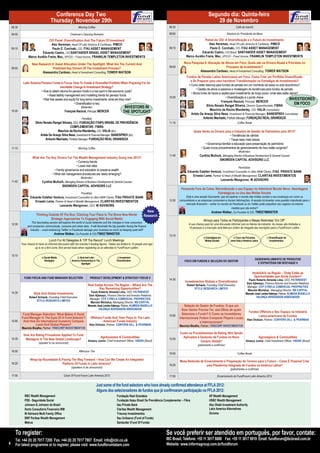

The document details an upcoming prestigious wealth management conference in Latin America, featuring over 70 leading CEOs, CIOs, and industry experts discussing investment strategies and market trends. The event will cover economic updates, regulatory impacts, and the future of asset management, along with networking opportunities for investors and fund buyers. The conference is set to take place on November 27-29, 2012, in São Paulo, Brazil.