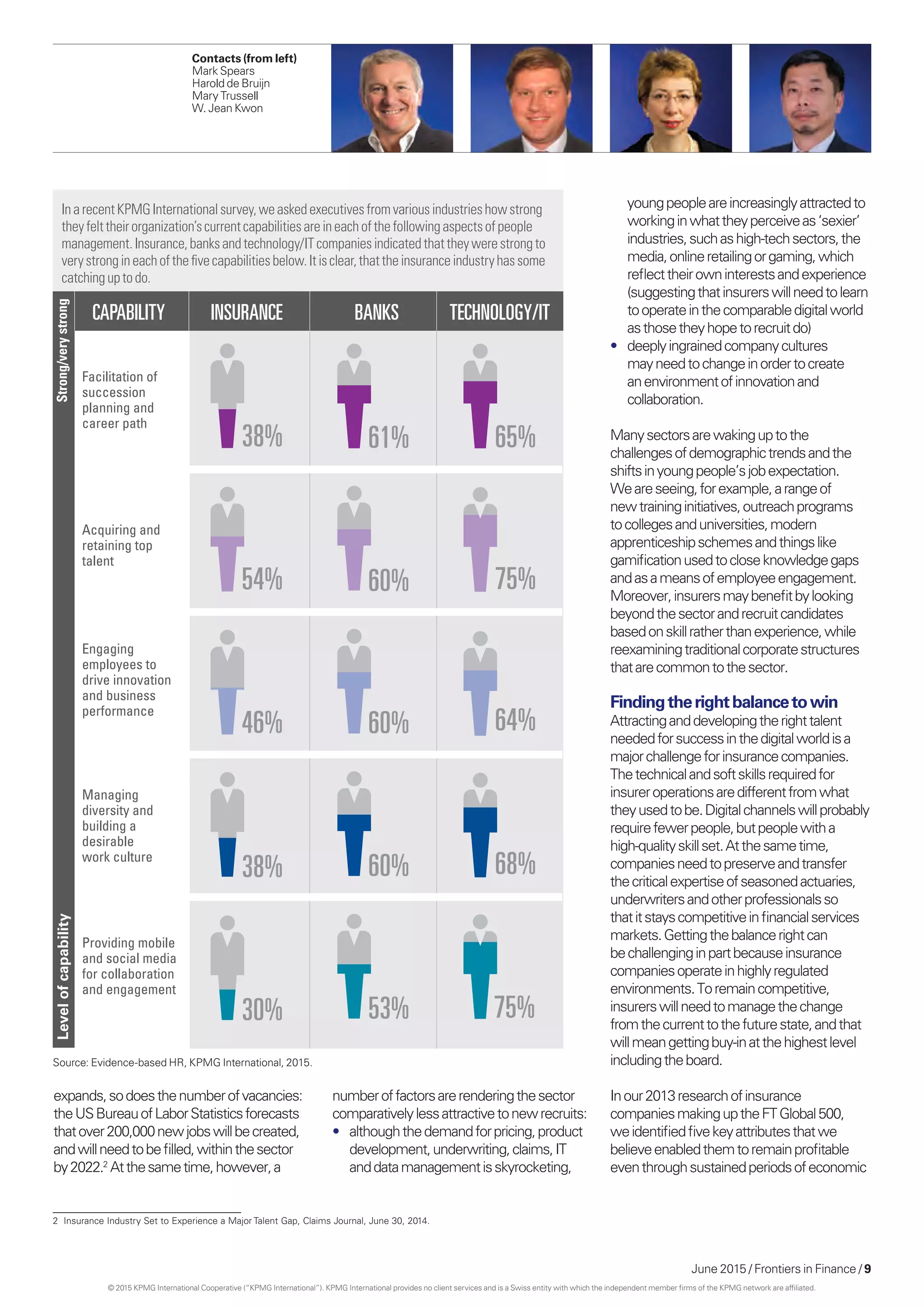

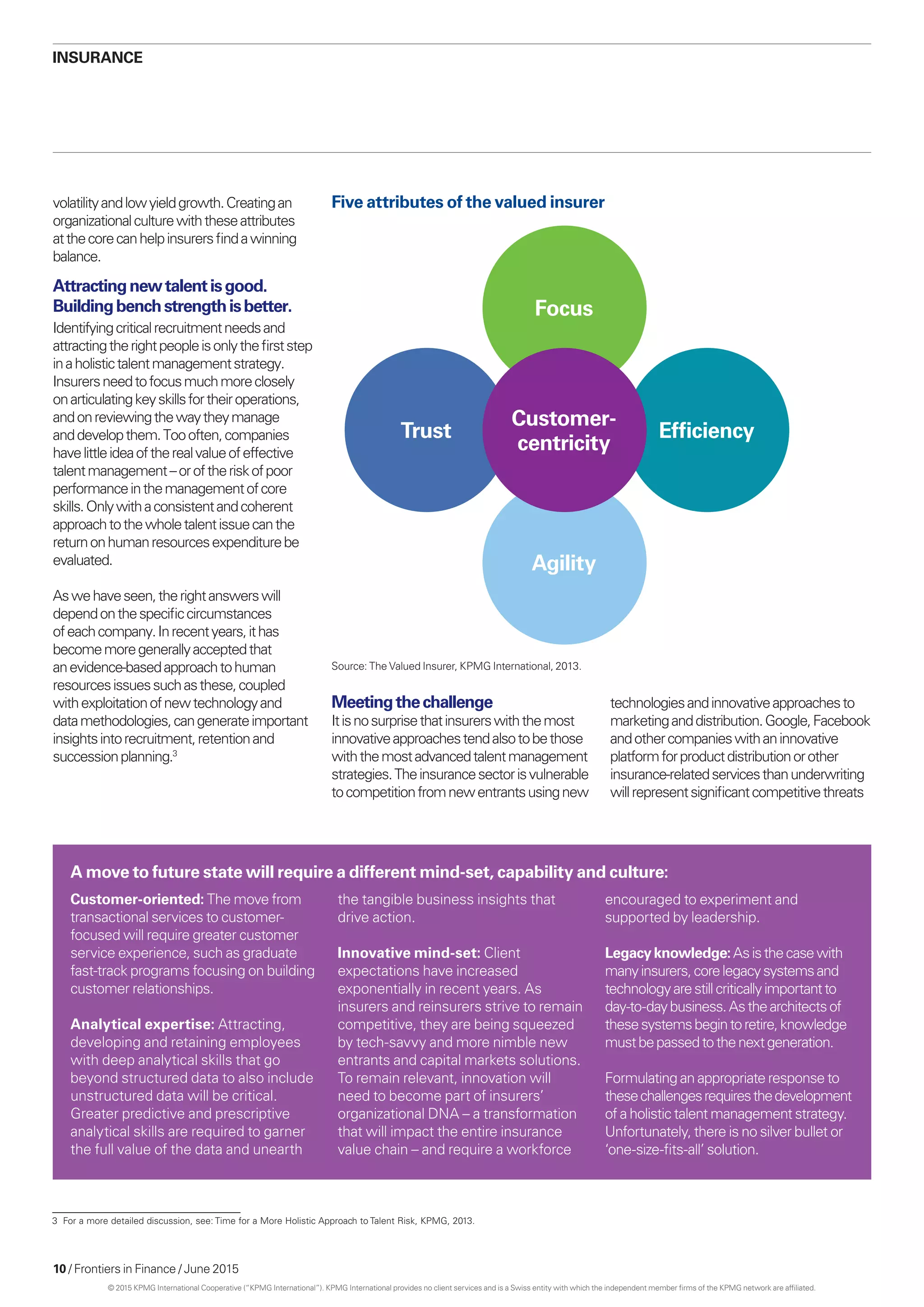

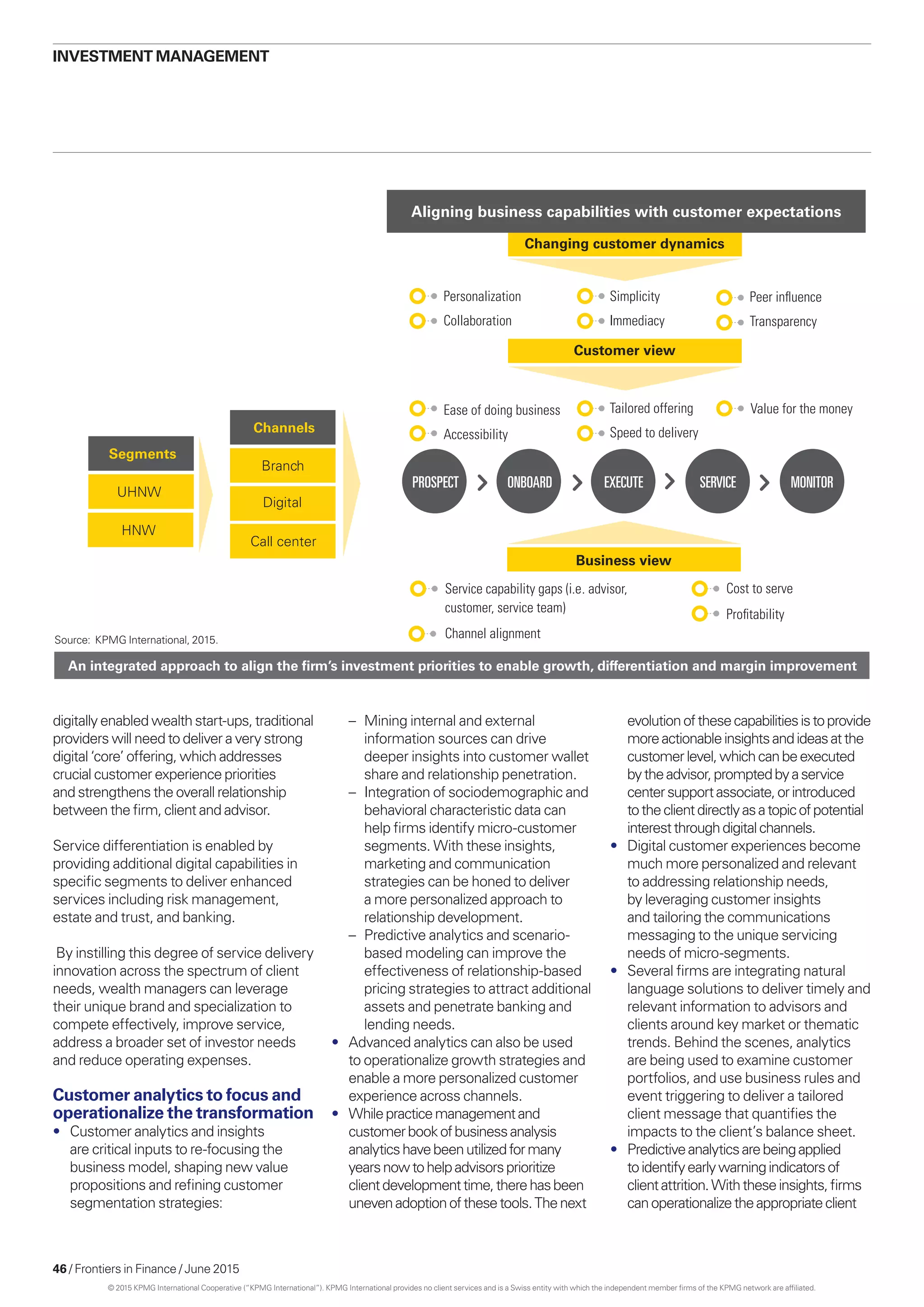

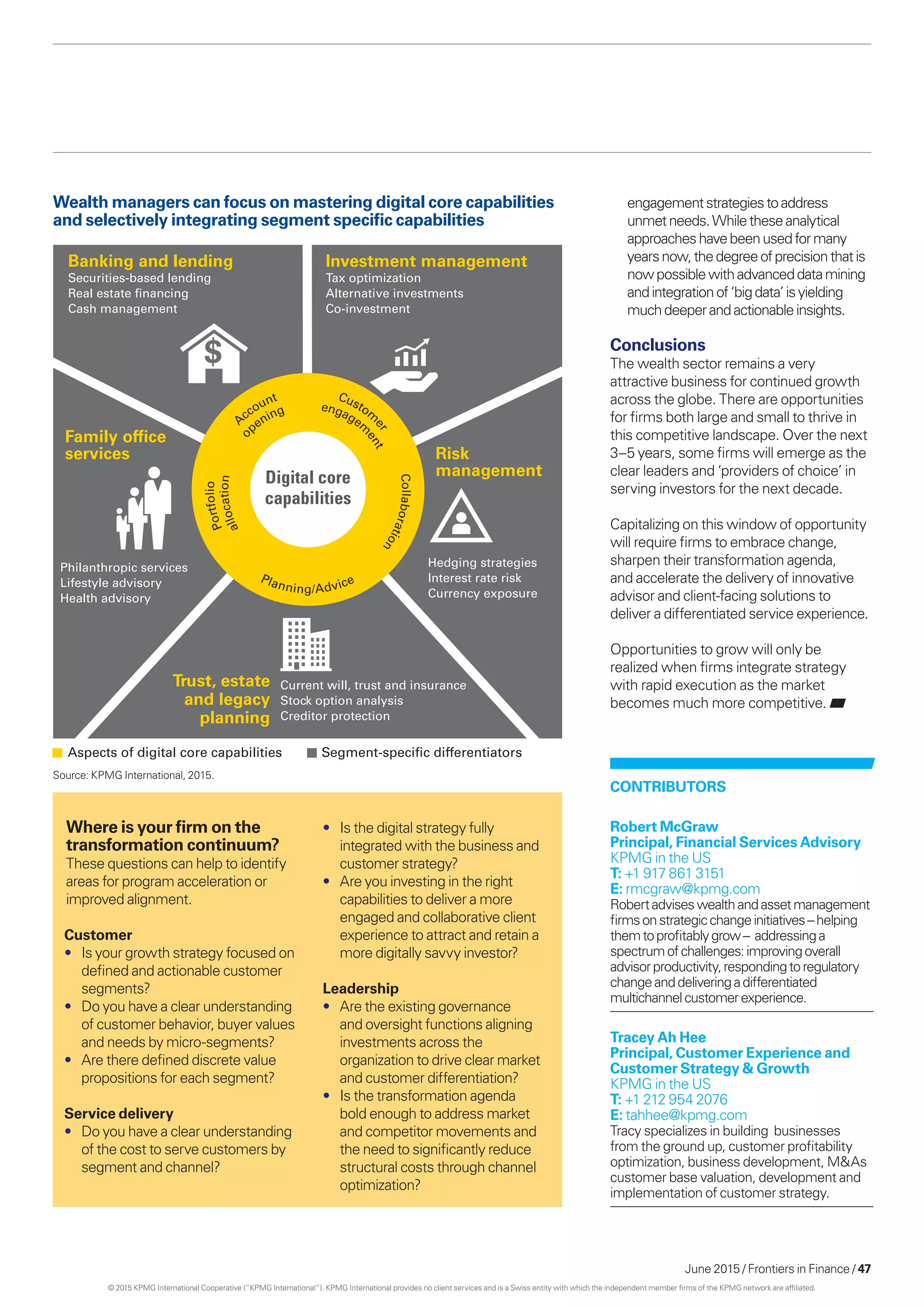

