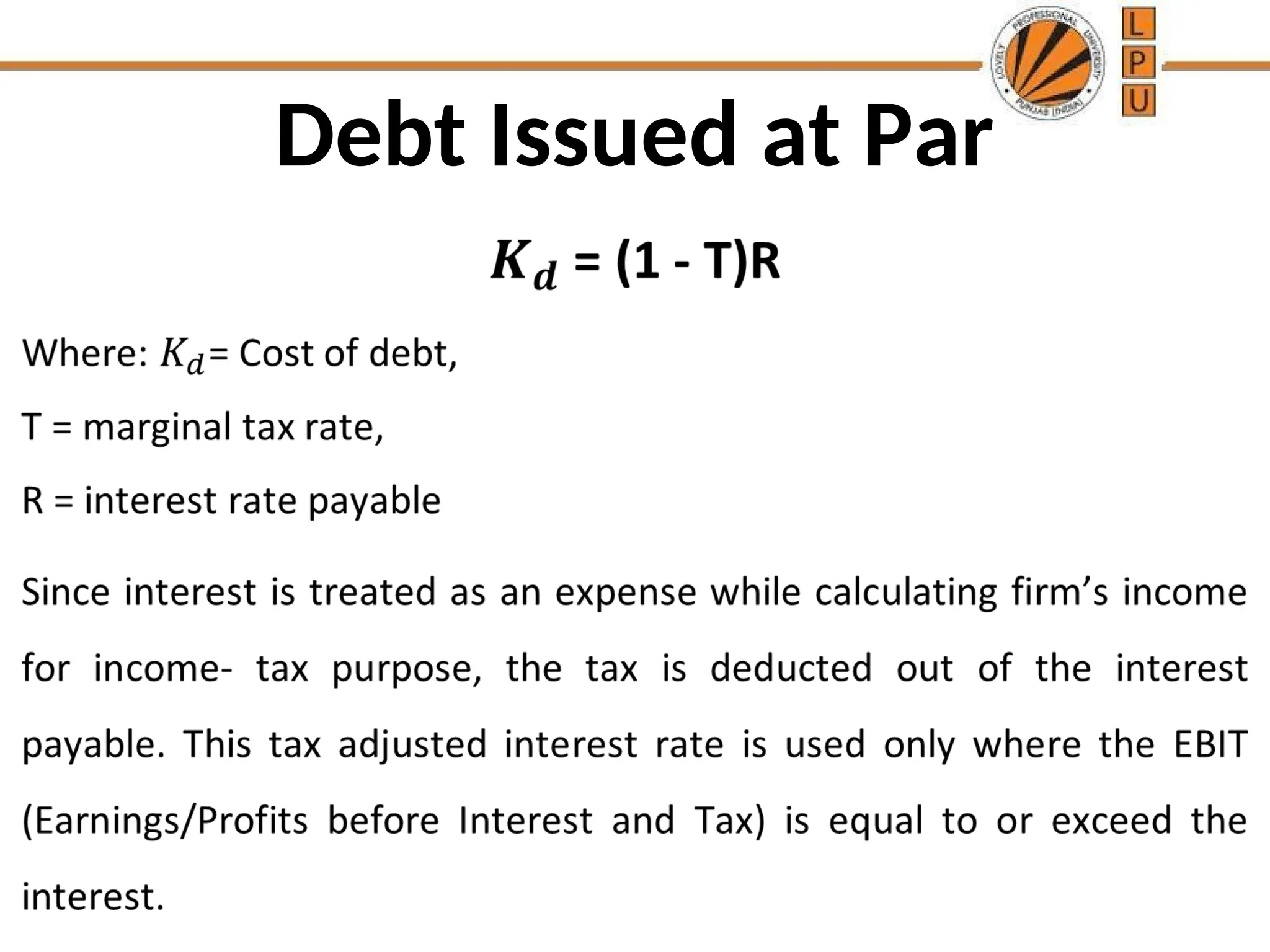

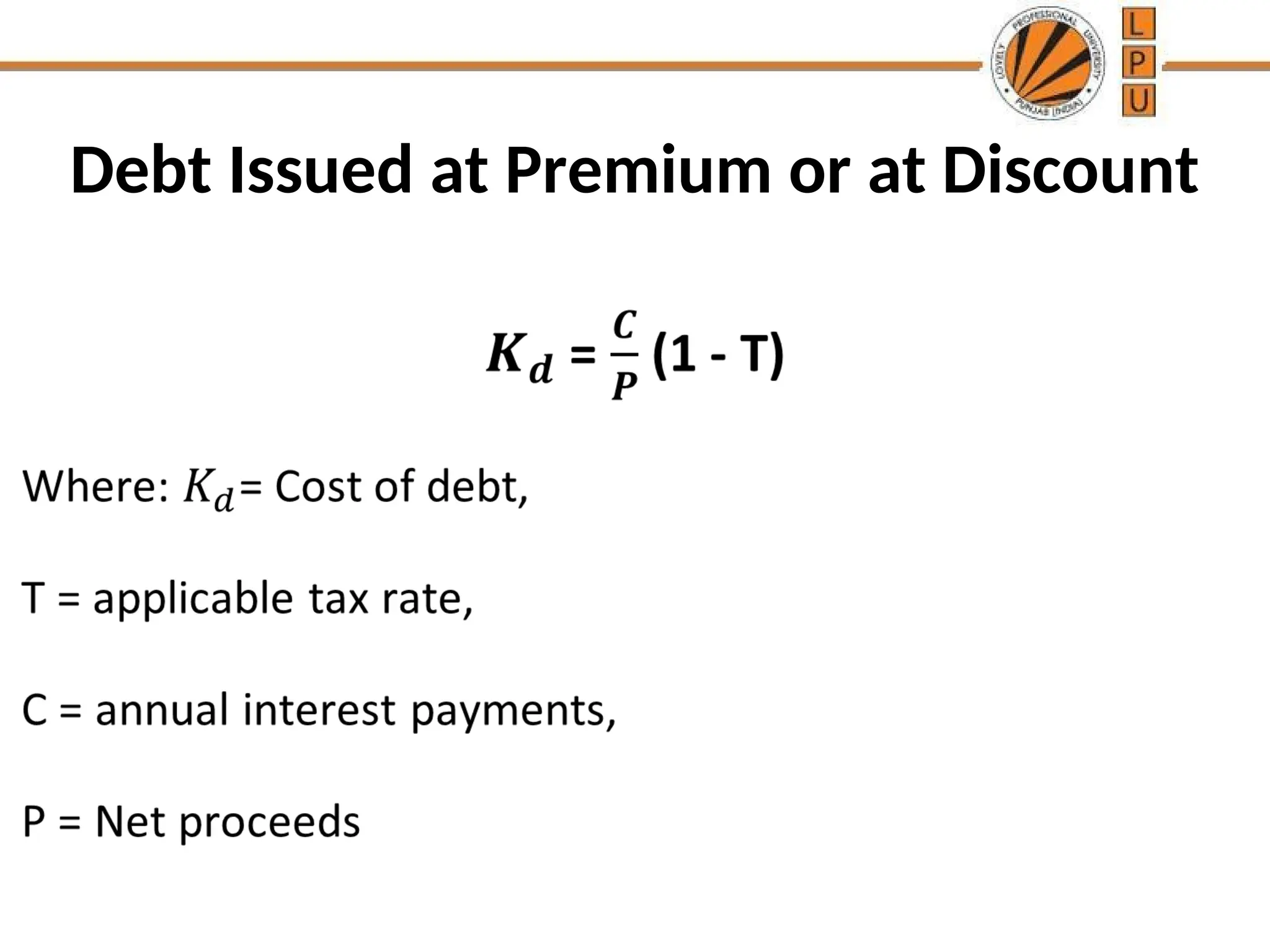

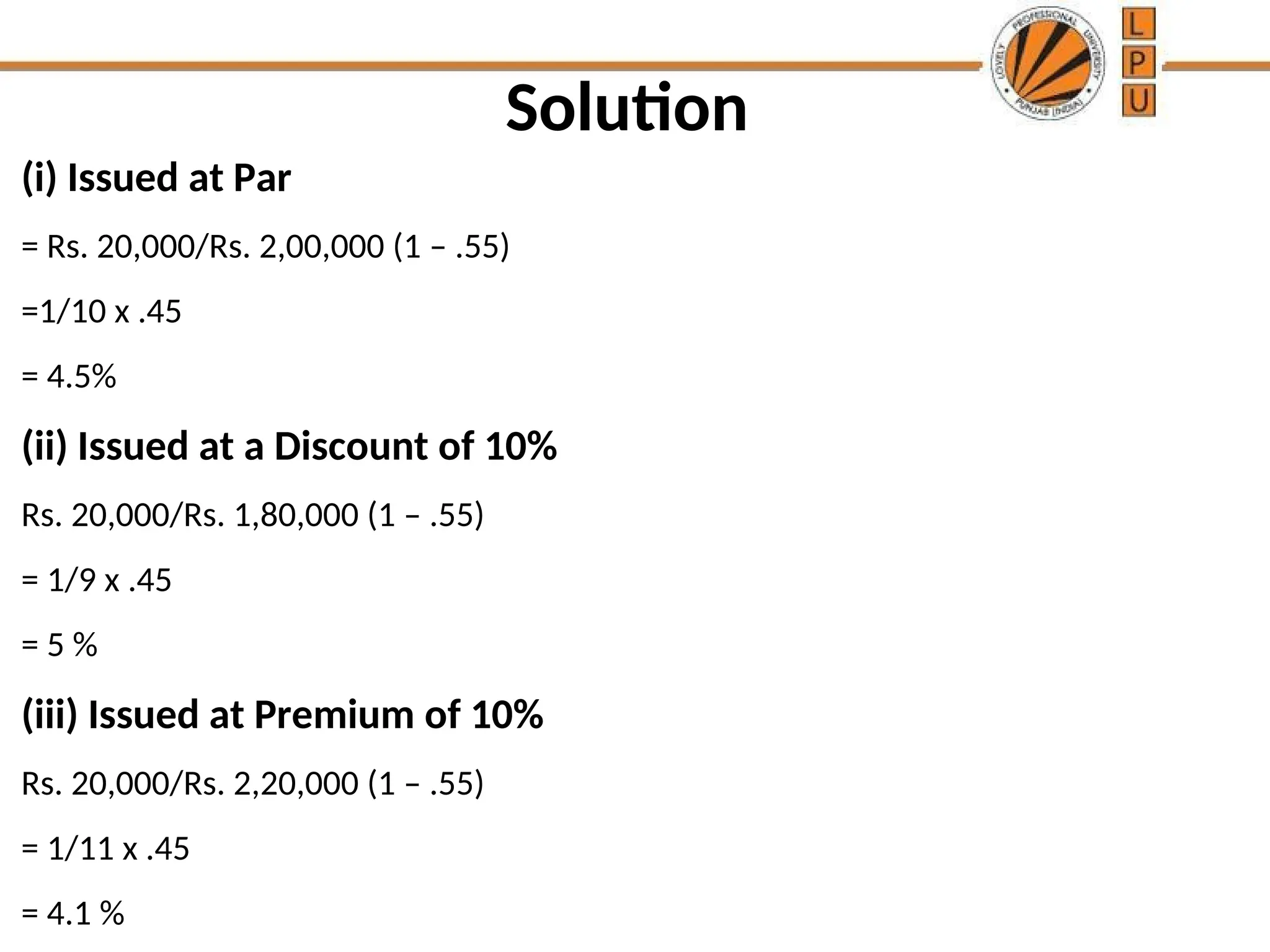

