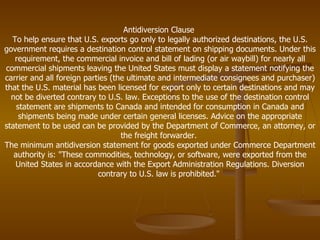

The document provides information about export compliance for LR International, including establishing an export compliance system, understanding export regulations, controlling commodities, approving customers, using licensed service providers, and understanding legal requirements like the Shipper's Export Declaration and Automated Export System for documenting exports. It emphasizes the importance of knowing regulations, customers, destinations, and keeping good records.

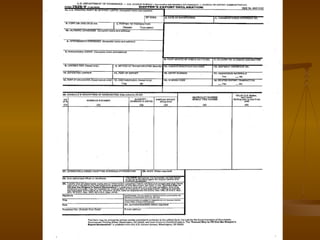

![Shipper's Export Declaration (SED or form 7525-V) Filling out the Shipper's Export Declaration The Shipper's Export Declaration (SED or Form 7525-V) is used by the U.S. Census Bureau to compile trade statistics and to help prevent illegal exports. The SED and instructions on how to fill it out are available from a variety of sources including the U.S. Government Printing Office (202-512-0000) and the U.S. Census Bureau's home page . Do I Need to Submit an SED for My Shipment? The following facts can be used to determine whether or not the SED is needed for shipment: The SED must be filled out for any shipment valued at $2,500 or above (If the shipment is valued at over $2,500 but is made up of various commodities falling under several Schedule B numbers none of which is valued at $2,500 or higher, no SED is required.) The SED is required for any shipment to particular countries, such as Cuba, Libya, and North Korea, and for any shipment requiring a validated export license [call the Trade Information Center 800-USA-TRAD(E) for more information]. An SED is required for shipments to Puerto Rico, the U.S. Virgin Islands and the former Pacific Trust Territories even though they are not considered exports (unless each Schedule B item is under $2,500). Shipments to Canada do not require an SED . (Shipments to third countries passing through Canada do need an SED.)](https://image.slidesharecdn.com/exportcompliance-100712100052-phpapp01/85/Export-compliance-14-320.jpg)

![Trade & Technology Coming Together AES is trade and technology coming together because trade and technology belong together. Manual processes are being replaced by automation in all aspects of life - in today's world automation is the norm, not the exception. AES is the tool that is keeping the export industry in step with the Information Age. AES offers you a chance to be competitive in today's global economy, to join the movement toward a global EDI climate, and to put technology to work for you. Getting Started When you decide to join AES send a Letter of Intent to Census. Upon receipt of the letter, a Customs Client Representative and a Census Client Representative will be assigned to serve as your technical advisor during development, testing and implementation. This concludes the tour. We would like to thank you for taking the time to learn about AES. Again, we encourage you to sign our Guest Book before leaving the AES Web site. For more information on AES you can call the AES toll-free Answerline at 1-800-549-0595 or send an e-mail to [email_address]](https://image.slidesharecdn.com/exportcompliance-100712100052-phpapp01/85/Export-compliance-22-320.jpg)