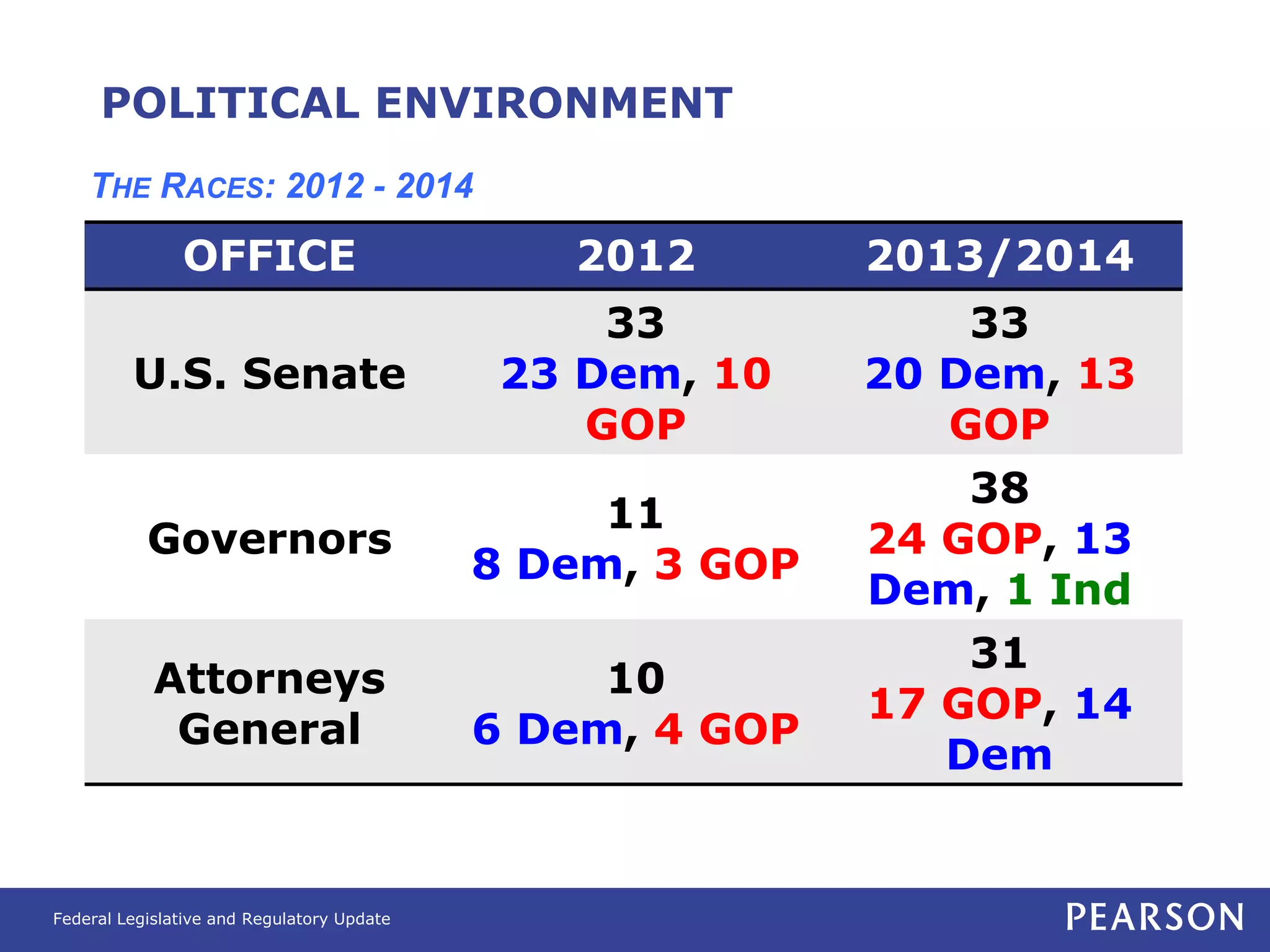

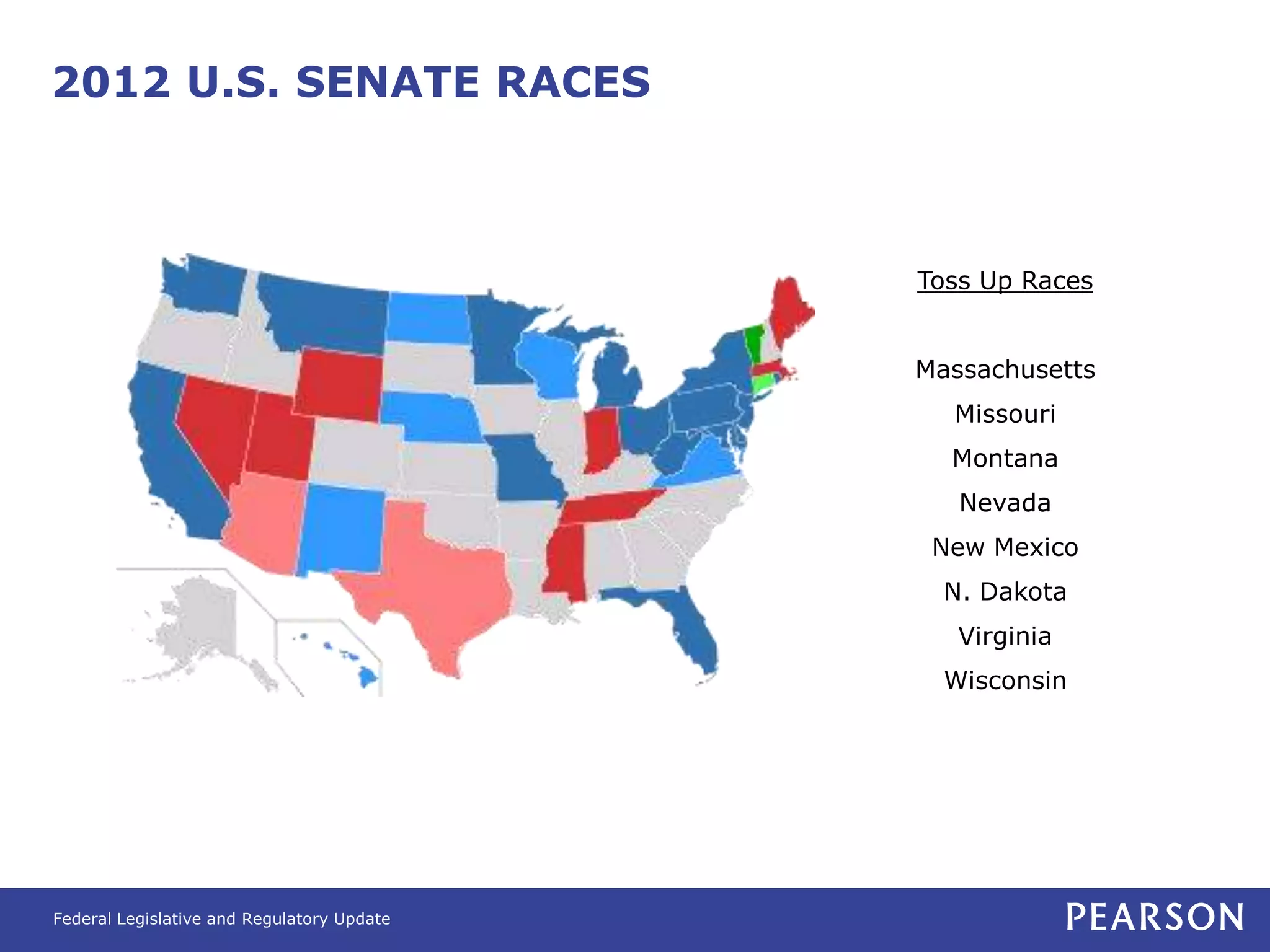

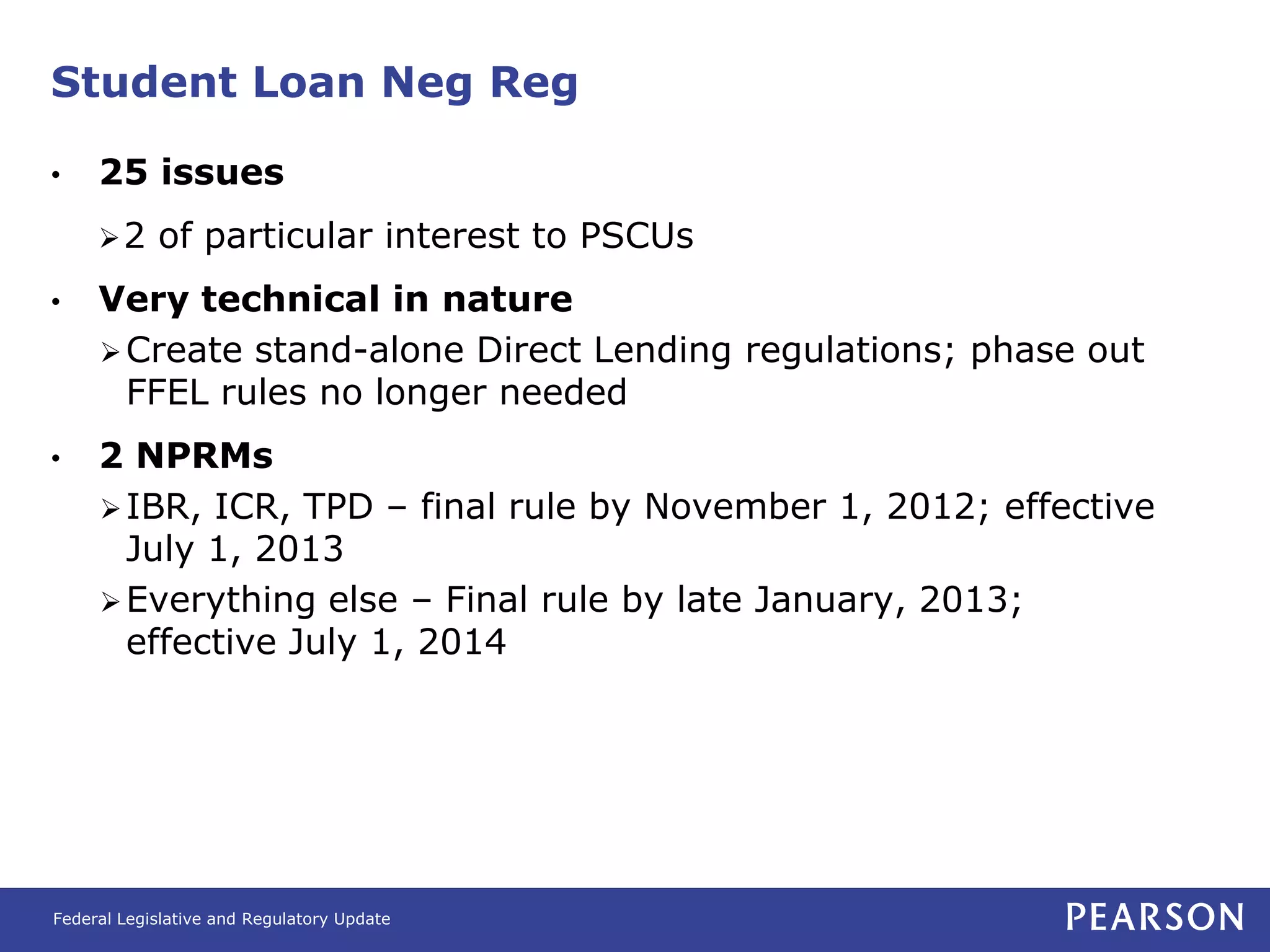