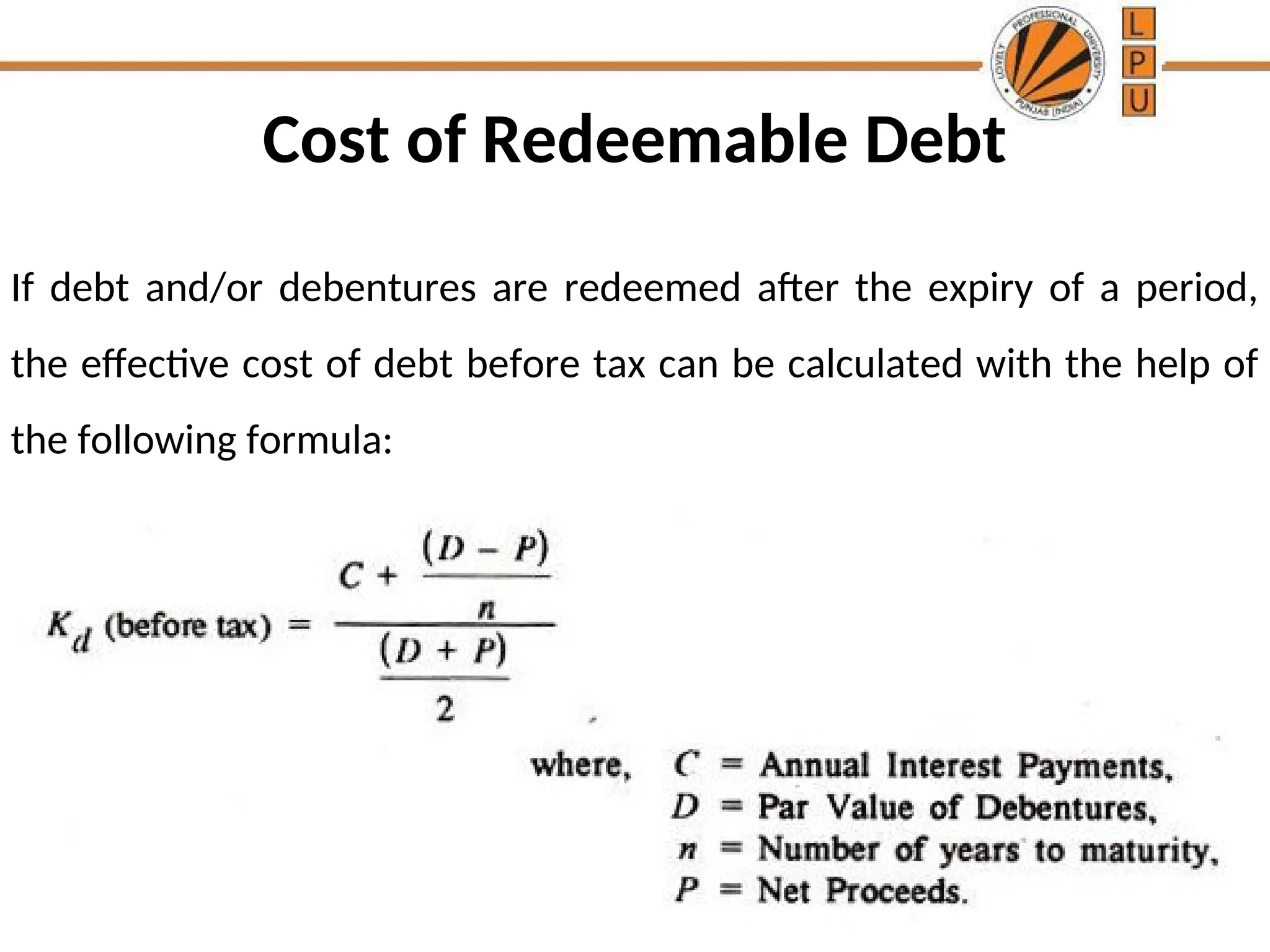

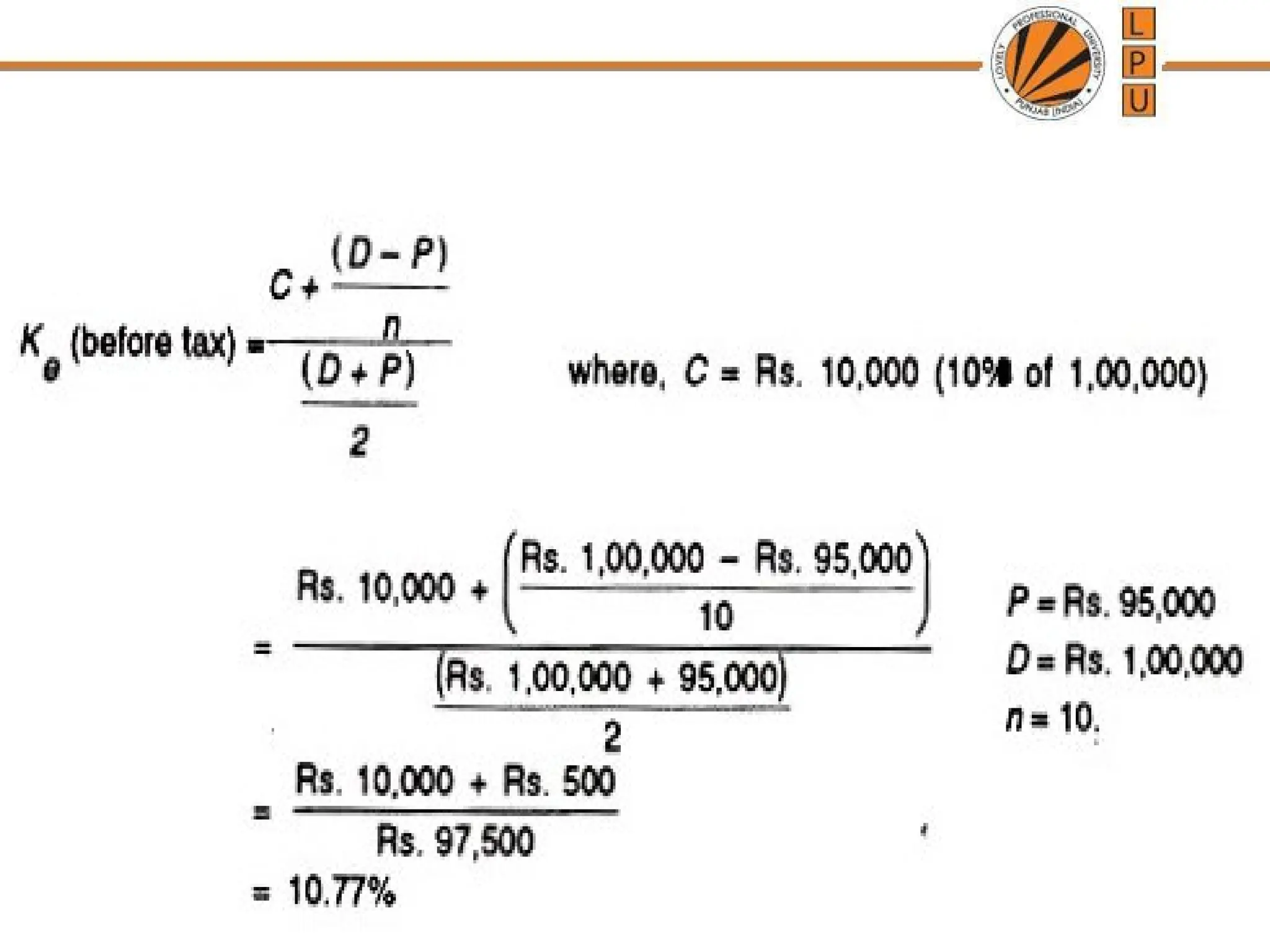

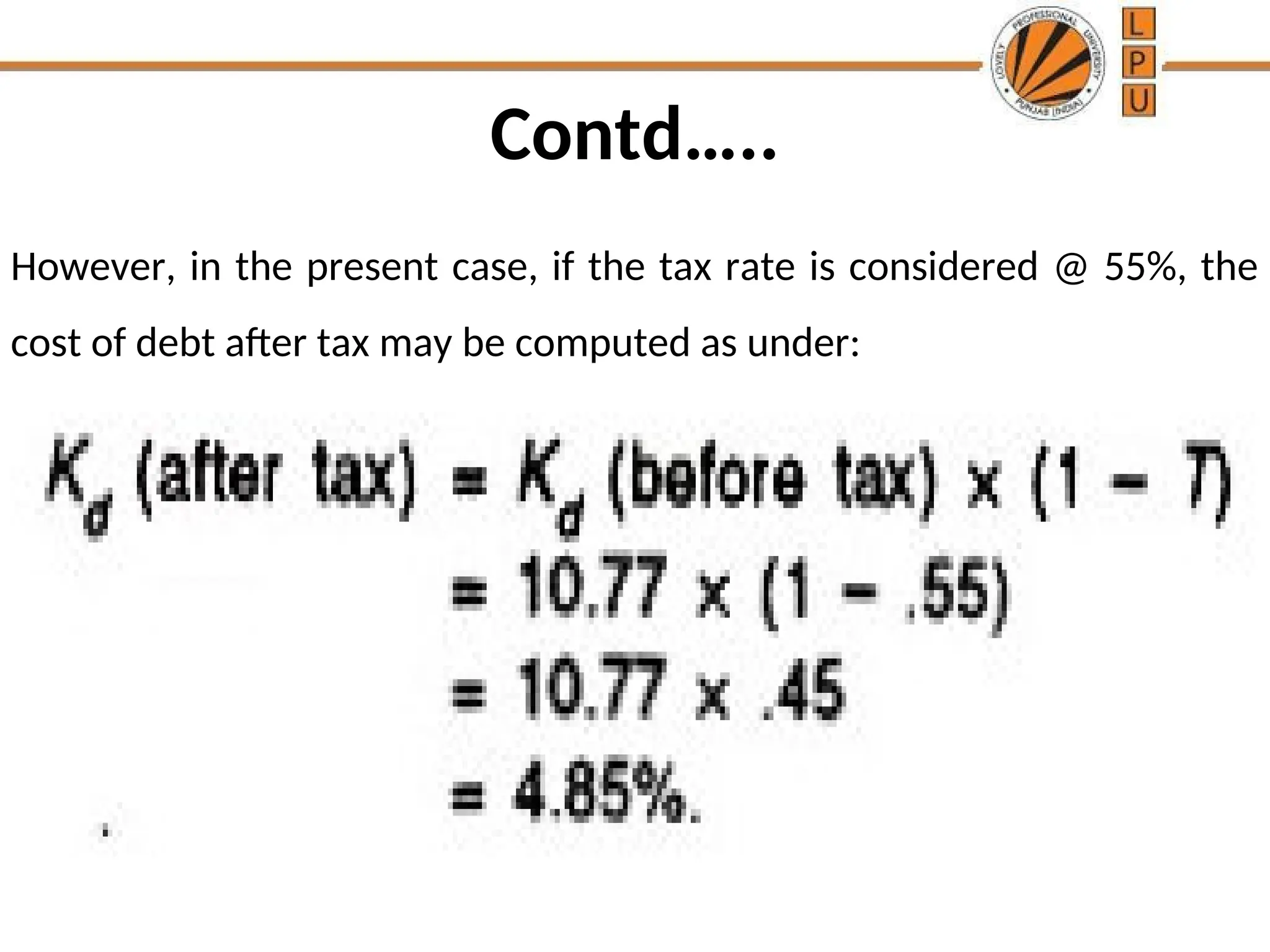

The document outlines the concept of cost of capital and its critical role in financial decision-making, emphasizing that it is determined by project risk rather than firm characteristics. It details the components of cost of capital, including the cost of debt, preference capital, equity capital, and retained earnings, along with methods to calculate costs based on different debt issuance scenarios. Additionally, the document addresses the significance of cost of capital in maximizing firm value, capital budgeting, and financial performance evaluation.