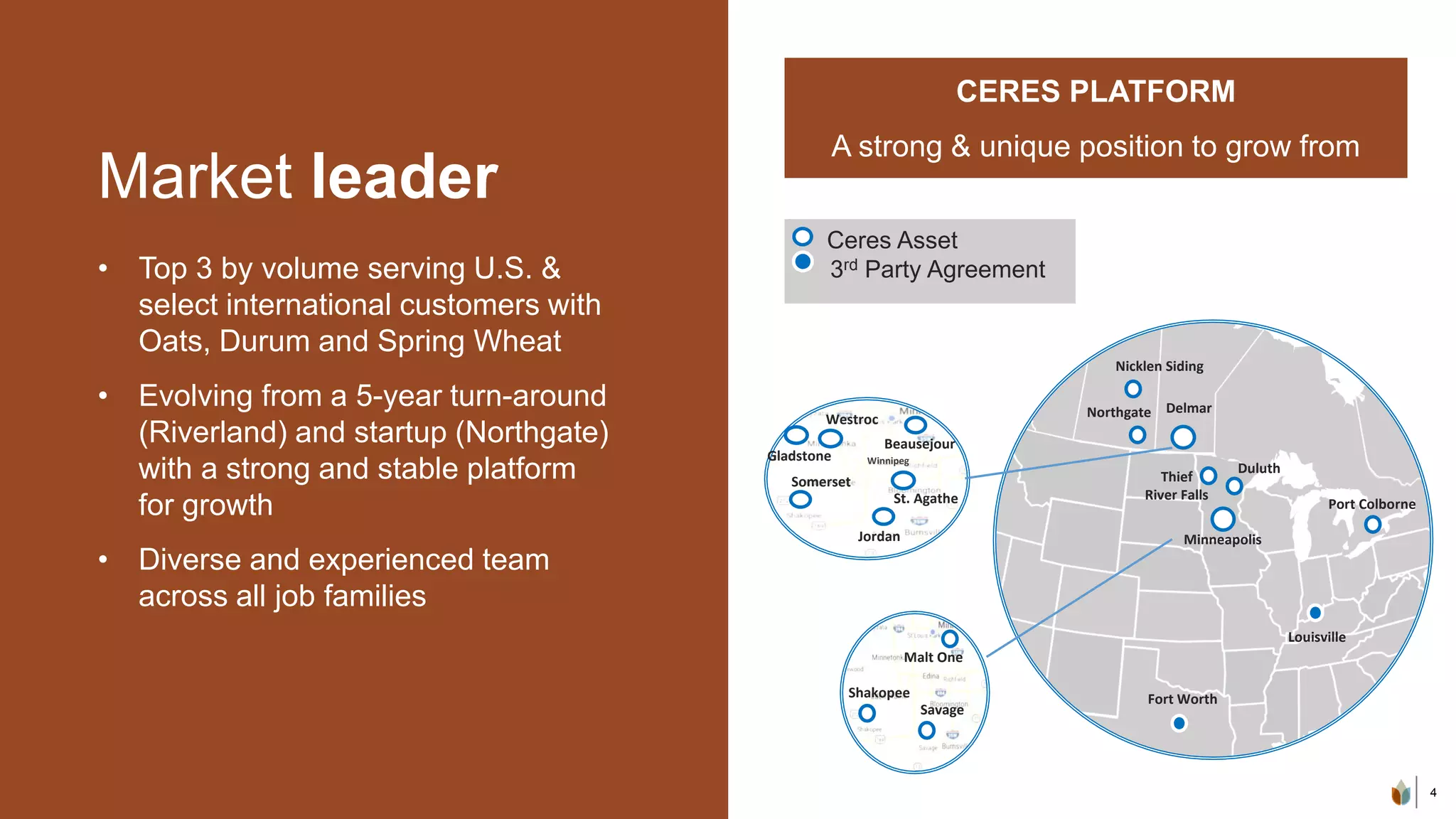

