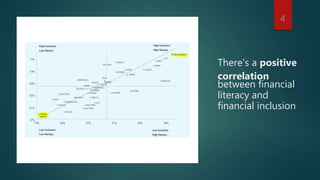

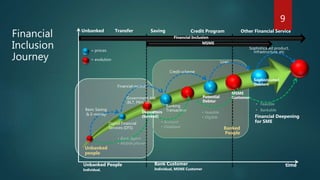

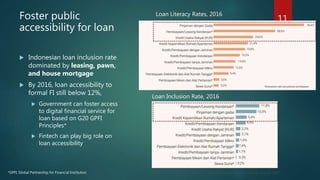

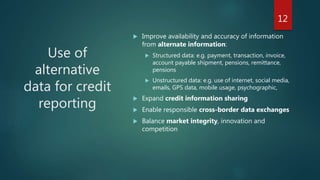

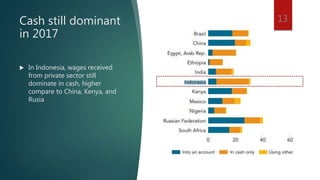

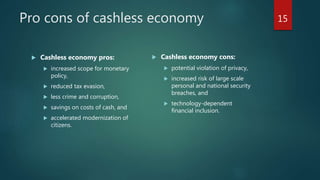

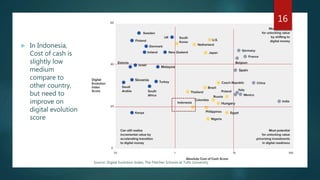

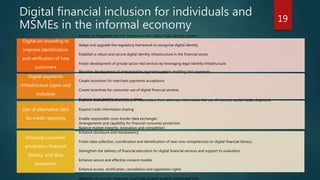

The document discusses the challenges of financial inclusion in Indonesia, highlighting the significant number of unbanked individuals and the barriers they face, such as low financial literacy and poor infrastructure. It emphasizes the role of digital financial services in overcoming these challenges and promoting access to credit, while also exploring the implications of transitioning to a cashless society. Additionally, it outlines the necessity for improved credit reporting and regulatory frameworks to enhance financial inclusion for individuals and MSMEs in the informal economy.