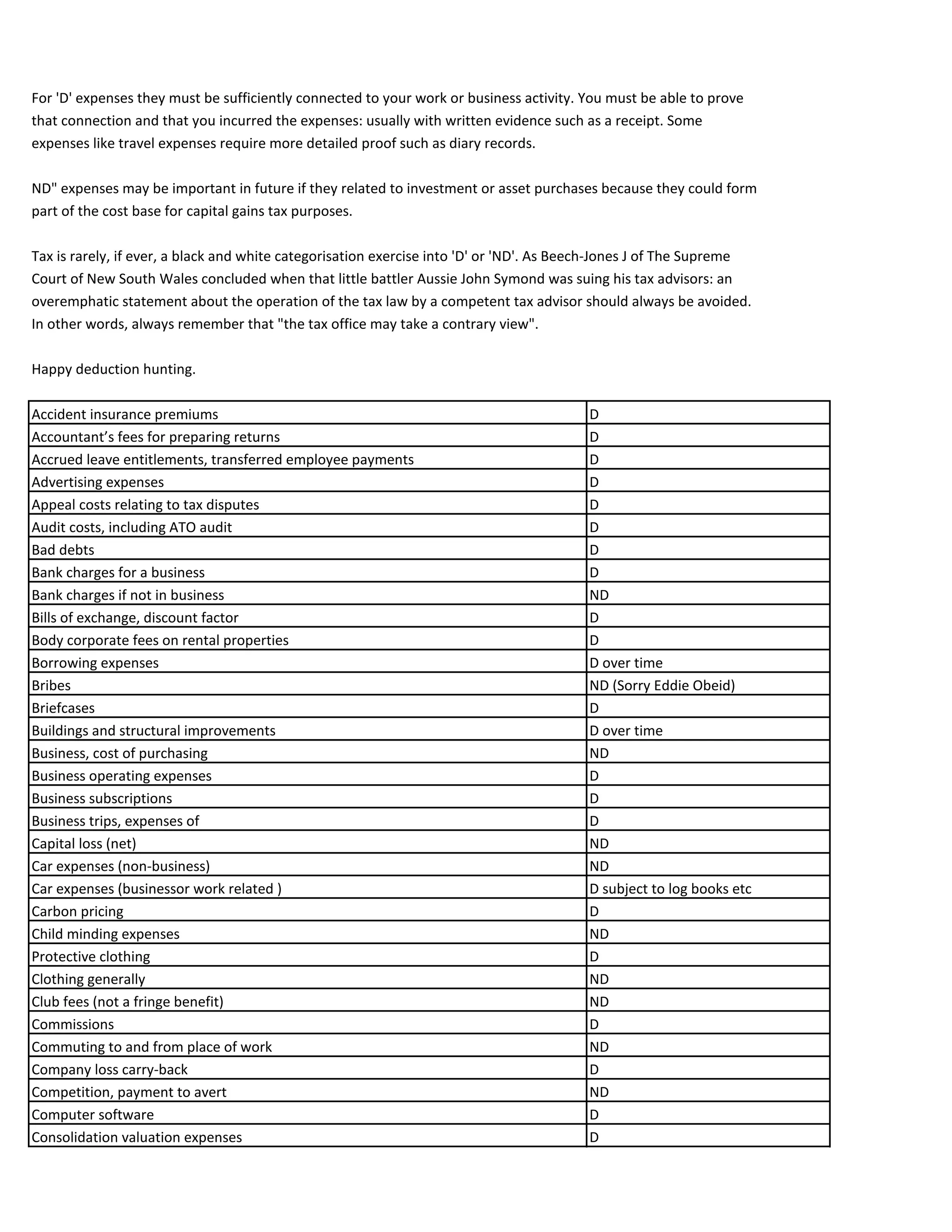

For business expenses to be deductible, taxpayers must prove that the expenses are connected to their work or business and incurred in gaining or producing assessable income. Some expenses like travel require detailed proof such as diary records. Tax treatment of expenses is rarely black and white and the tax office may take a contrary view, so taxpayers should avoid overstating deductions. The document then provides examples of expenses and whether they would generally be deductible (D) or non-deductible (ND).