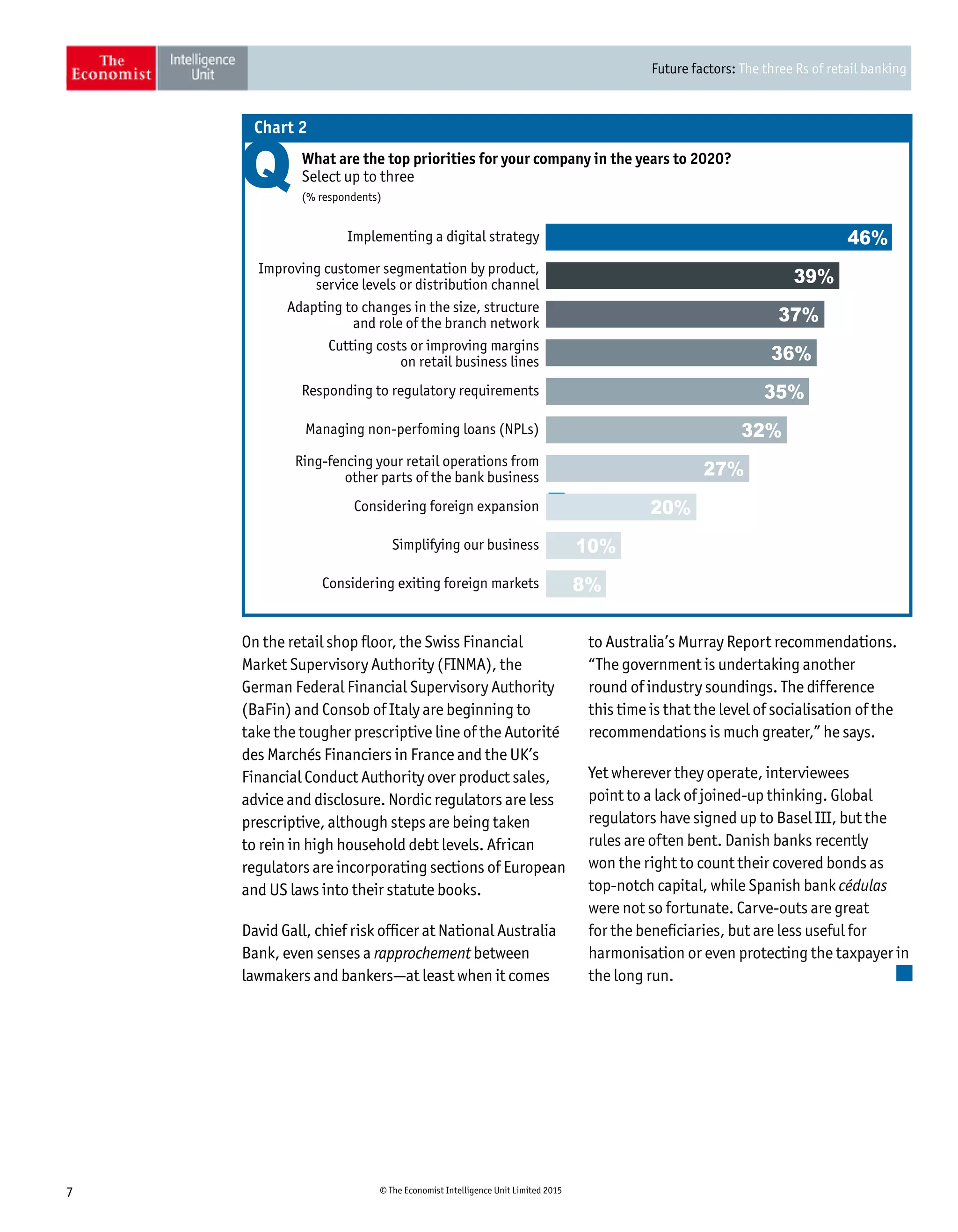

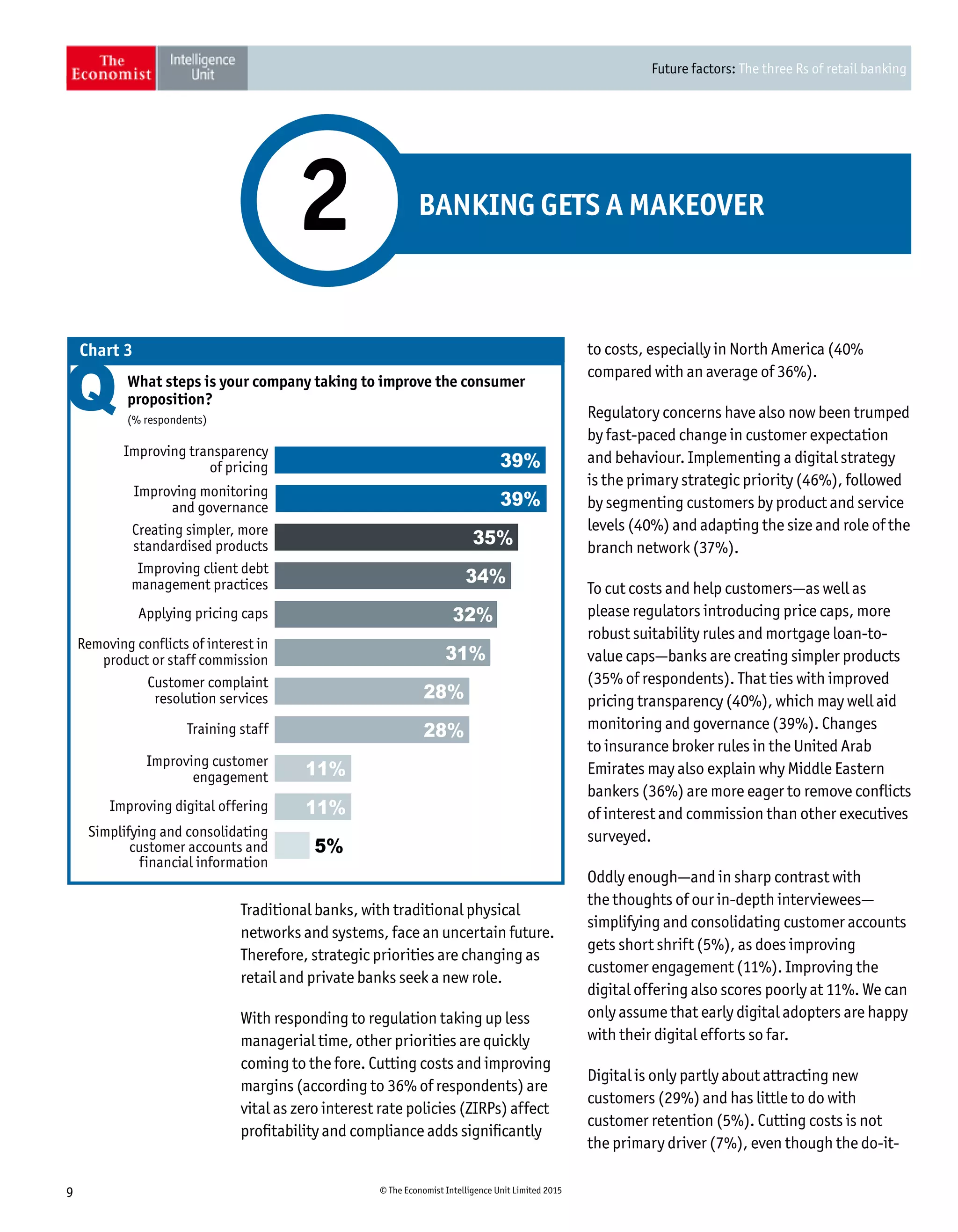

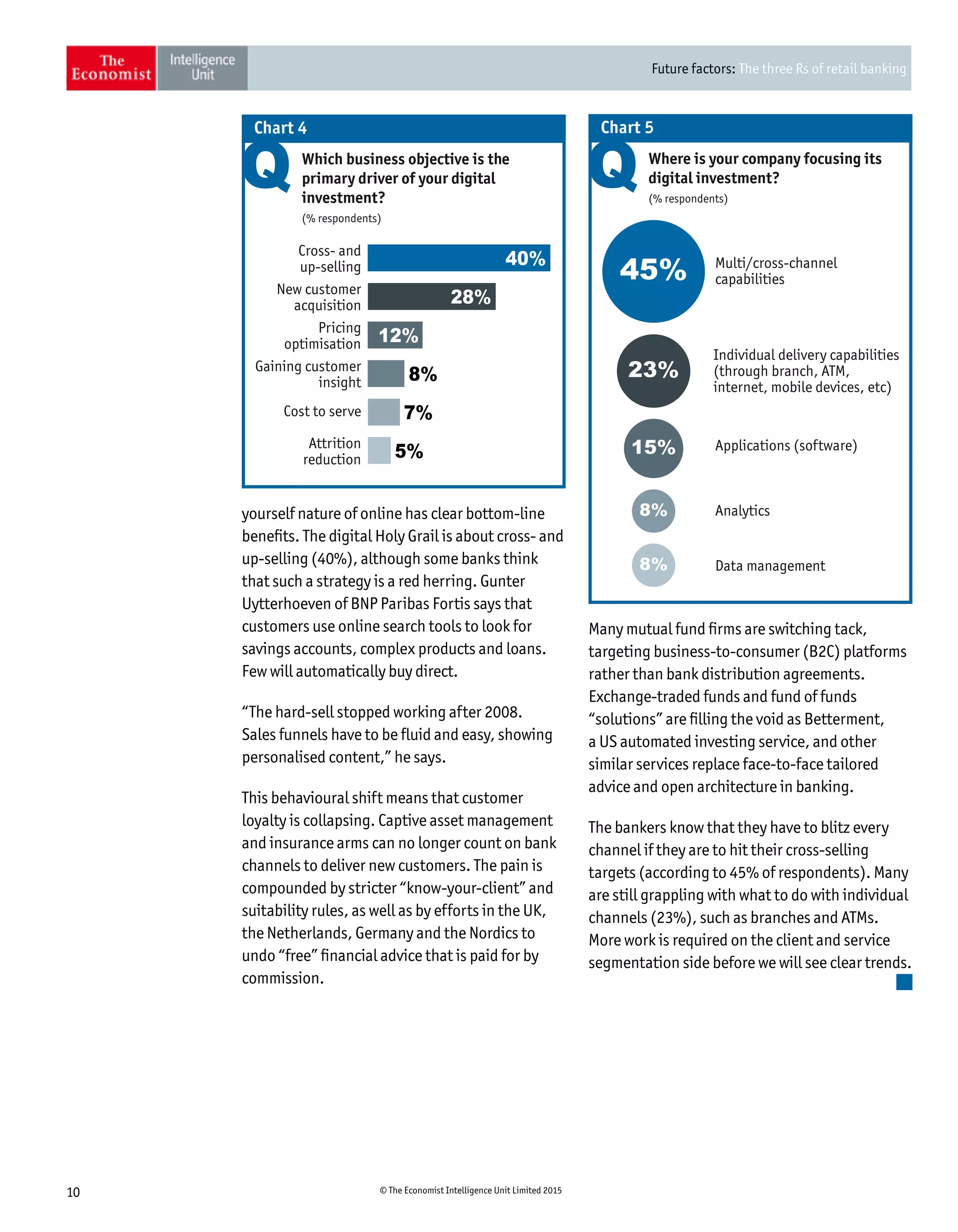

