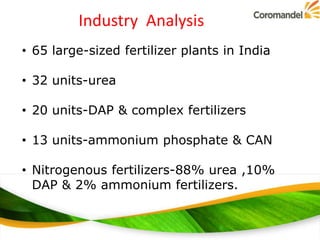

Coromandel International Ltd is a leading fertilizer company in India that manufactures phosphate fertilizers and crop protection products. It produces fertilizers like DAP, complexes, and single super phosphate. The industry is dominated by large plants producing primarily urea, DAP, and ammonium-based fertilizers. Coromandel offers various nitrogen and phosphate-based complex fertilizers tailored to soil and crop needs. A new nutrient-based subsidy policy in 2010 benefited farmers, industry and government by ensuring timely fertilizer availability through imports and subsidy reimbursements.