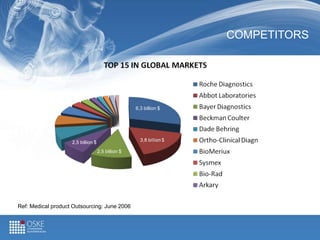

This document describes the Medical Device Gateway (MDG) program, a Chinese-Finnish network aimed at commercializing medical device technologies. The program seeks to bring Chinese medical device innovations to European markets through Finnish companies, and to open Chinese markets to Finnish medical ventures. It identifies opportunities in the large and growing Chinese IVD market and regulatory changes making it more accessible. The document outlines the program's operations of establishing strategic partnerships between Finnish and Chinese organizations to more quickly develop and place new products on global markets.