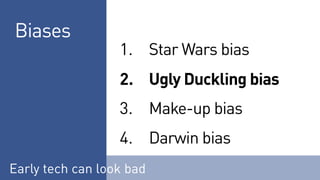

The document presents an overview of deep tech investment, highlighting SOSV's role in funding early-stage deep tech startups, particularly in sectors like biotech and food. It discusses deep tech's potential to address significant challenges while outlining current trends, notable investments, and biases that investors face. The presentation emphasizes the importance of understanding the unique risks associated with deep tech and the diverse opportunities it presents across various sectors.