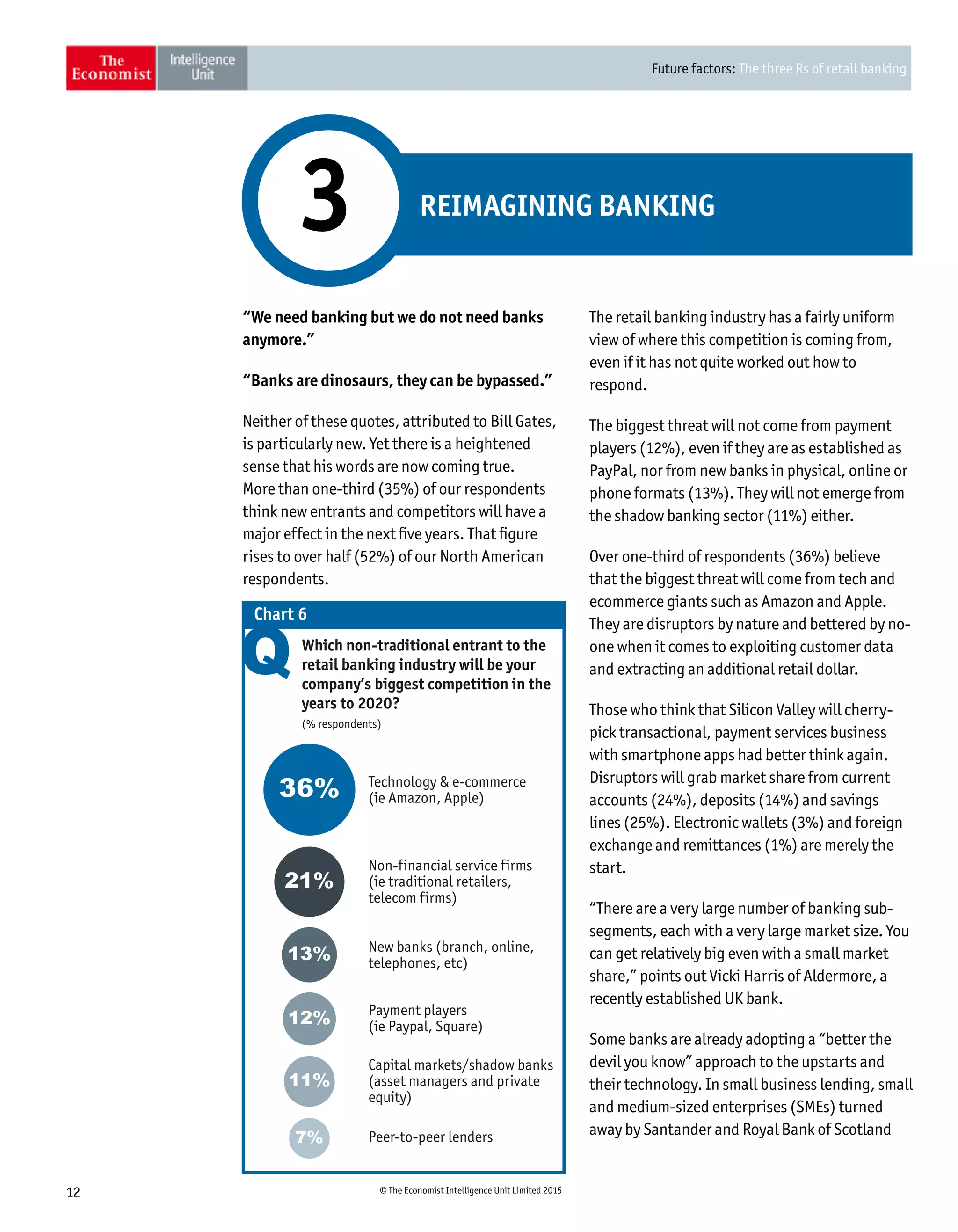

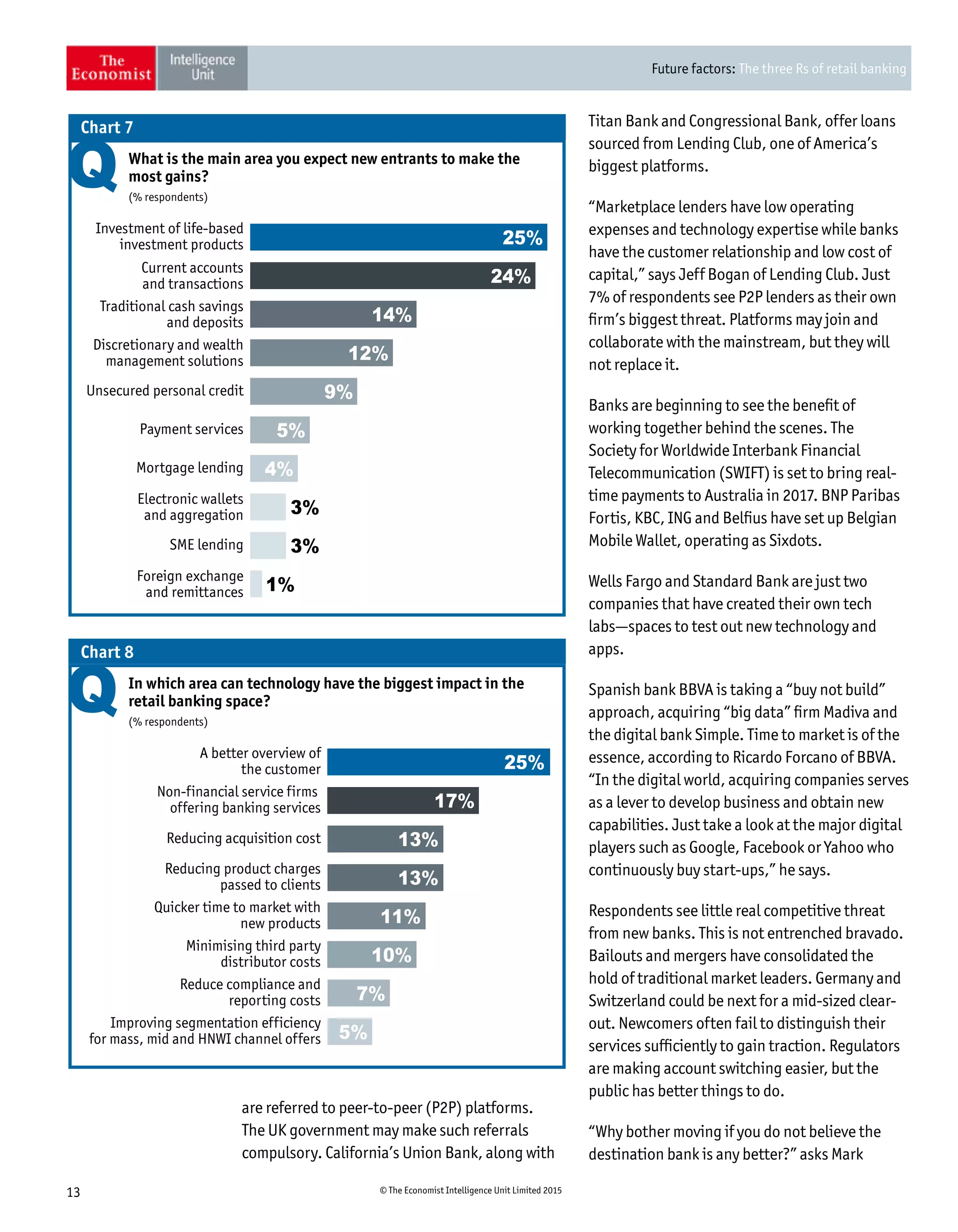