This document provides an overview of the June 2015 issue of Frontiers in Finance, a publication focused on decision-makers in the financial services industry. It includes the following key points:

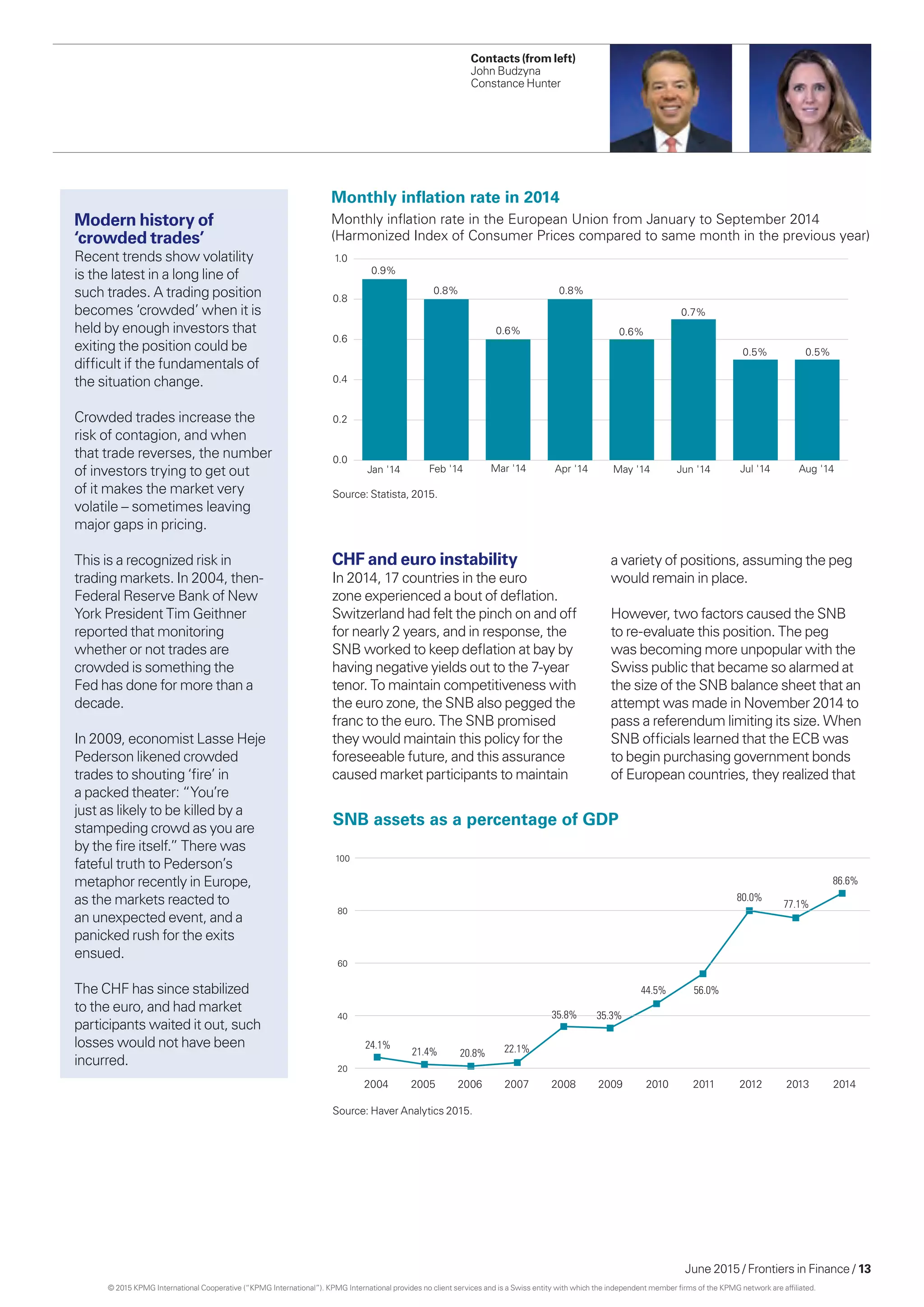

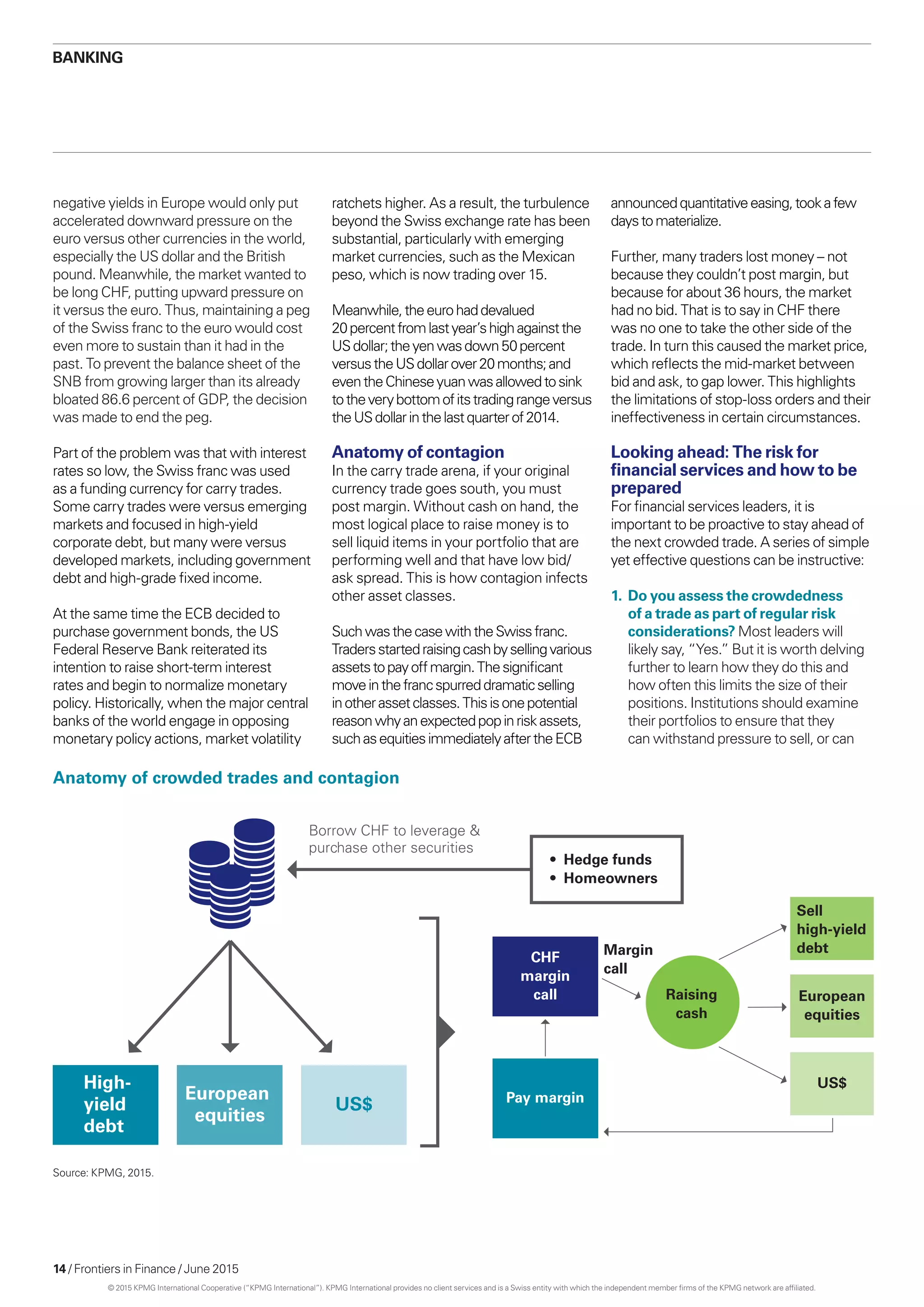

- The document discusses several