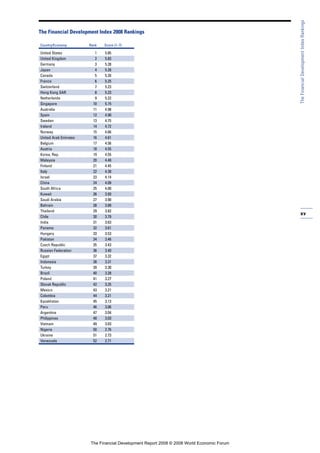

This document provides an introduction and summary of the World Economic Forum's inaugural Financial Development Report 2008. It was published at a time of financial instability and uncertainty. The report aims to provide a holistic perspective on financial development by assessing countries' financial systems, examining the link between finance and economic growth, and discussing financial reforms. It incorporates input from academics, business and political leaders through the Forum's multistakeholder engagement process. The report includes the Financial Development Index, country profiles, data tables, and analysis to facilitate discussions on financial system strengths, priorities and reforms.

![Recent crises of the Western financial system

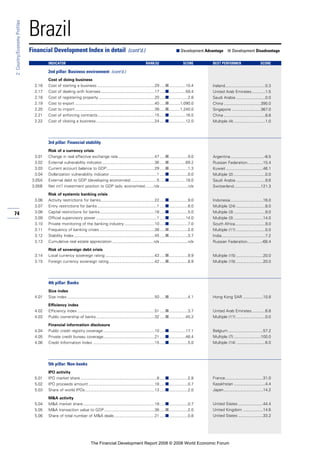

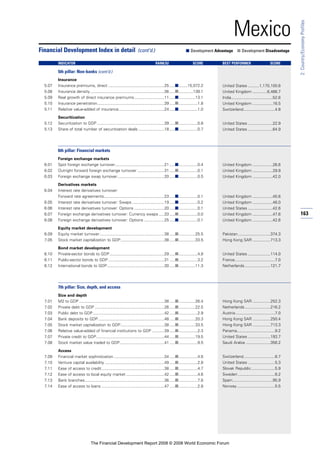

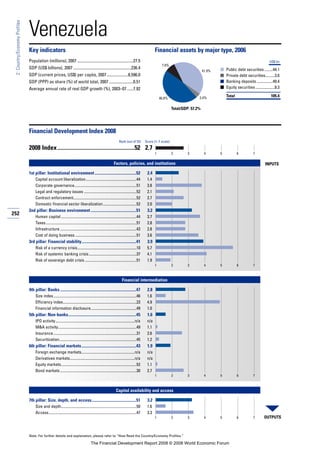

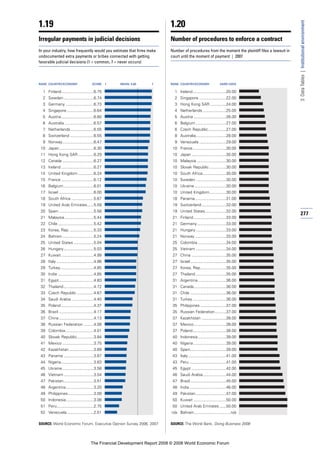

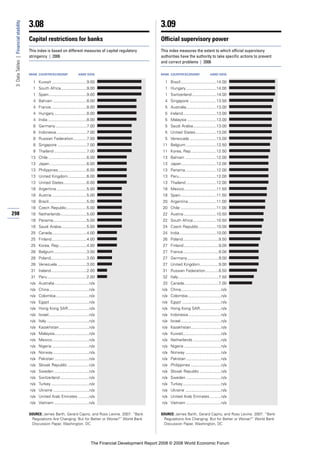

The decade from 1994 until 2003 was one of repeated

financial crises in emerging market economies: Mexico

in 1994;Thailand, Indonesia, Malaysia, and Korea in

1997–98, Russia in 1998; Brazil, Ecuador, Pakistan, and

Ukraine in 1999;Turkey and Argentina in 2001; and

Uruguay and the Dominican Republic in 2003.These

crises were caused by a combination of macroeconomic

weaknesses, policy mistakes, inappropriate exchange rate

policies, balance sheet vulnerabilities, poor corporate

governance, and weak and poorly supervised and regu-

lated financial systems.

