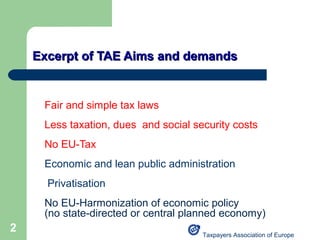

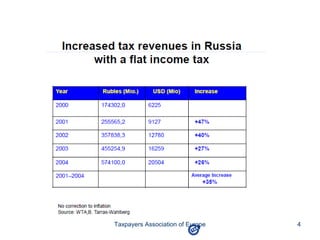

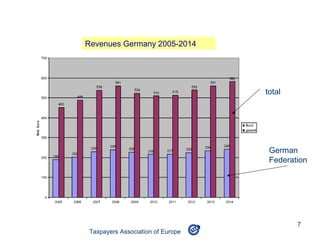

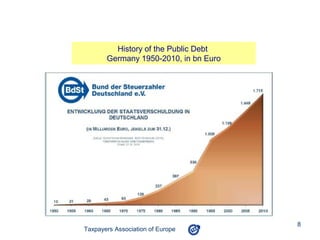

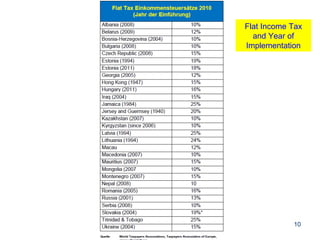

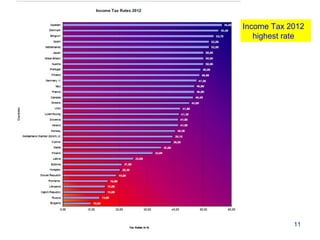

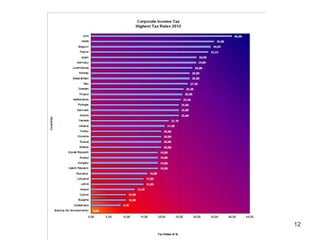

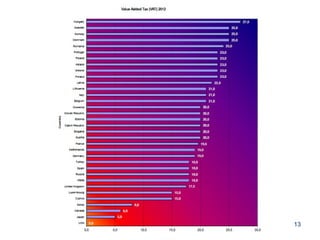

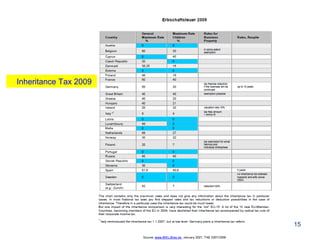

The document discusses taxation policies in developed countries. It summarizes the aims of the Taxpayers Association of Europe, which include fair and simple tax laws, less taxation and social costs, and no EU tax harmonization. The association's research shows that high taxation is linked to lower economic growth, while low taxation encourages growth. However, some countries are using fiscal crises as an excuse to increase tax rates or introduce new taxes. The association advocates for flat tax systems to stimulate growth and argues against the European Commission's proposals to harmonize direct taxes across countries.