challenges facing financial institutions, including how to sustain competitive advantage, develop new products and services, and move faster than competitors in a constantly changing environment.

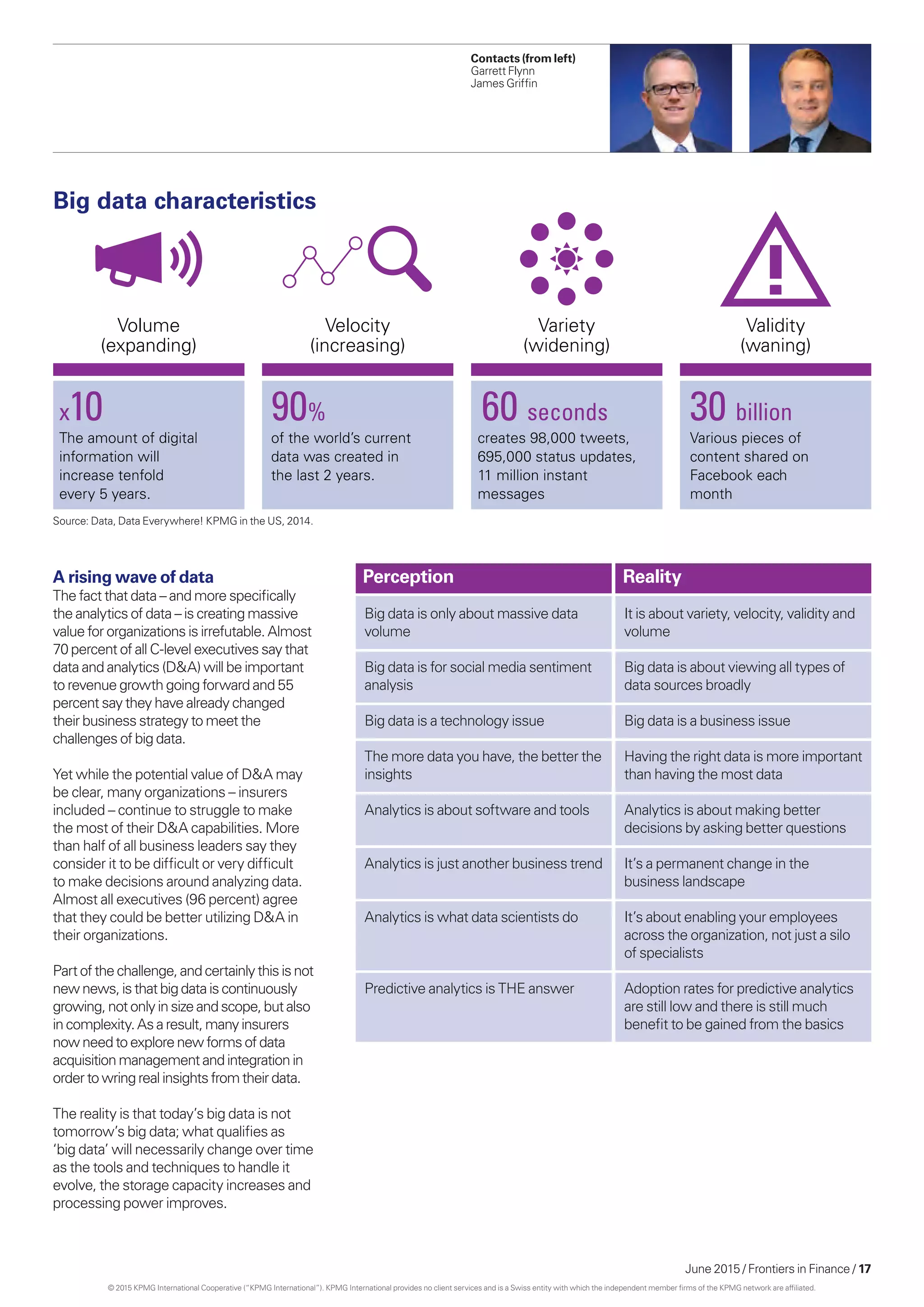

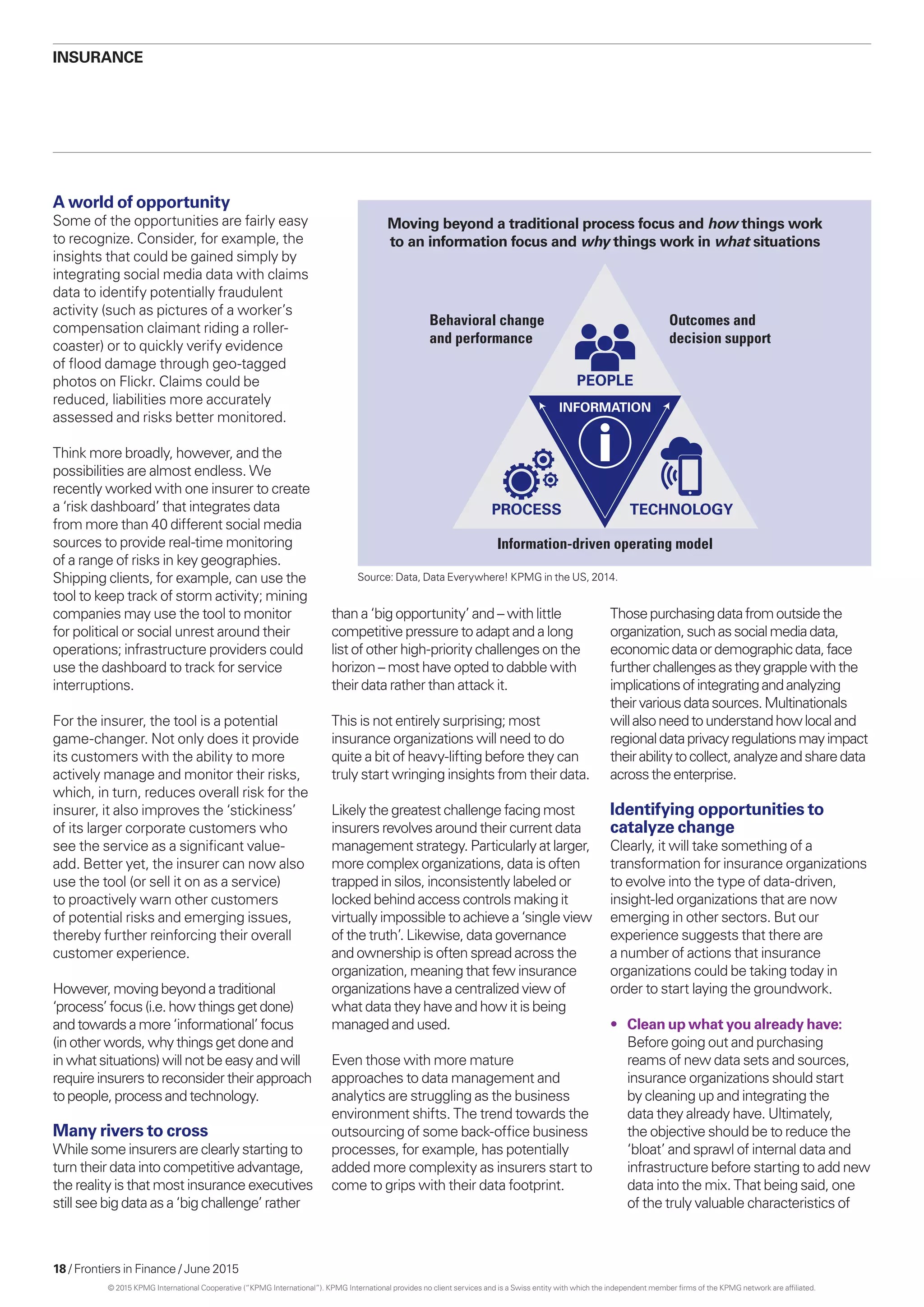

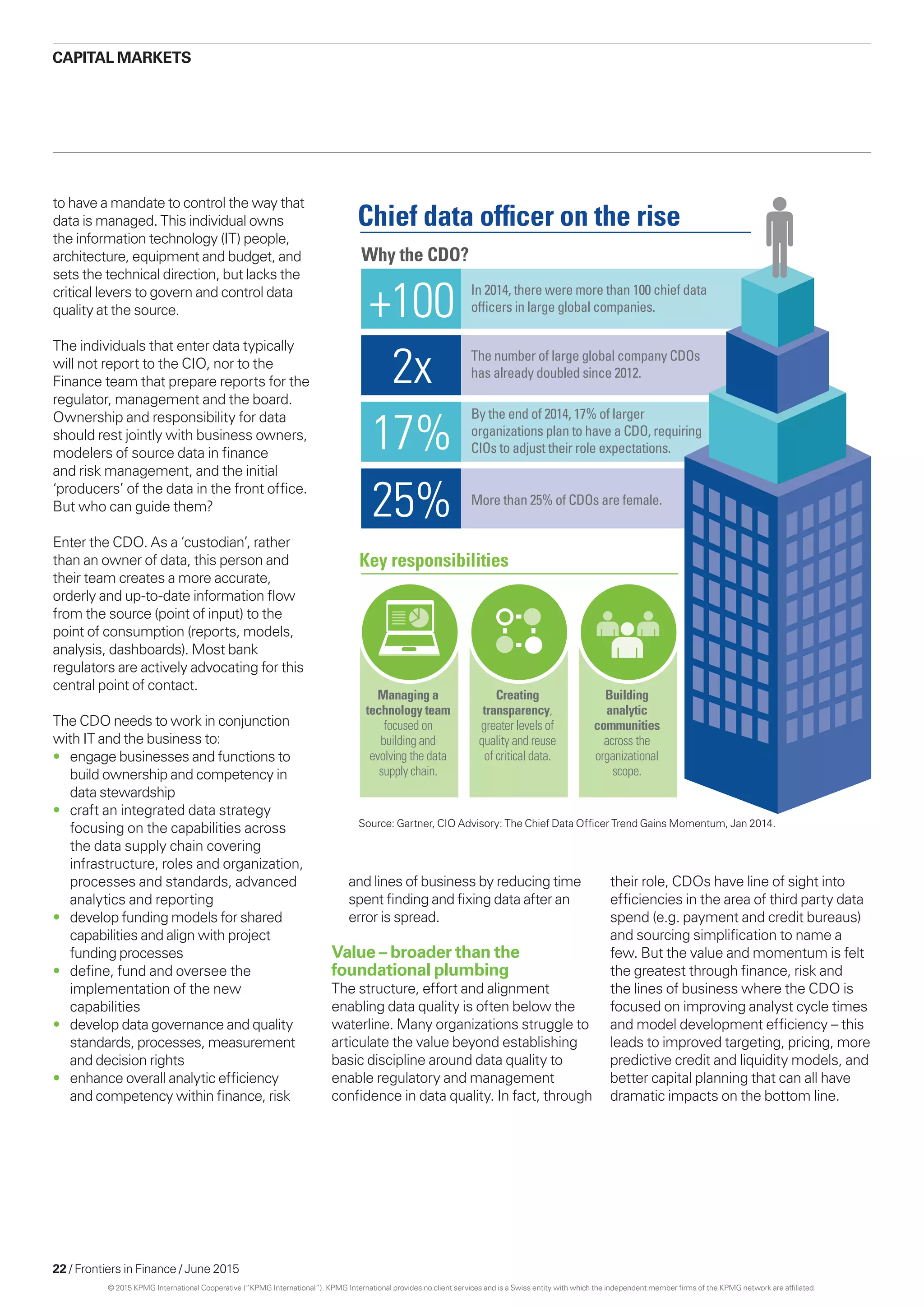

