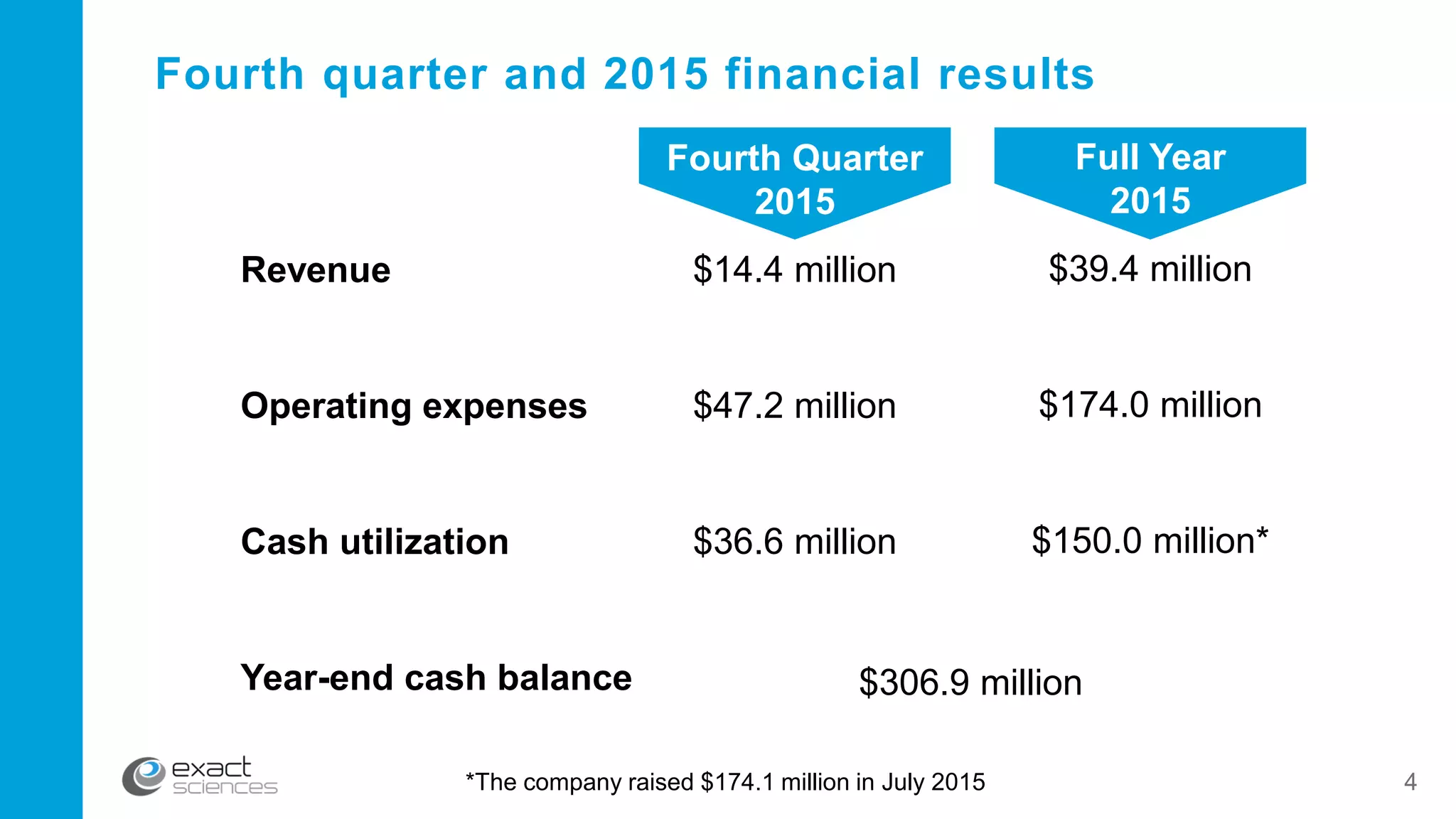

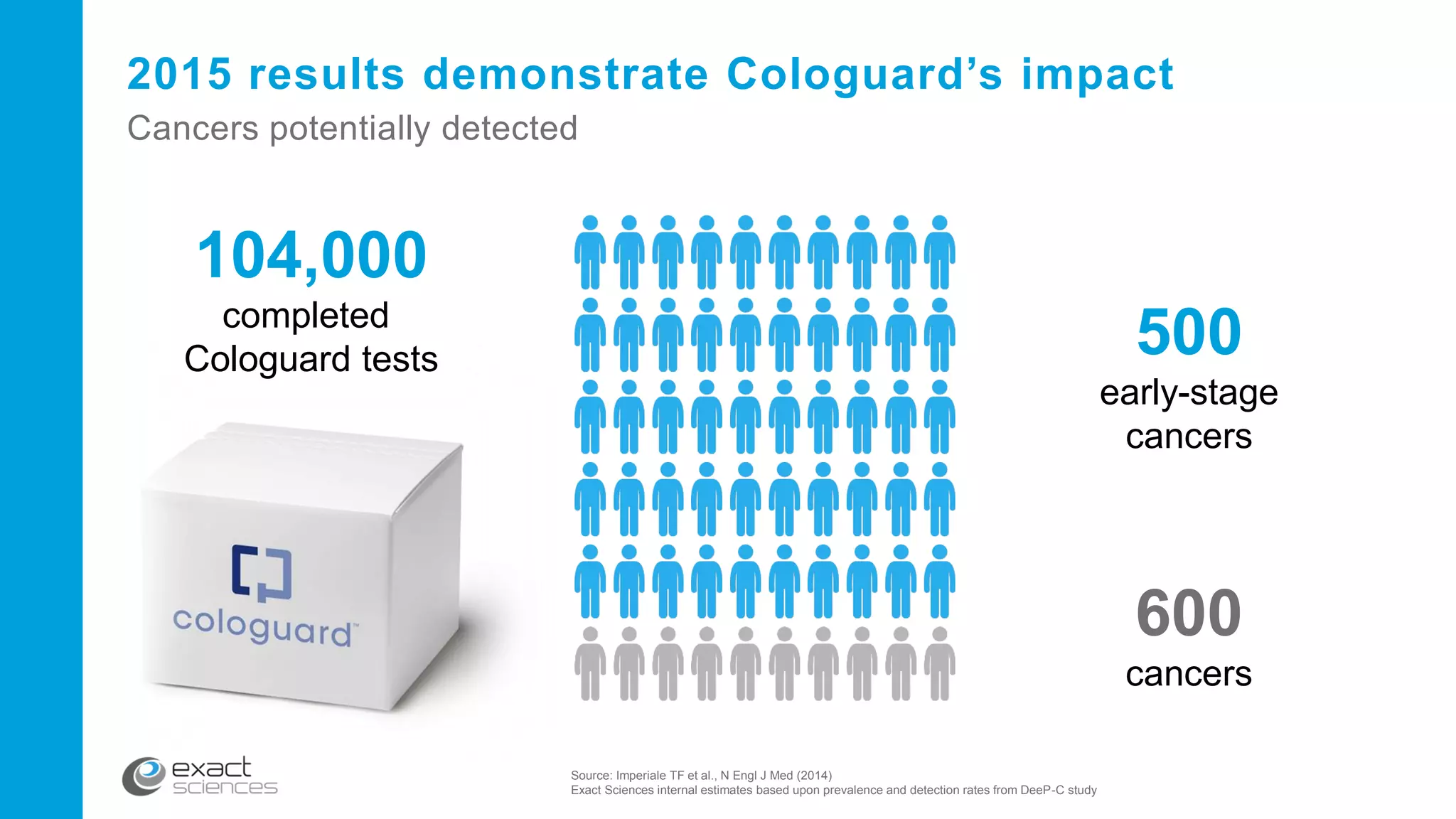

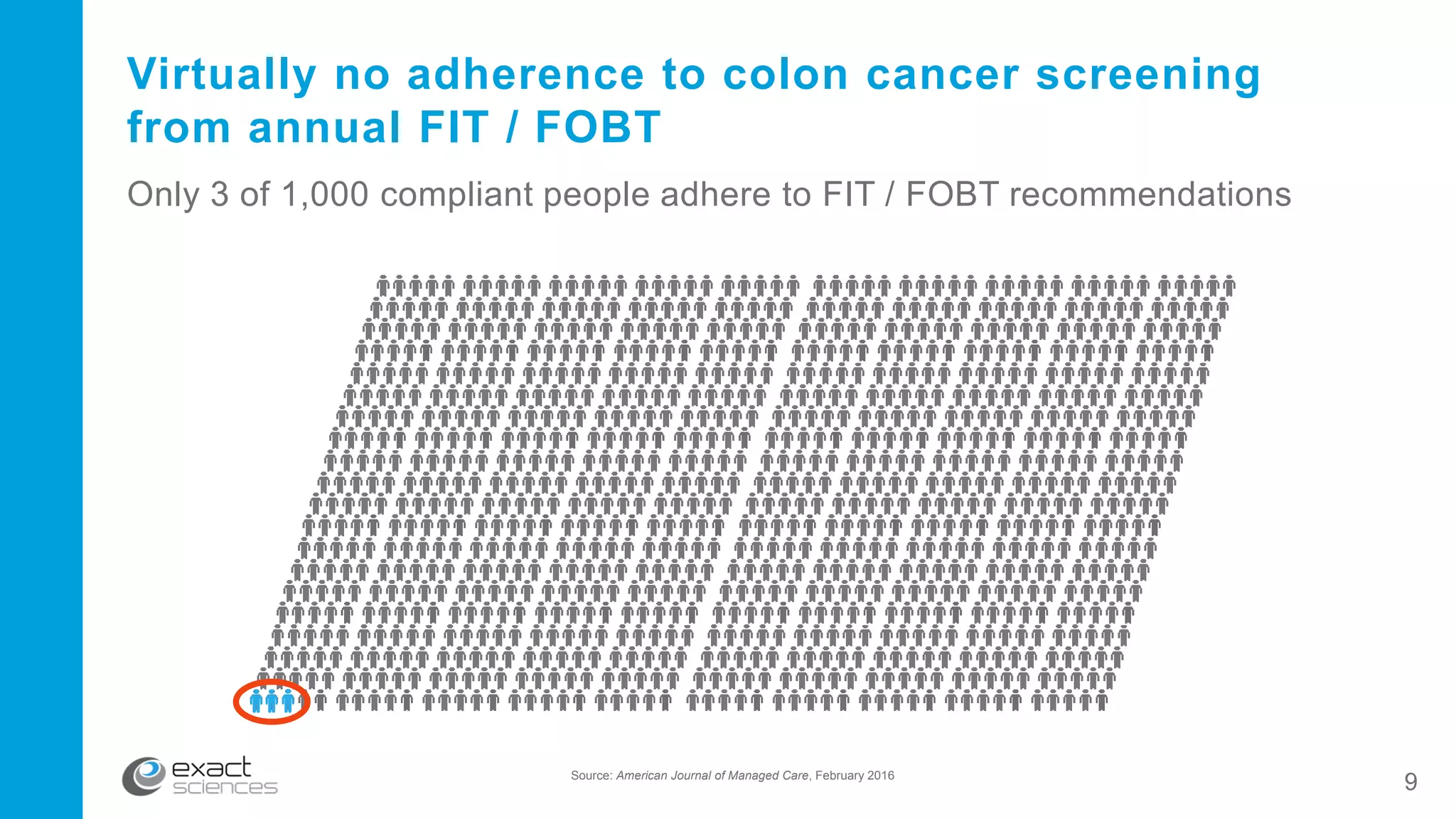

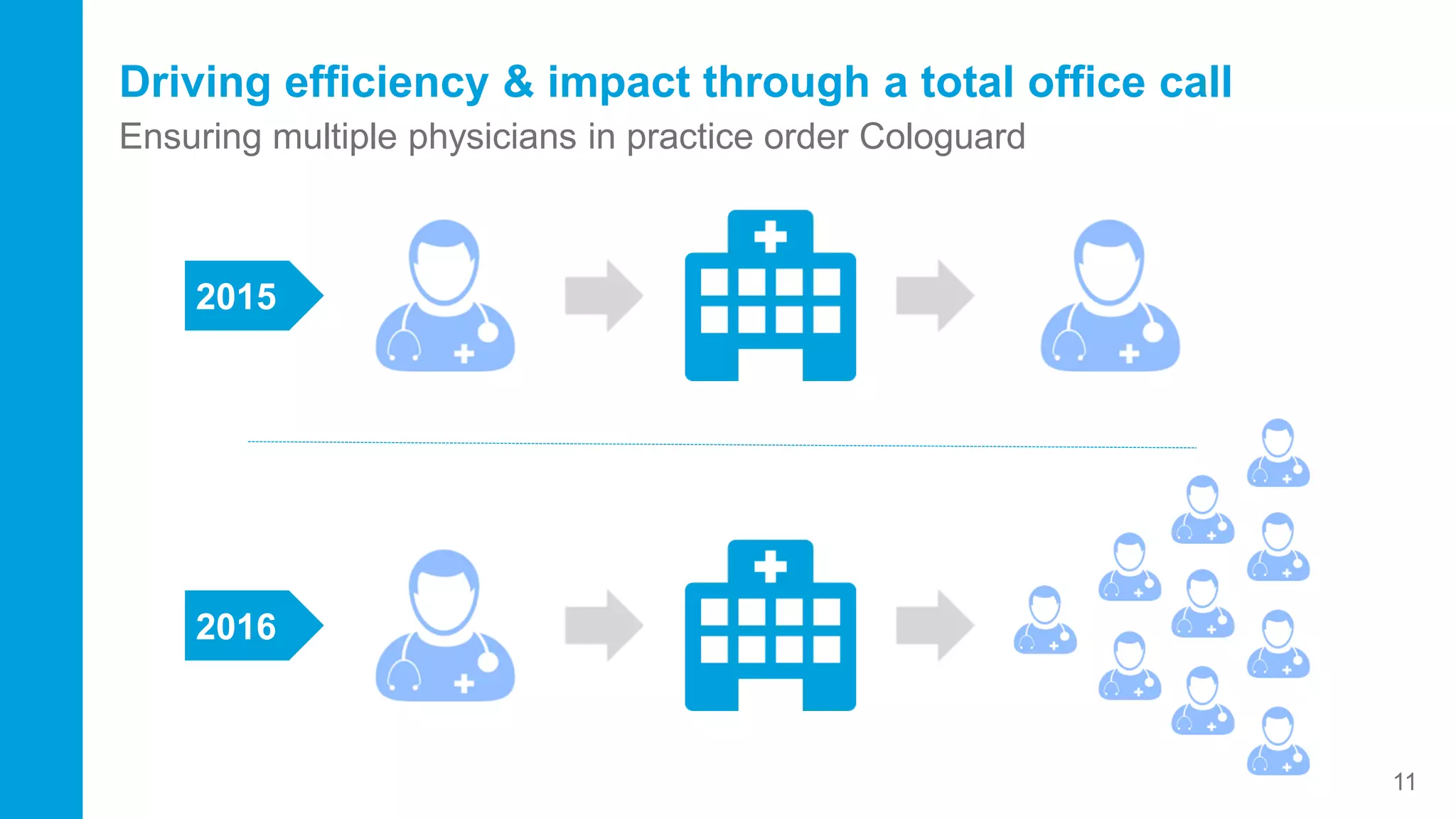

