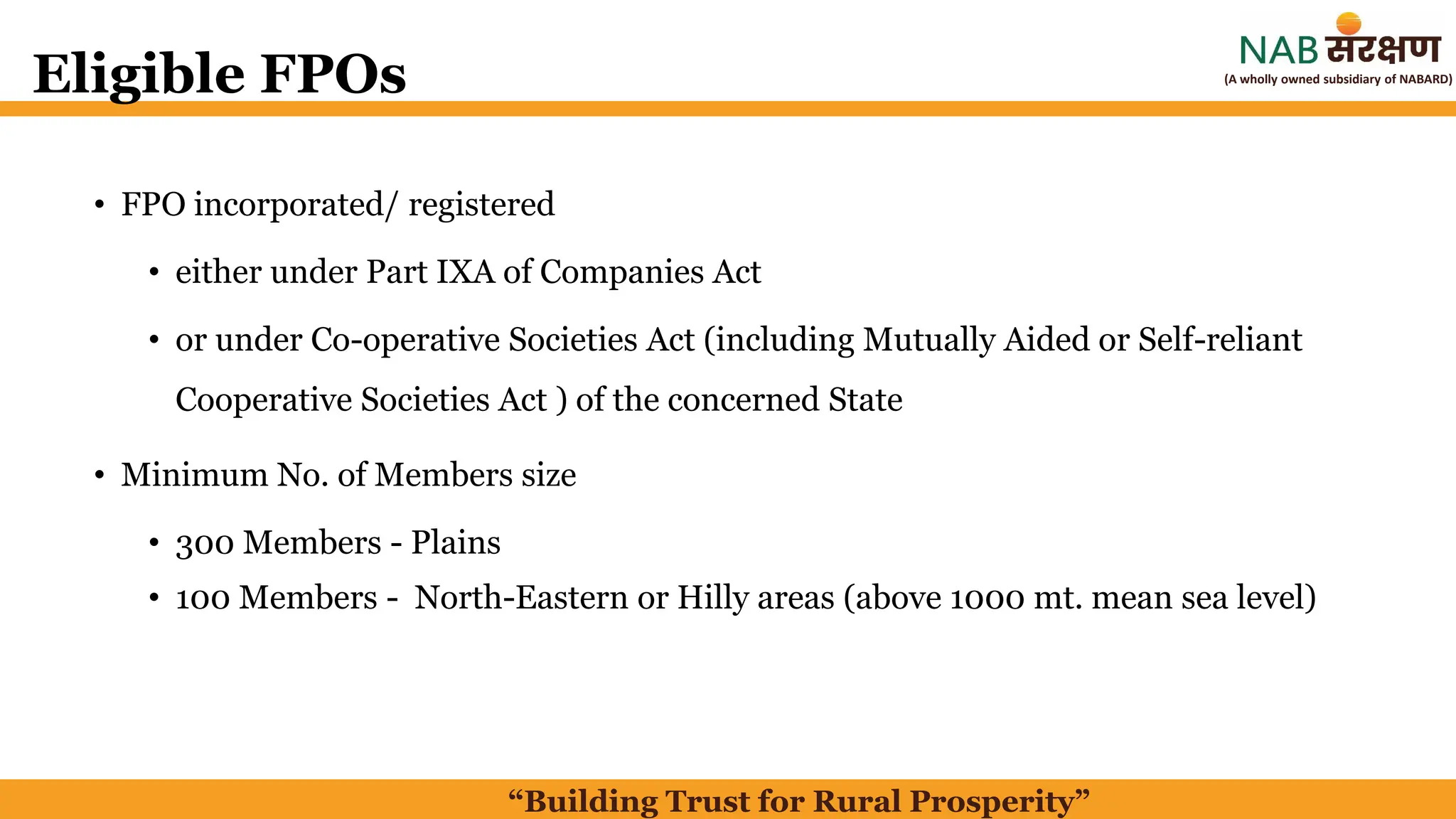

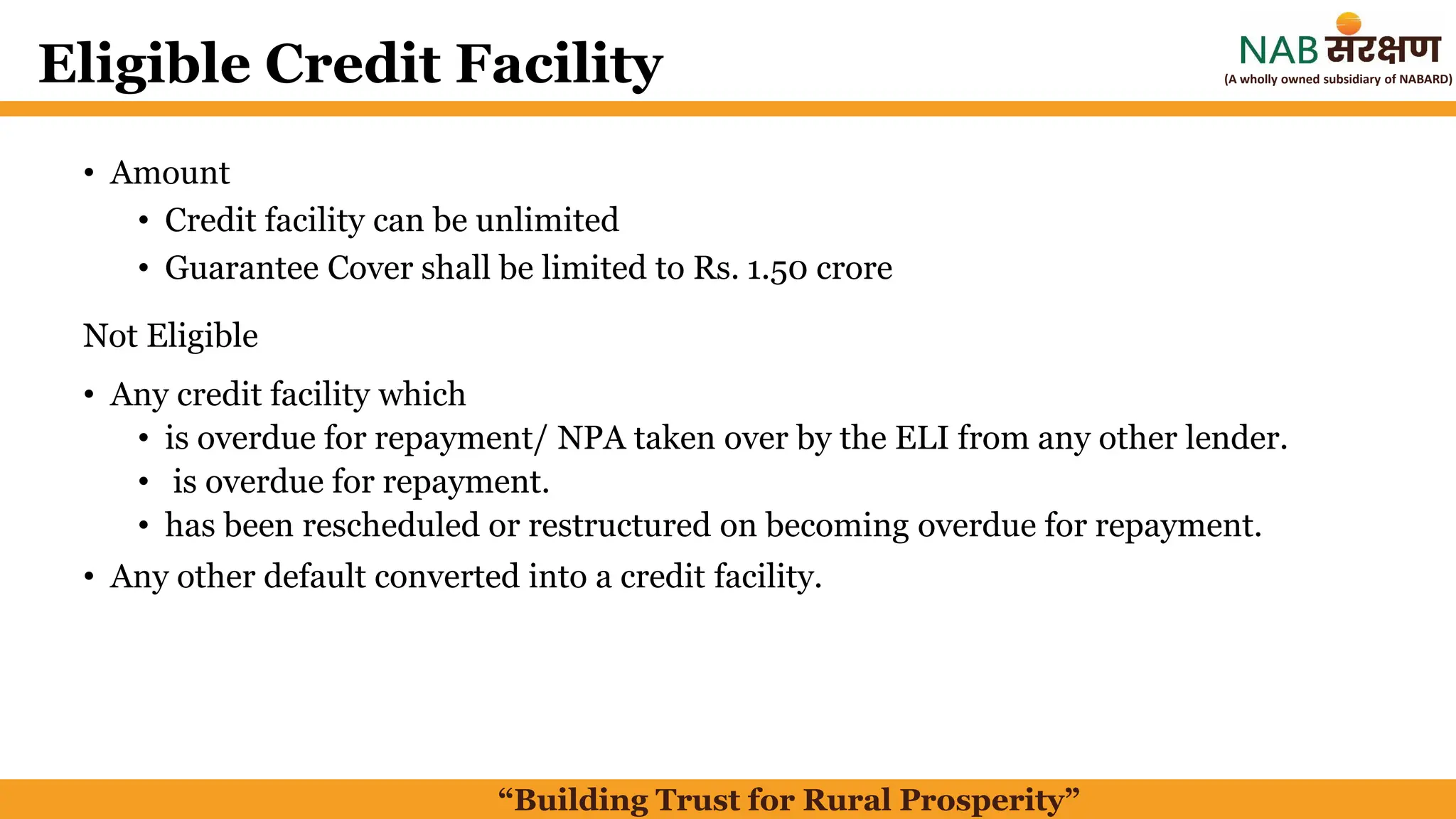

The document outlines a credit guarantee scheme by NABARD aimed at promoting farmer producer organizations (FPOs) by minimizing lending risks for eligible lending institutions (ELIs). The scheme offers collateral-free credit up to a maximum guarantee cover of Rs. 1.50 crore for eligible FPOs, which must be registered and meet specific member criteria. A 0.75% to 0.85% annual guarantee fee is applicable depending on the sanctioned amount, fostering access to finance for rural prosperity.