- It highlights opportunities around better utilizing data and analytics to improve performance, reduce risk, and drive growth. The role of the chief data officer is becoming increasingly important in this area.

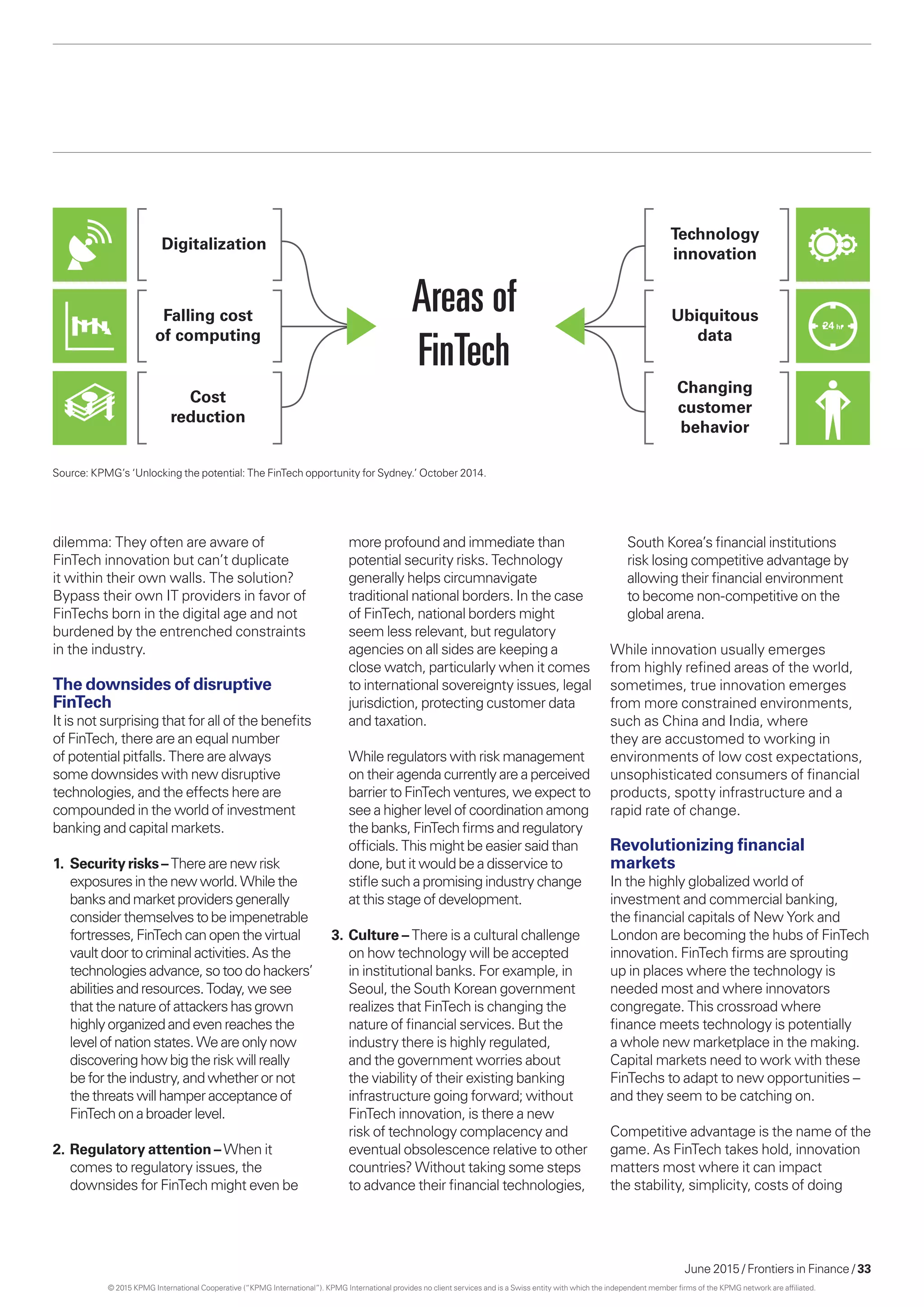

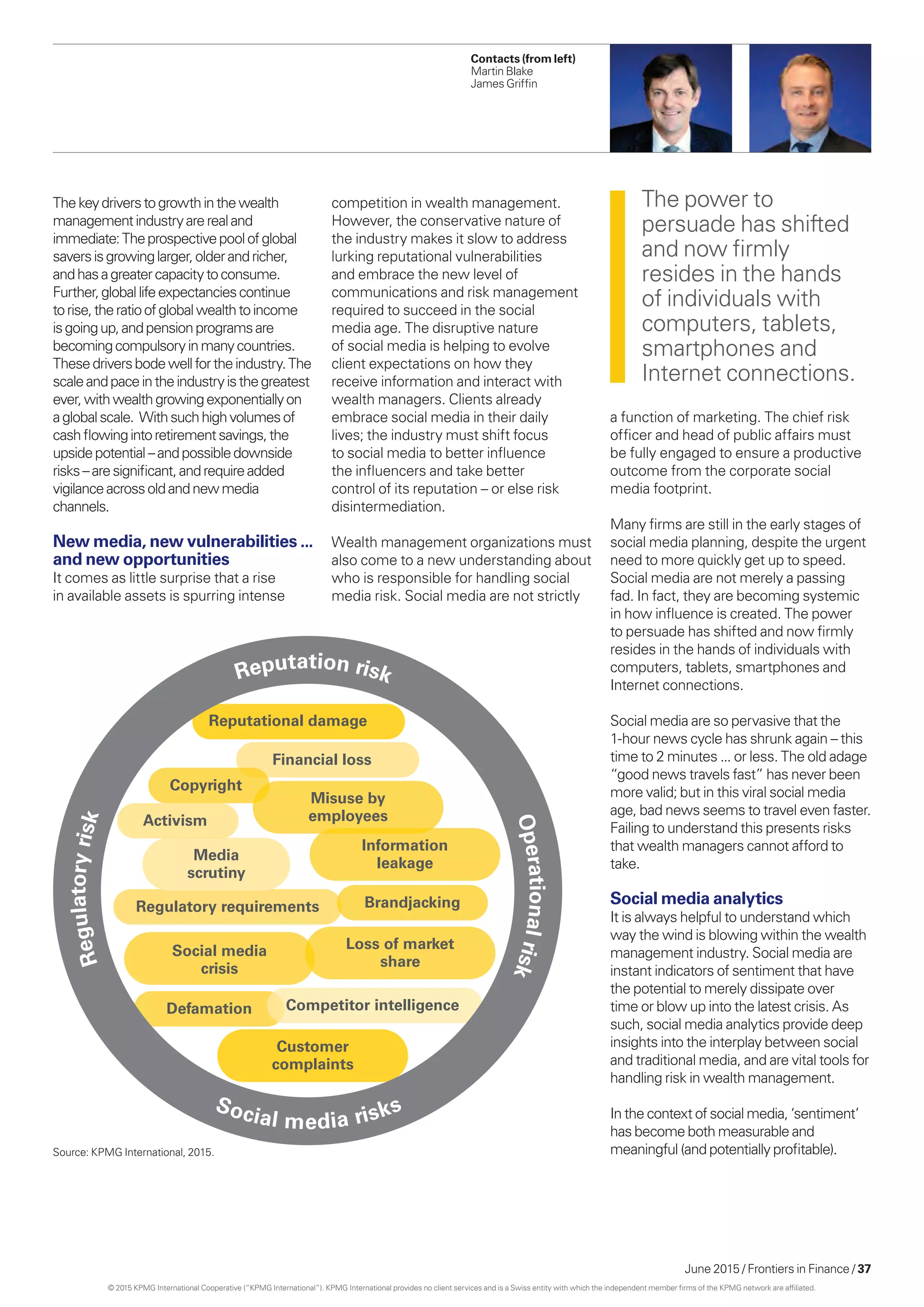

- Emerging technologies like social media, FinTech, and big data are disrupting traditional models and providing new sources of customer insights. Partnerships between financial institutions and