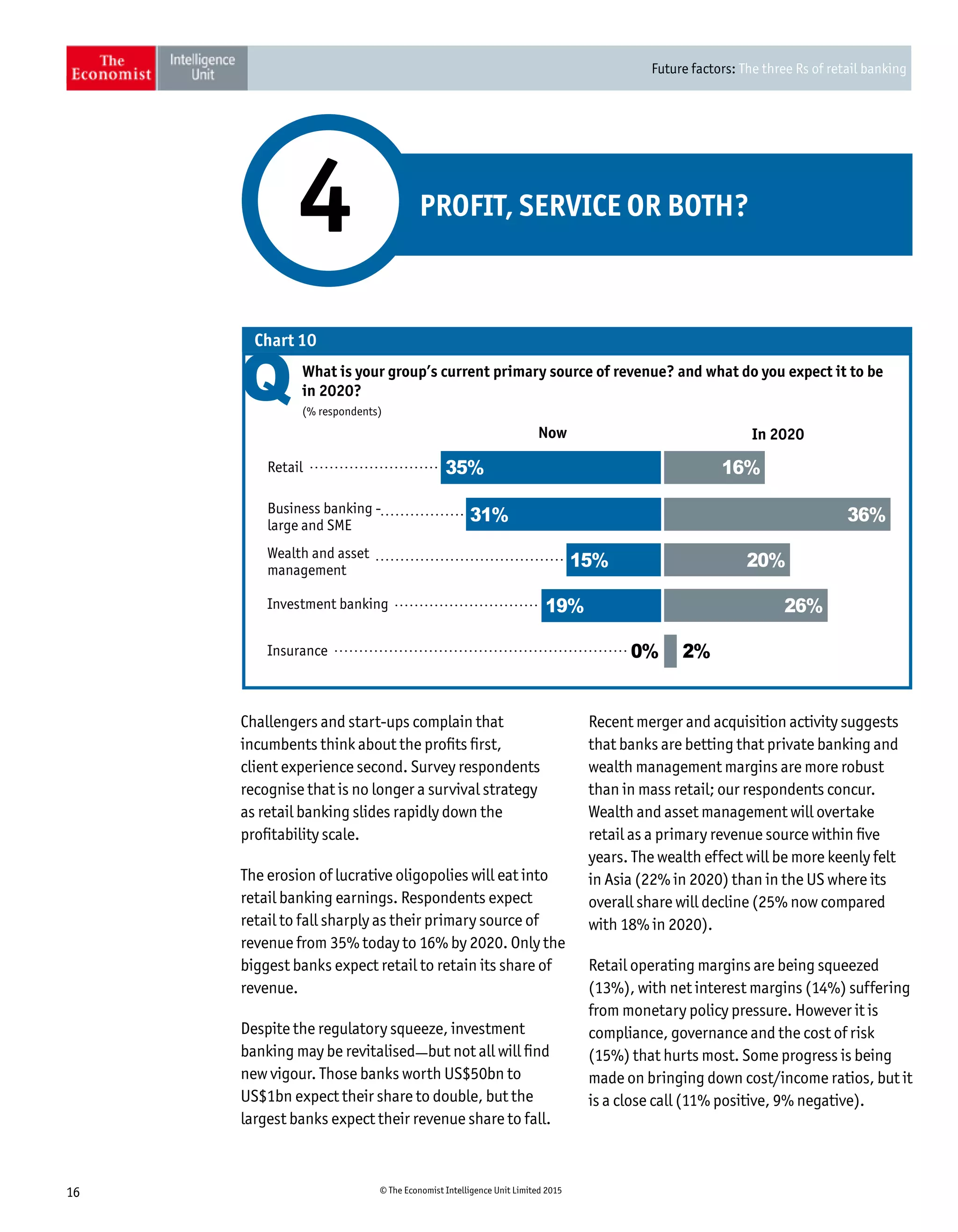

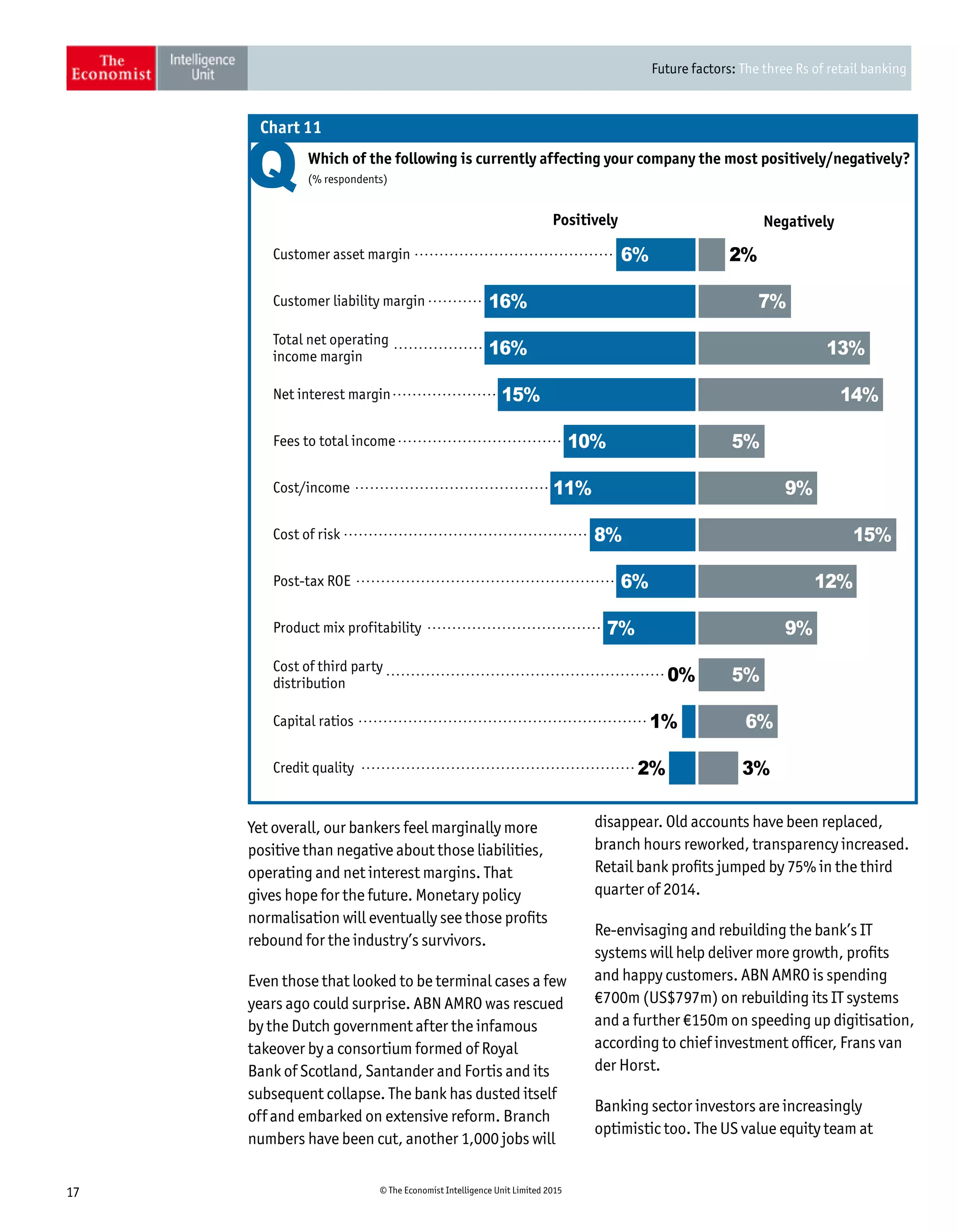

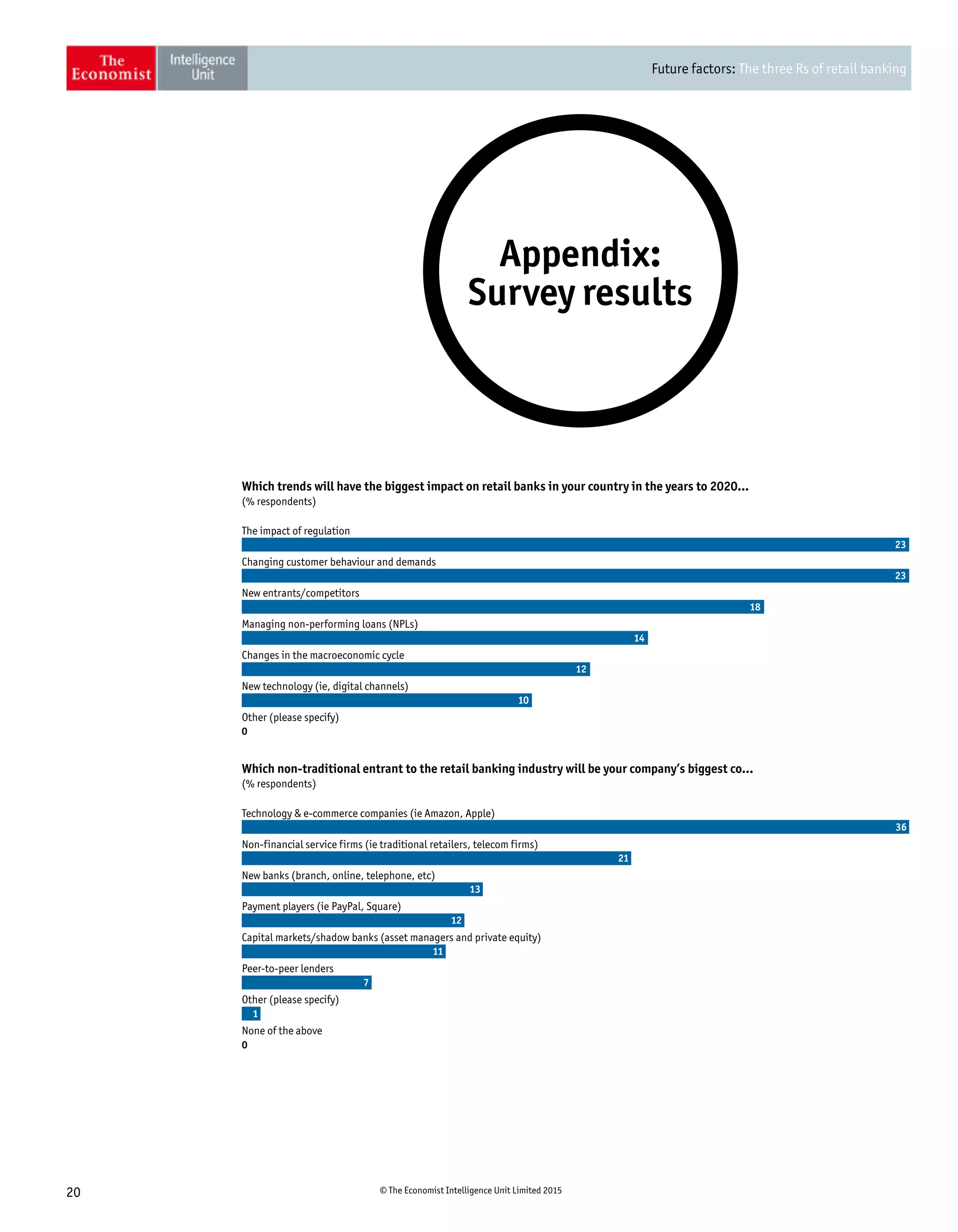

