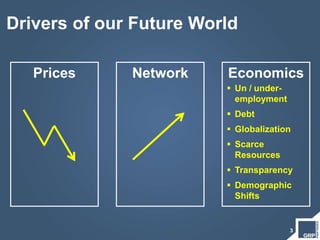

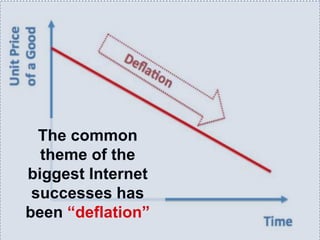

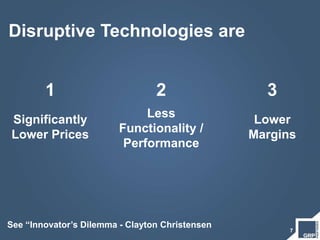

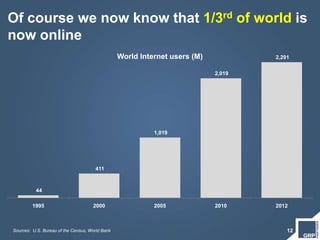

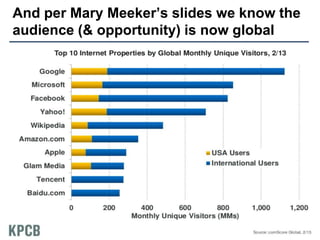

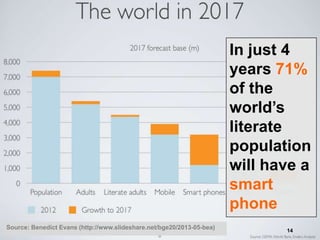

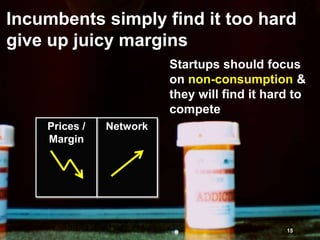

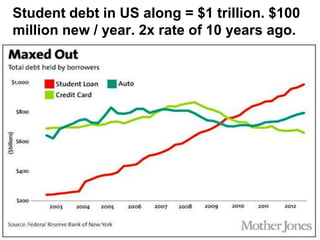

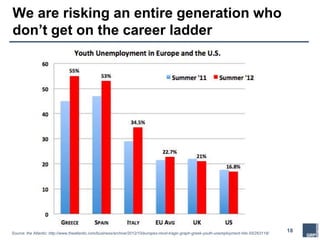

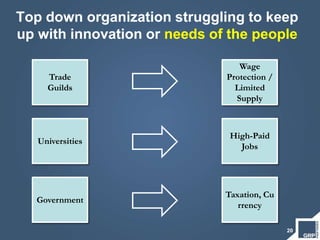

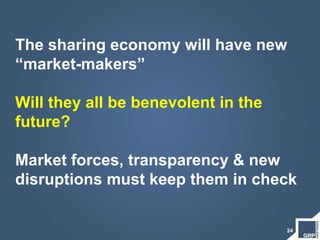

The document discusses the rise of the sharing economy. It argues that economic challenges like unemployment, debt, and scarce resources are driving the growth of collaborative consumption models enabled by new networking technologies. These models allow underutilized assets and skills to be monetized, creating new opportunities for both individuals and businesses. The sharing economy empowers people in developing economies and removes physical boundaries to access global markets. While it creates efficiencies, open data from these networks also enables new forms of monitoring that must be balanced with user privacy and empowerment.