Although not every one of these financial crises

ended up in a systemic crisis of the banking or financial

system or the corporate system, many of them did.The

weaknesses in corporate governance, the emergence of

credit and asset bubbles, the poor supervision and regu-

lation of financial institutions, the distorted incentives

for financial institutions (in part because of moral hazard

distortions created by implicit and/or explicit govern-

ment bailout guarantees), and phenomena such as

directed and connected lending combined led to credit,

debt, and financial excesses that eventually triggered sys-

temic banking and corporate crises.

The resolution of these crises implied a variety of

policy actions, including structural reforms to make cor-

porate and financial systems less vulnerable and more

resilient as well as fundamental reforms of financial reg-

ulation and supervision.At the time of these crises, the

International Monetary Fund (IMF), the United States,

and the G7 countries were highly critical of the finan-

cial weaknesses—particularly the quality of institutions,

regulations, and governance—that had been triggering

factors in these crises.The fact that structural reforms in

the financial sector of these economies did occur—on

top of macro and policy changes—explains the high

growth rate of emerging market economies in the last

few years and their resilience, in spite of global shocks

that have hit advanced economies and their financial

markets in the last few years.

It is thus somehow ironic and paradoxical that,

while a decade ago (1997–98), the United States and

other G7 policymakers were lecturing East Asian and

other emerging market policymakers about the structur-

al weaknesses of their financial systems and prodding

them to implement structural reform, today the financial

turmoil and stress is at the core of the financial systems

of the most advanced economies and financial markets

in the world: those in the United States, in the United

Kingdom, and, to a smaller extent, in the euro zone.

The severe liquidity and credit crunch that started

with the housing bust and the collapse of the subprime

mortgage market in the United States revealed a much

larger credit and asset bubble and financial excesses of

leverage that went well beyond subprime mortgages.

Excessive debt accumulation and risky leverage occurred

in subprime mortgages, near prime mortgages, prime

mortgages, commercial real estate, the whole plethora of

securitized products associated with mortgages and

other asset-backed securities (ABSs), structured finance

products (mortgage-backed securities [MBSs], collateral-

ized debt obligations [CDOs], constant proportion debt

obligations [CPDOs], collateralized mortgage obligations

[CMOs], collateralized loan obligations [CLOs]), unse-

cured consumer credit (credit cards, auto loans, student

loans), leveraged loans financing excessively leveraged

leveraged buy-outs (LBOs), muni bonds, industrial and

commercial loans, junk corporate bonds, and credit

default swaps (CDSs).This credit house of cards began

to sway in 2007 and collapsed in 2008.The excesses

were not limited to the United States but extended to

other advanced economies; housing bubbles and credit

booms in consumer credit were widespread in the

United Kingdom, Spain, Ireland, and—in minor part—

other euro zone economies.The financial turmoil and

credit/liquidity crunch triggered by the subprime melt-

down revealed fundamental weaknesses in the operation

of advanced economies’ financial markets and in the sys-

tem of supervision and regulation of the financial sys-

tem, including banks and non-bank financial institu-

tions.

This crisis has led to the recognition that funda-

mental reforms of the regulation and supervision of the

financial systems of advanced economies are necessary in

a world of financial globalization.A plethora of propos-

als for reform have been advanced by a number of insti-

tutions: the Financial Stability Forum, the Fed, the US

Treasury, the G7, the FSA and other policy bodies in the

United Kingdom, the BIS, the IMF. It is clearly recog-

nized that the system of regulation and supervision of

financial institutions is in trouble and in need of serious

reform.

Which reforms are most appropriate? Instead of

considering the specific reforms suggested by individual

institutions and regulatory bodies, it makes sense to ana-

lyze the fundamental weaknesses, distortions, and open

issues in the advanced economies’ financial markets, and

thus what the appropriate principles for a new system of

regulation and supervision may be.The rest of this chap-

ter considers the most important issues related to reform

of the regulation and supervision of financial institutions

in a world of financial globalization.

Issues of reform in a world of financial globalization

Given the ongoing financial crisis in the United States

and parts of other advanced economies’ financial sys-

tems, the need for the appropriate reform of the system

of supervision and regulation of financial institutions has

become a core and urgent subject of debate among

scholars, market experts, and policymakers.

To understand what the appropriate system of regu-

lation and supervision of financial institutions may be in

a world of financial globalization, one needs to analyze

39

1.3:FinancialCrises,FinancialStability,andReform

The Financial Development Report 2008 © 2008 World Economic Forum](https://image.slidesharecdn.com/financial-development-report-2008-1233057524747939-3/85/Financial-Development-Report-2008-57-320.jpg)