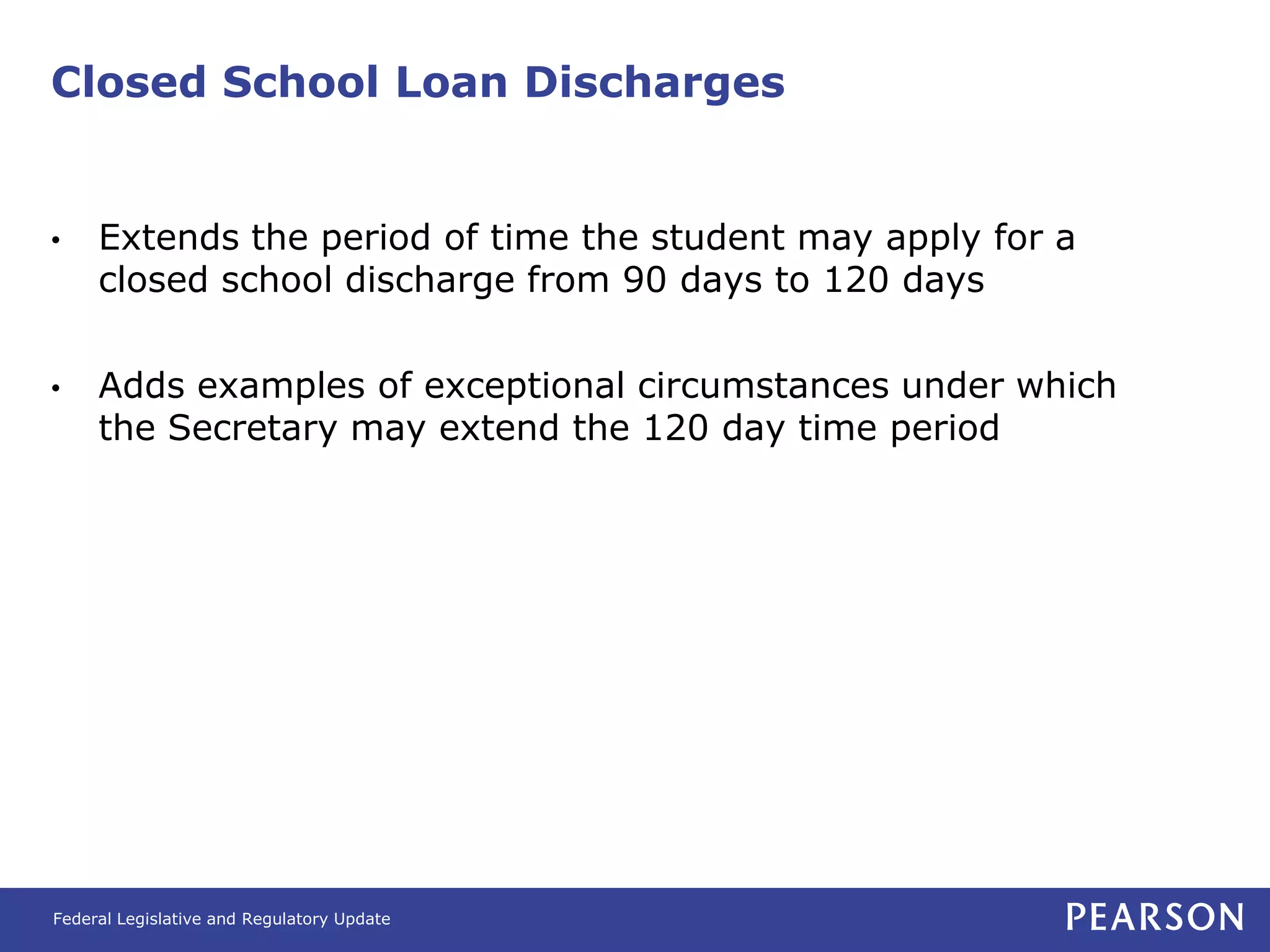

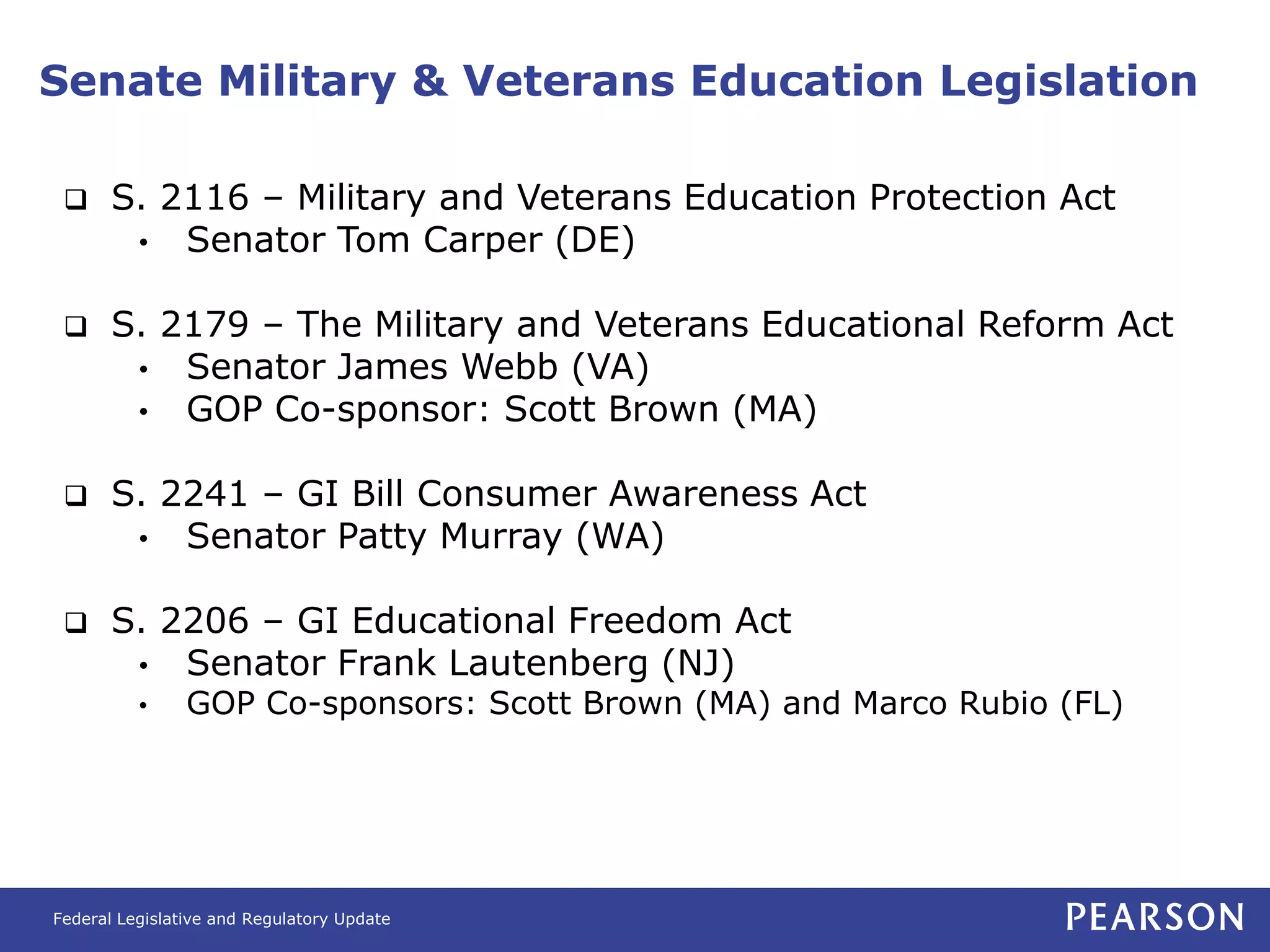

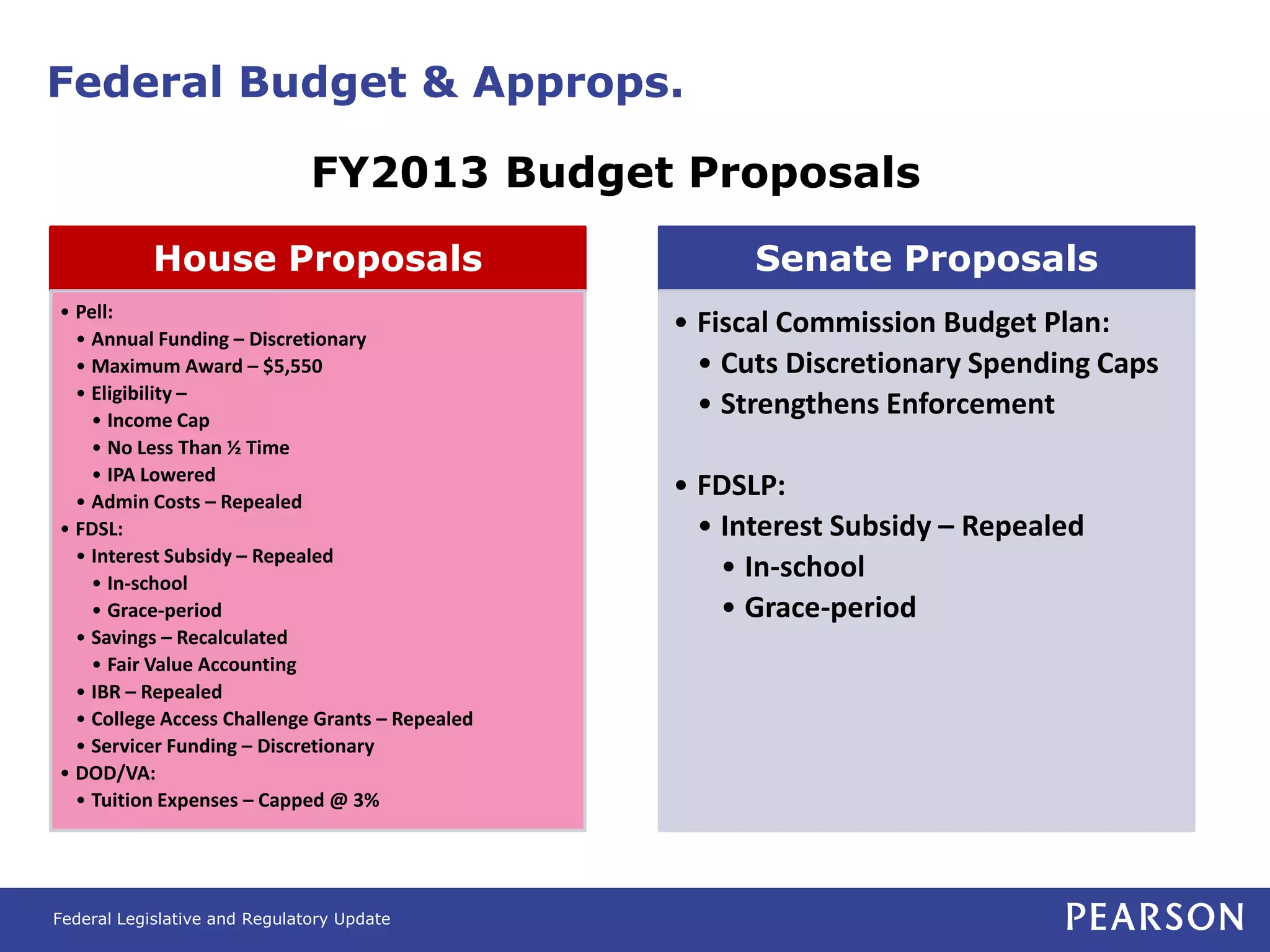

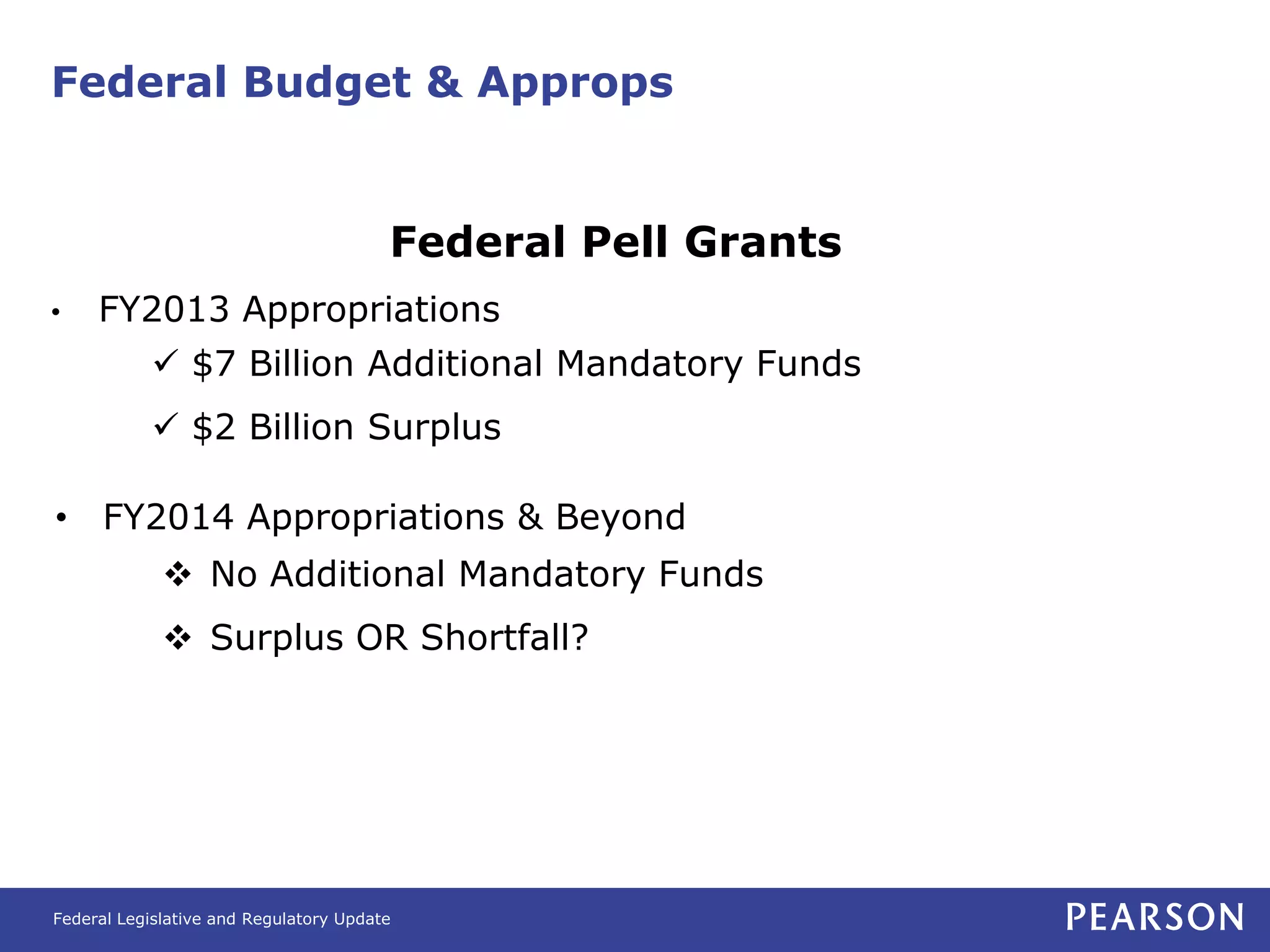