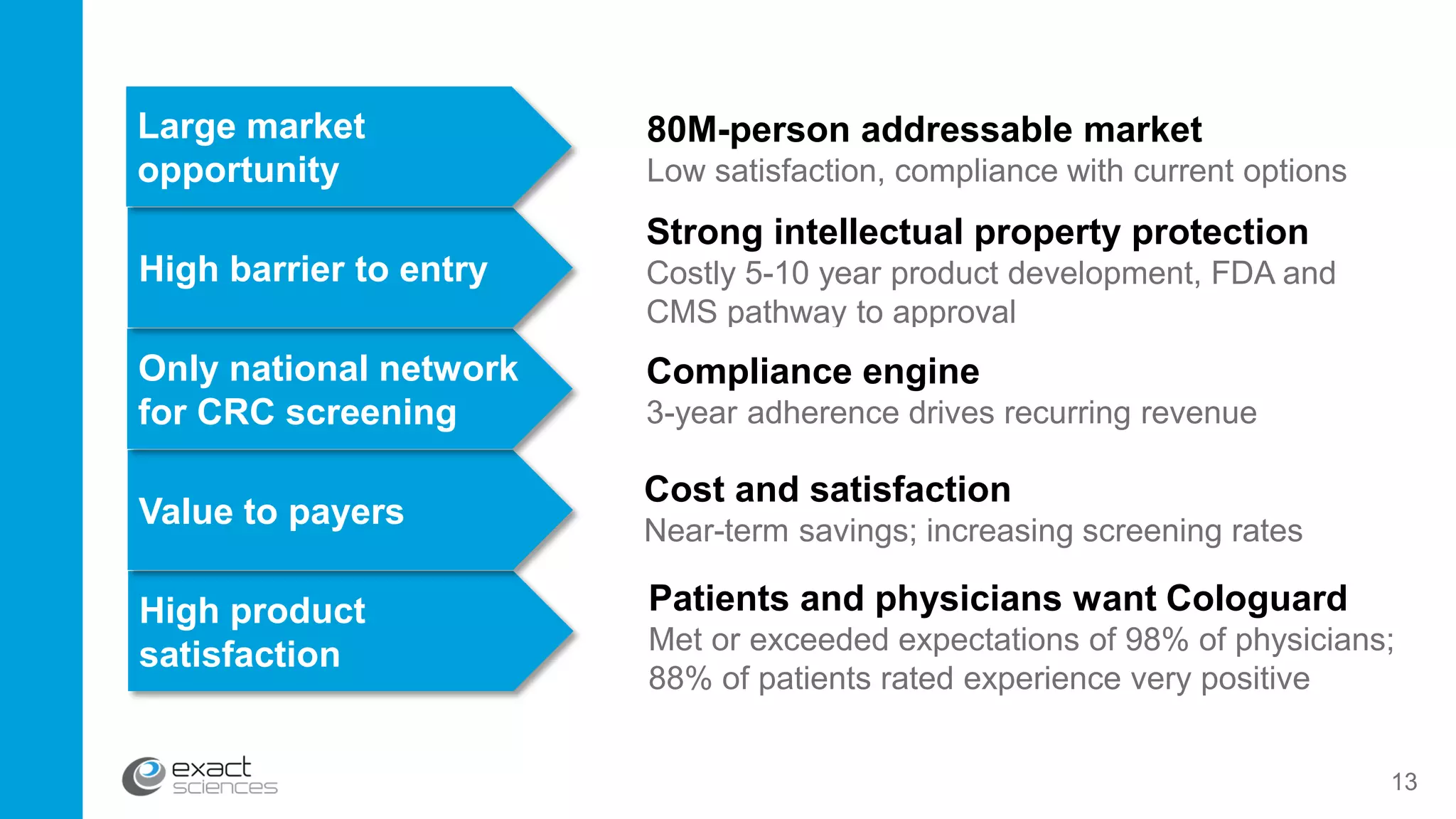

This document contains the summary of Exact Sciences' Q4 2015 and full year earnings call. It discusses the company's strong growth in 2015 with 104,000 Cologuard tests completed and 600 cancers detected. The company provides guidance of $90-100 million in revenue for 2016 by continuing to expand reimbursement coverage and increase marketing efforts. Exact Sciences also discusses opportunities to drive further growth through a total office sales call strategy and developing new product pipelines to detect other cancers like lung and pancreatic cancer. The presentation emphasizes Cologuard's superior performance, cost-effectiveness, high compliance rate, and patient preference compared to other colon cancer screening options.