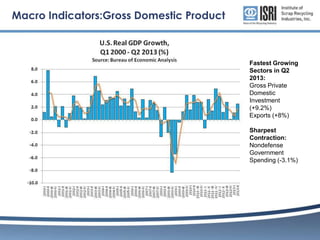

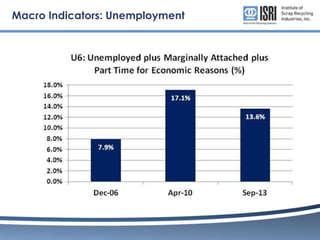

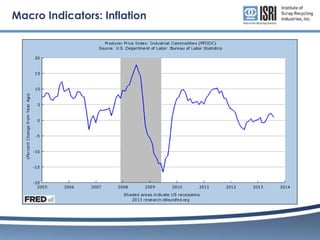

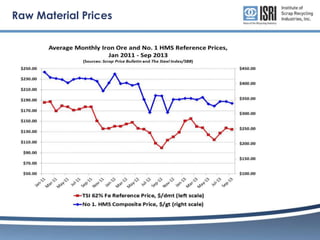

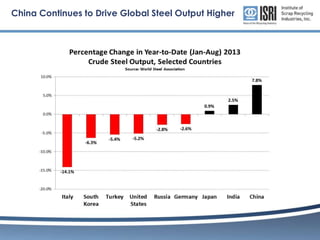

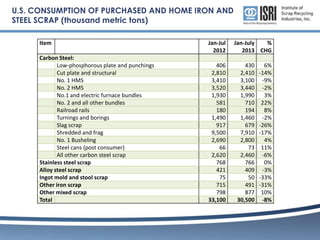

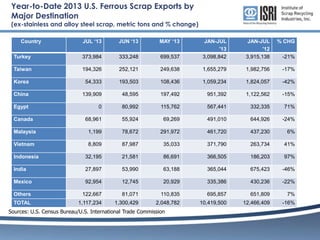

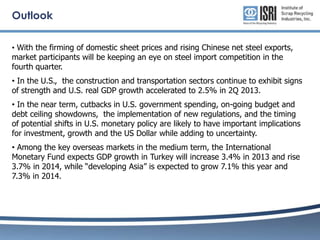

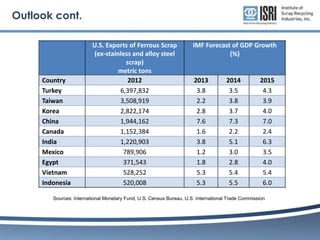

The document discusses the economic indicators affecting the ferrous metal market, highlighting growth in GDP and sectors like private investment and exports, contrasted with declines in government spending. It provides data on U.S. ferrous scrap exports and significant macroeconomic trends, such as steel consumption and international trade dynamics. The outlook suggests attention on steel import competition and economic growth forecasts for key markets including Turkey and developing Asia.