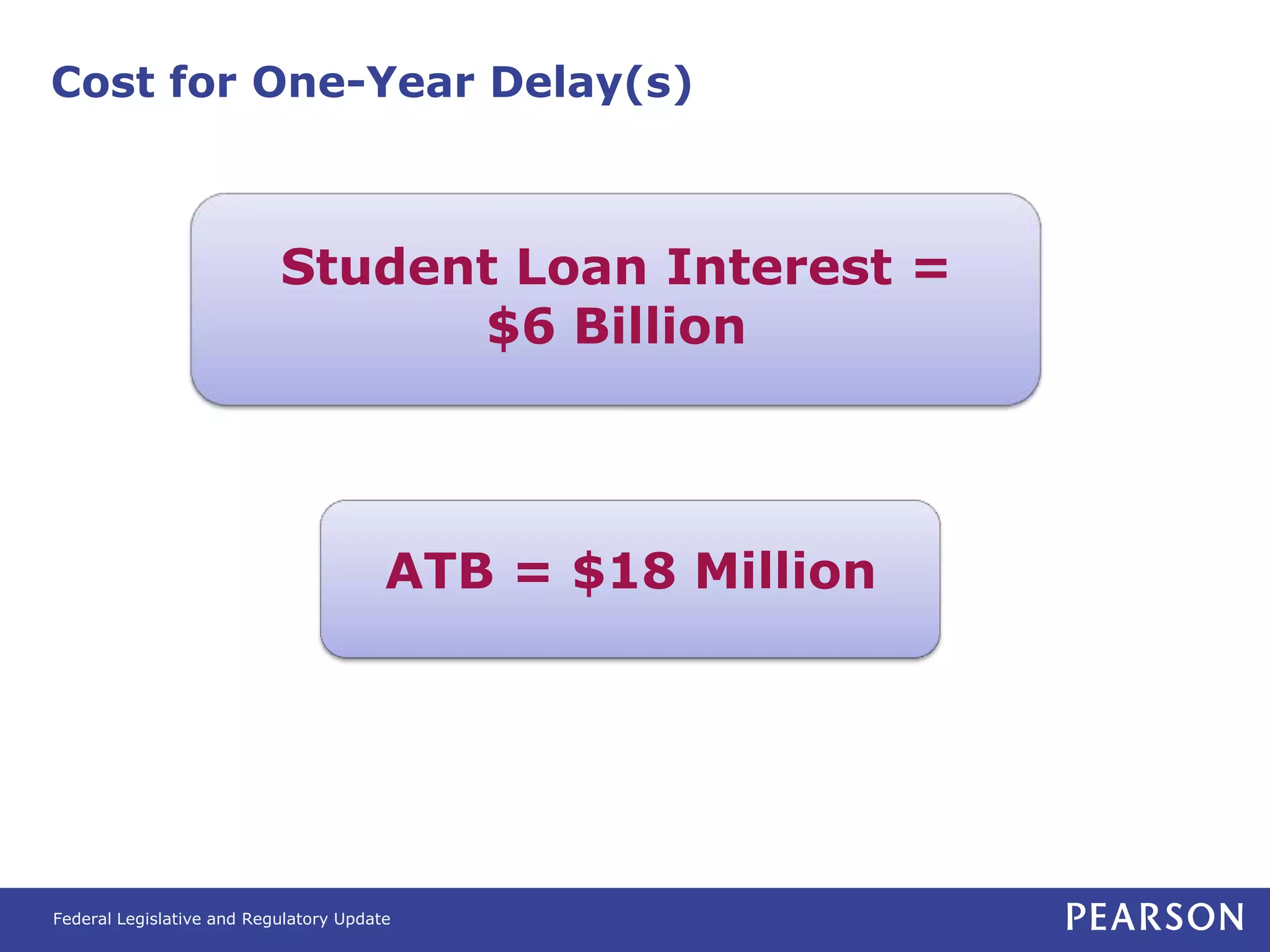

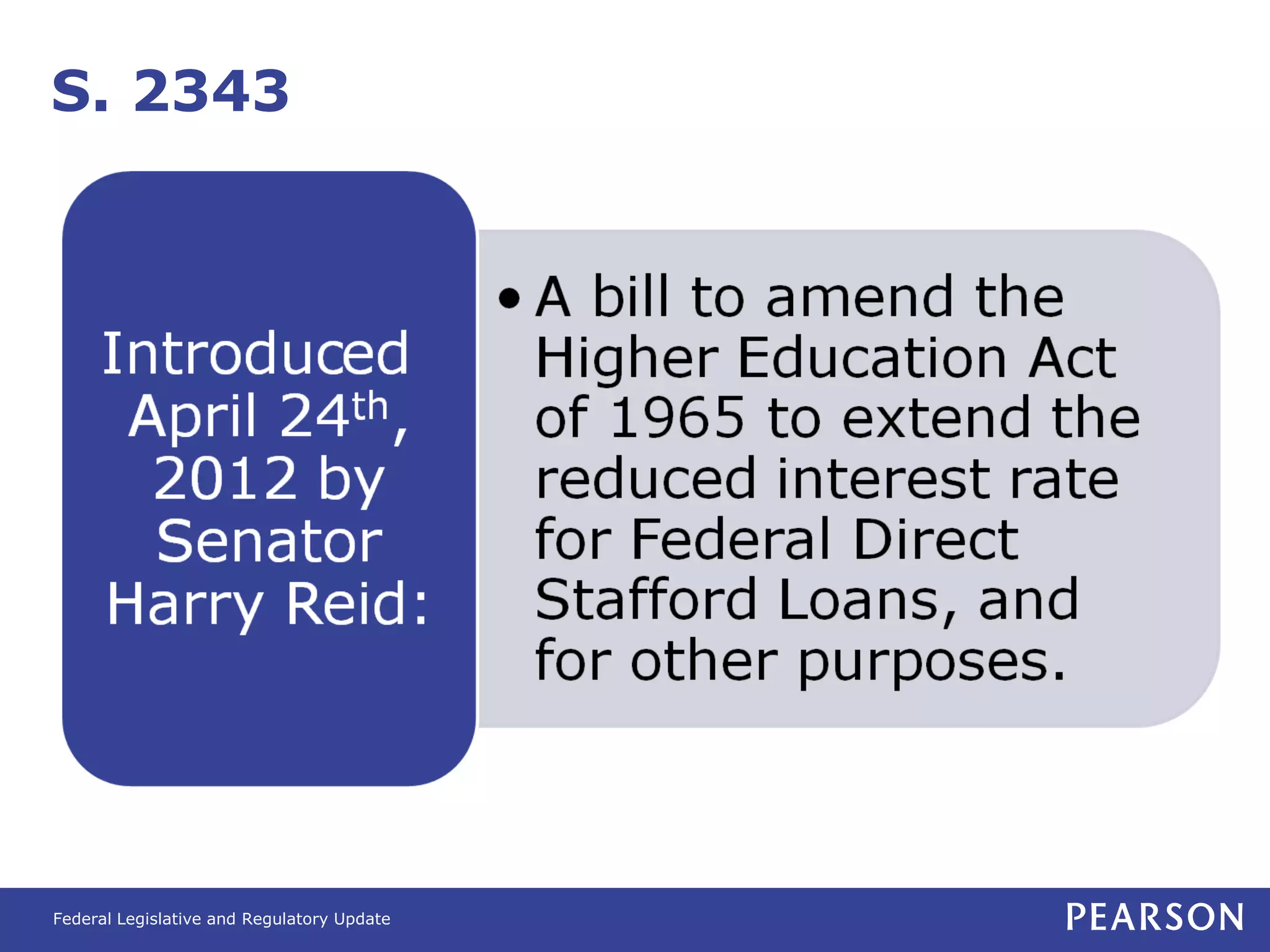

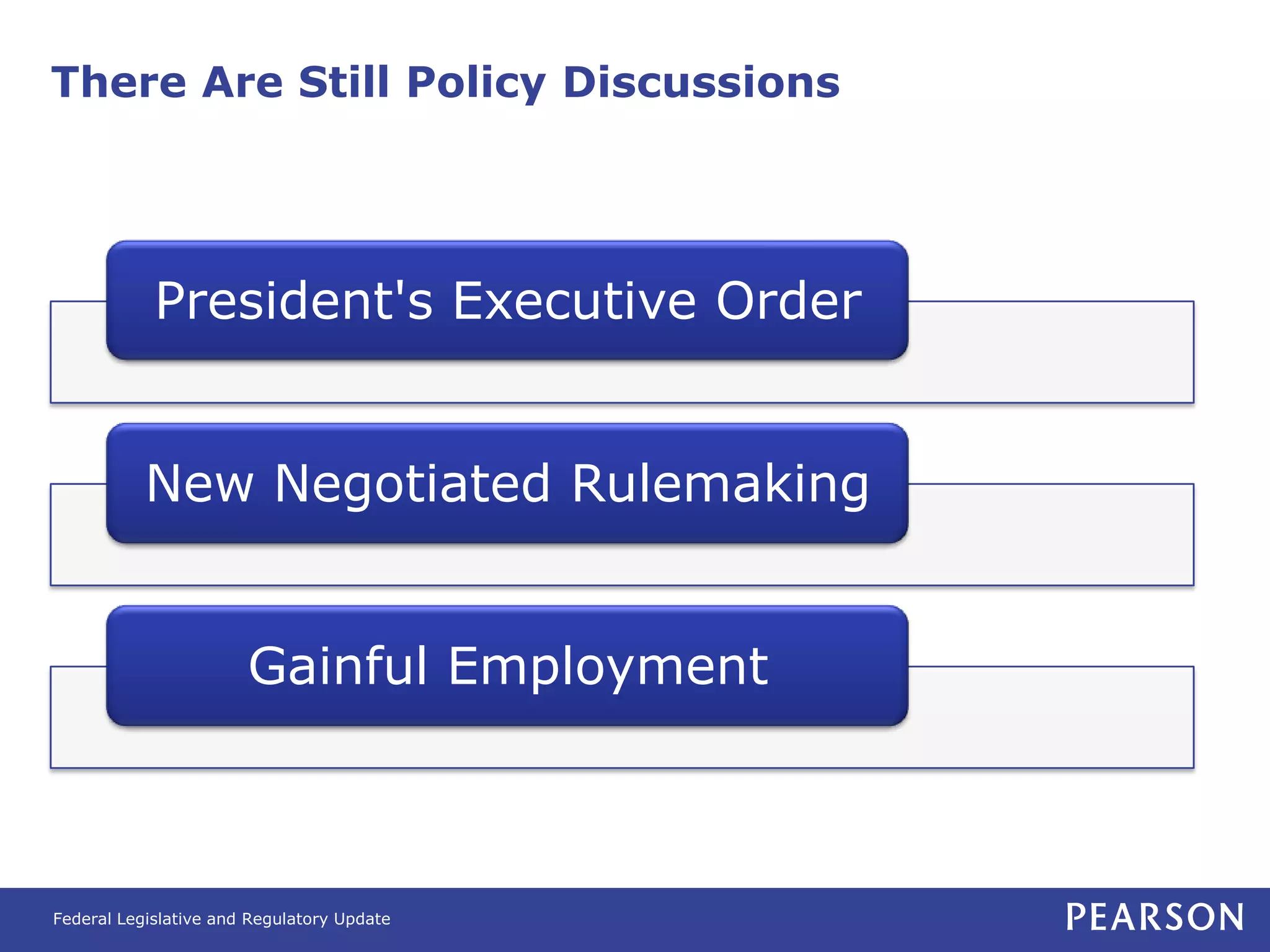