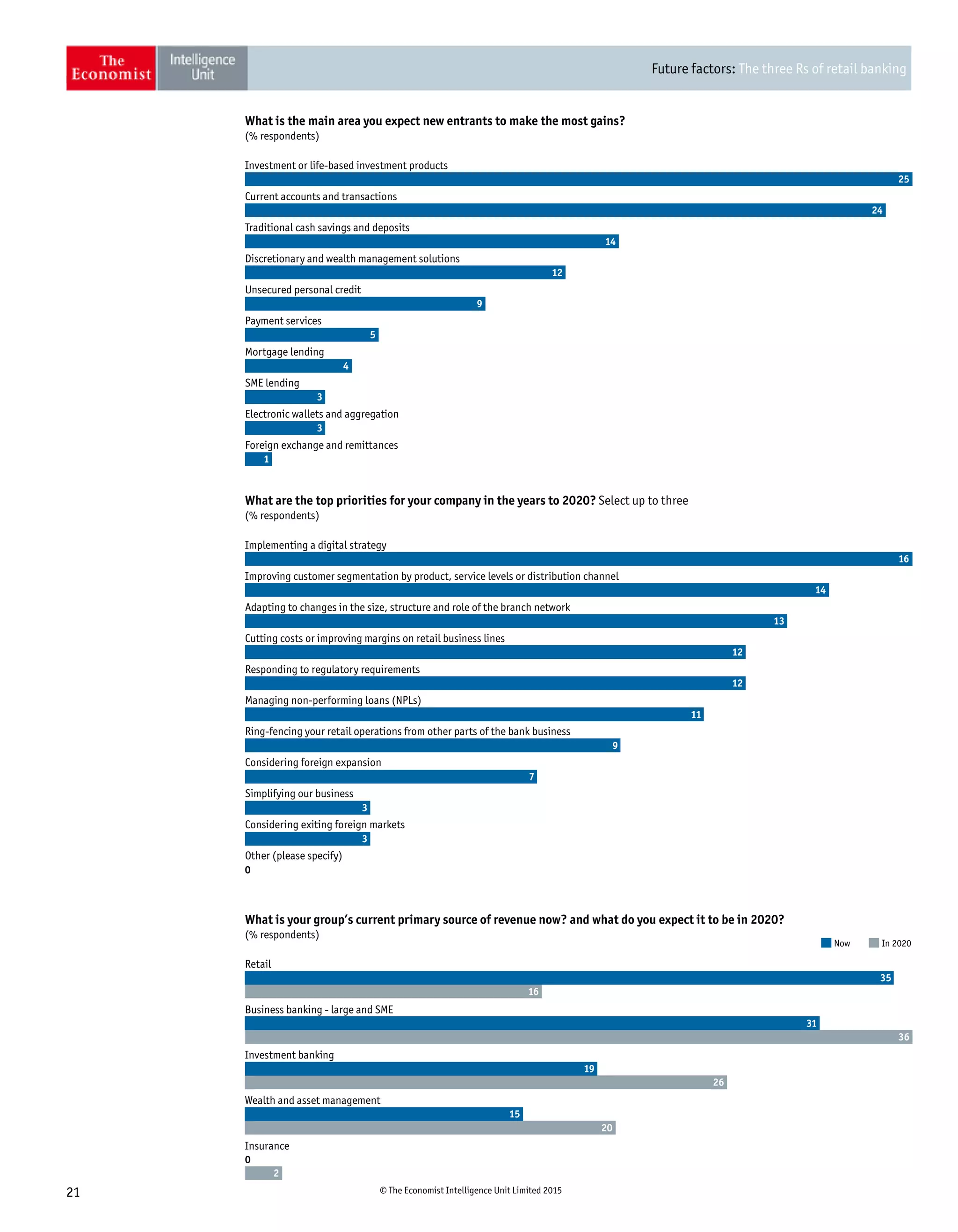

The report outlines the future of retail banking, highlighting the interrelated themes of regulation, revision, and re-envisioning within the industry. It indicates that regulatory pressures are decreasing, while customer expectations and technological advancements are driving significant changes in banking practices and strategies. The survey of 208 banking executives reveals that banks must quickly adapt to these shifts to maintain profitability and customer trust.