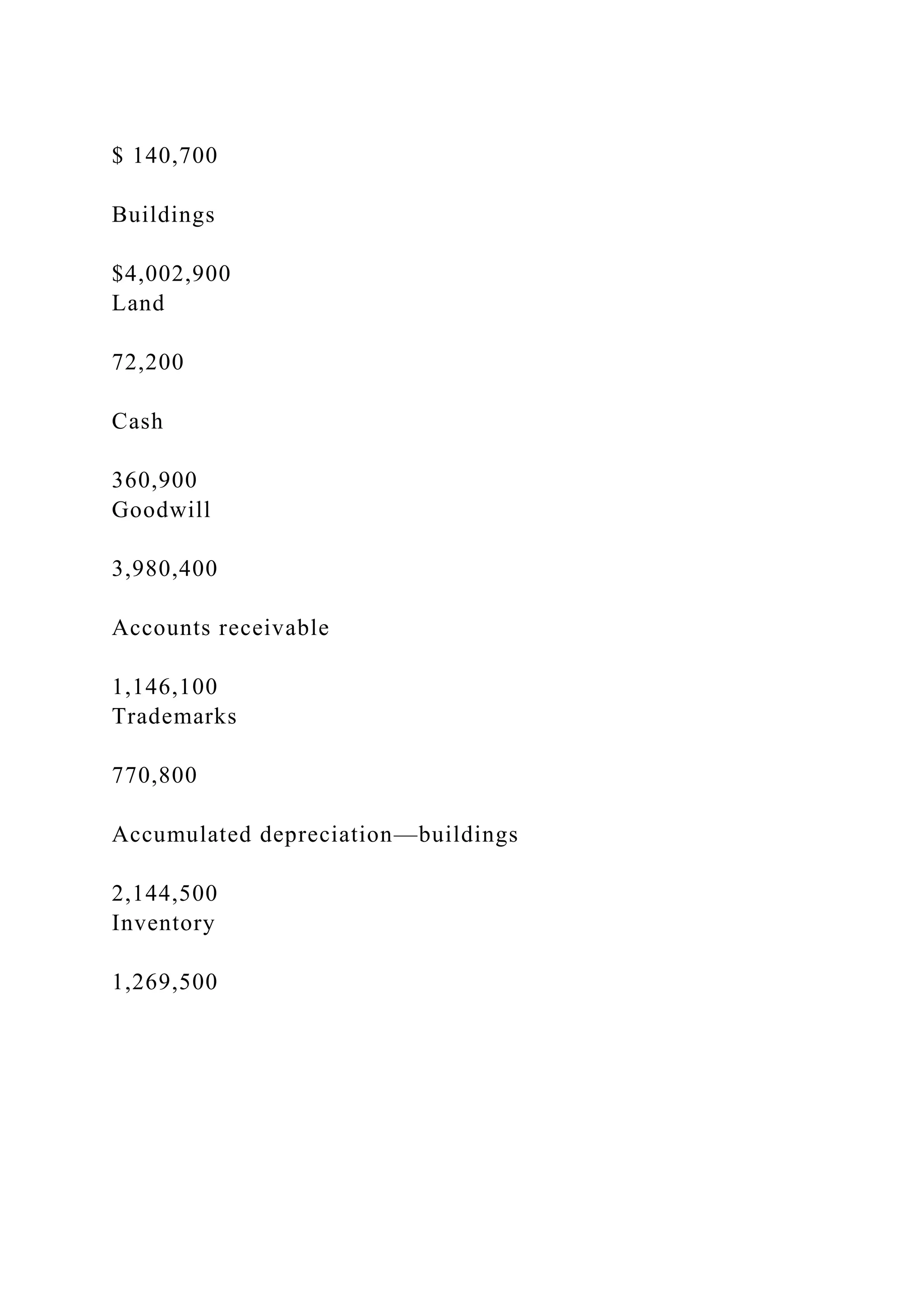

The document details financial analysis exercises for companies such as Bramble Corp, Wildhorse Co, Windsor, Inc., Swifty Corporation, and Novak Corp., focusing on income statements, retained earnings statements, and balance sheets. It includes instructions for creating financial statements using provided financial data, requiring identification of assets, liabilities, stockholders' equity, revenues, and expenses. Additionally, it prompts the calculation of financial ratios to assess companies' financial health.