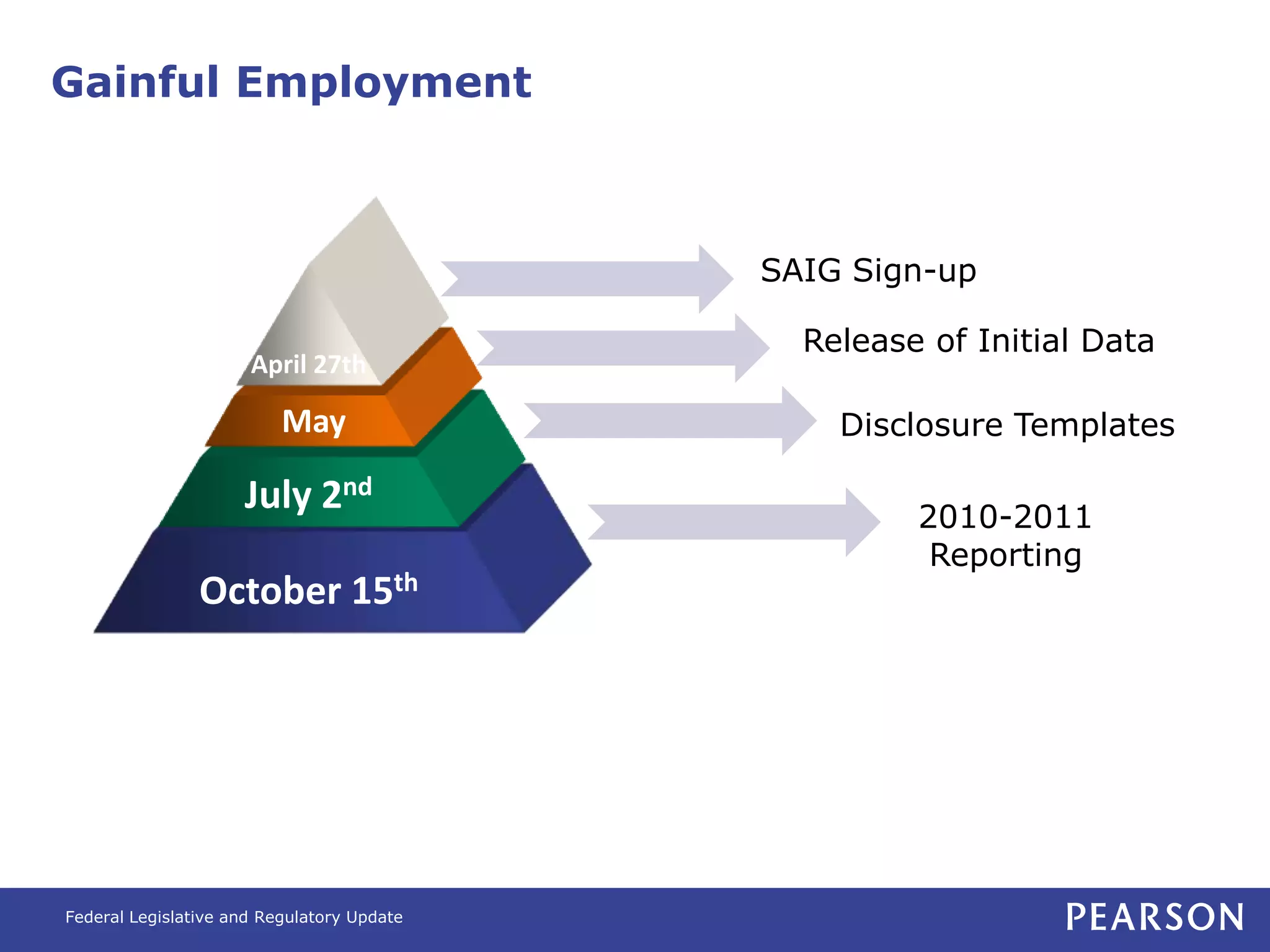

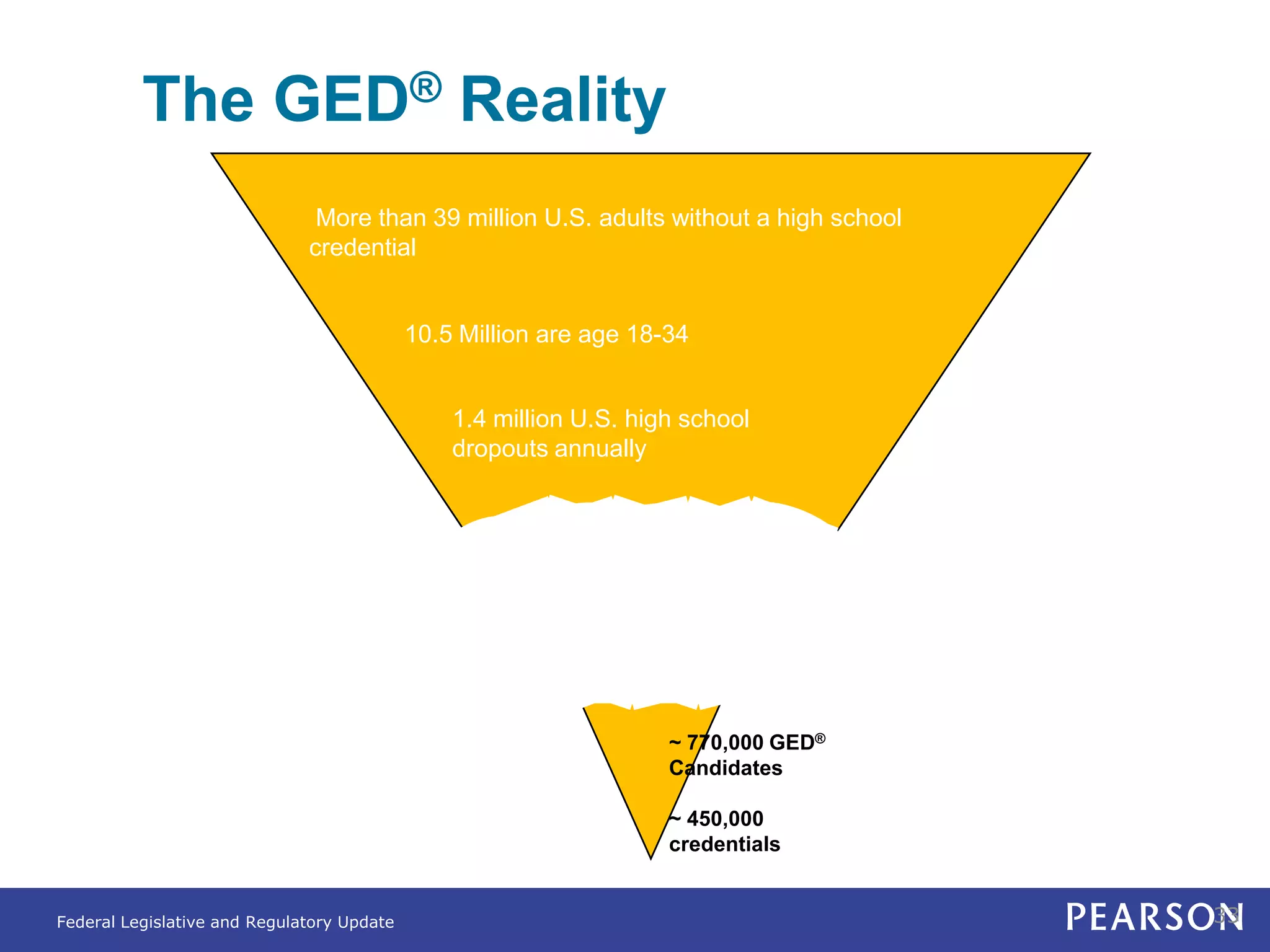

The document provides an overview of federal legislative and regulatory updates related to education as of Spring 2012, including key bills addressing student loans, closed school discharges, and changes to military and veterans education. It outlines important legislation affecting federal funding, such as the Protecting Our Students and Taxpayers Act, and discusses the implications of the Ability to Benefit rule. Additionally, it highlights trends in state legislation impacting higher education institutions, emphasizing the evolving political landscape and its effects on educational policy.