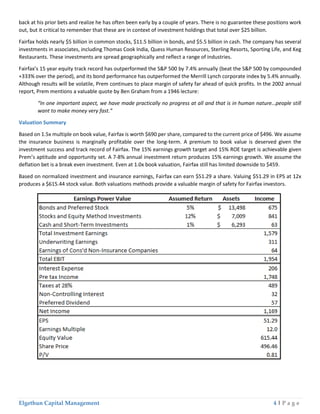

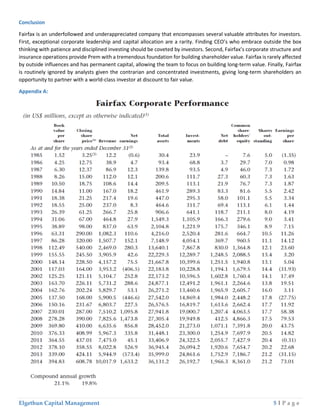

This document provides an investment thesis on Fairfax Financial Holdings Limited (FFH). It summarizes that FFH is a property and casualty insurance holding company led by CEO Prem Watsa. FFH's business model is similar to Berkshire Hathaway, using insurance premium cash flow and disciplined investment management to generate returns. Over 30 years, Prem Watsa has delivered outstanding returns for shareholders through successful insurance operations and investment performance that rivals Warren Buffett. The document evaluates FFH's operations, management team, investment portfolio performance, and provides a valuation for the company.