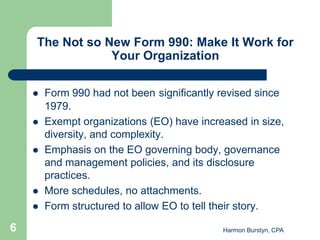

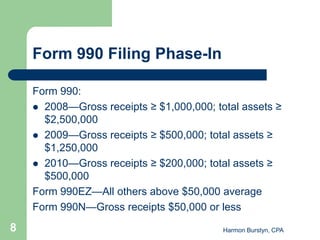

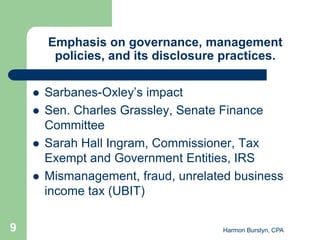

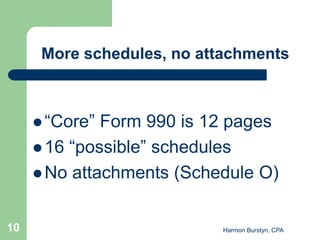

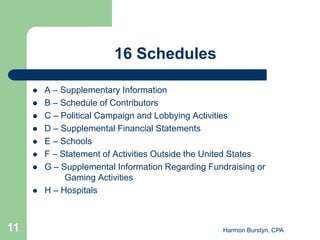

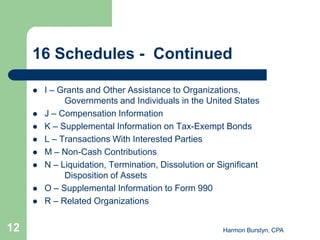

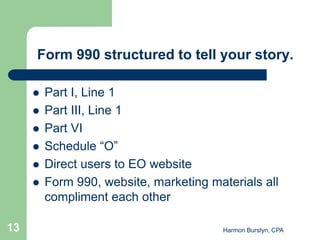

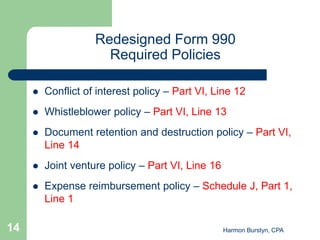

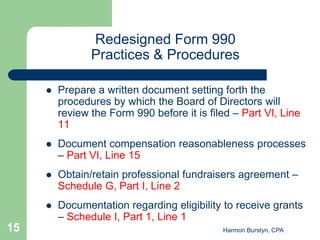

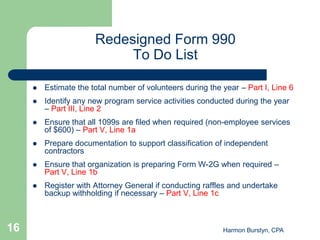

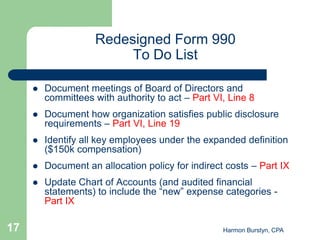

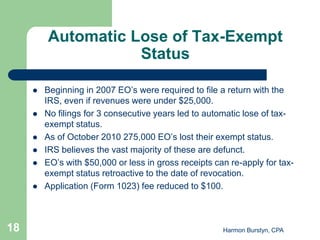

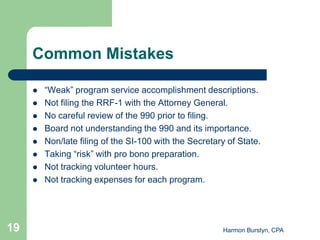

The document summarizes key points about the revised Form 990 that non-profit organizations in the US must file. It highlights changes made to emphasize governance, management policies, and disclosure practices. It provides an overview of the additional schedules and requirements for policies and documentation. It also lists common mistakes made in filling out the form and provides resources for non-profits to ensure compliance.