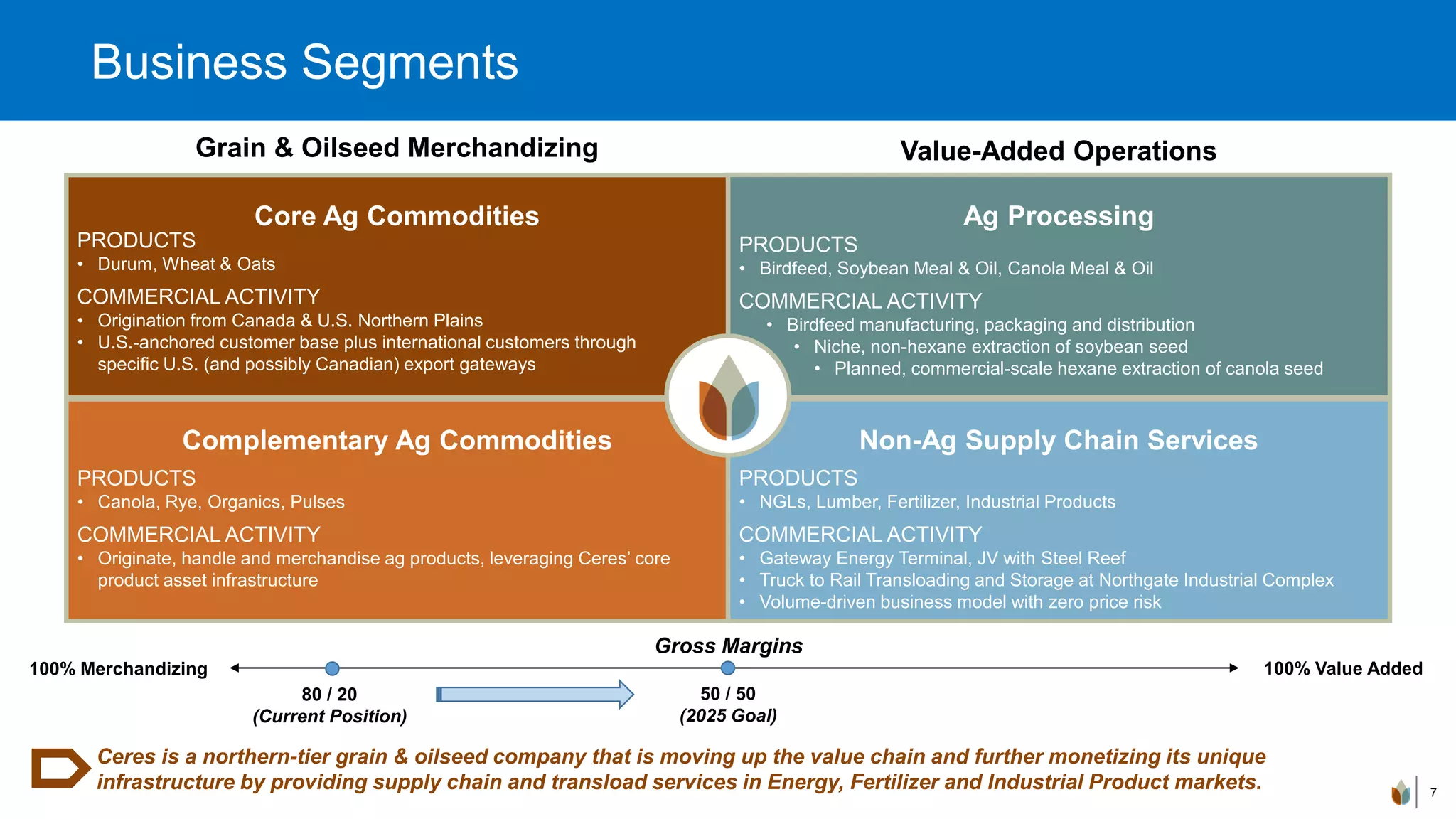

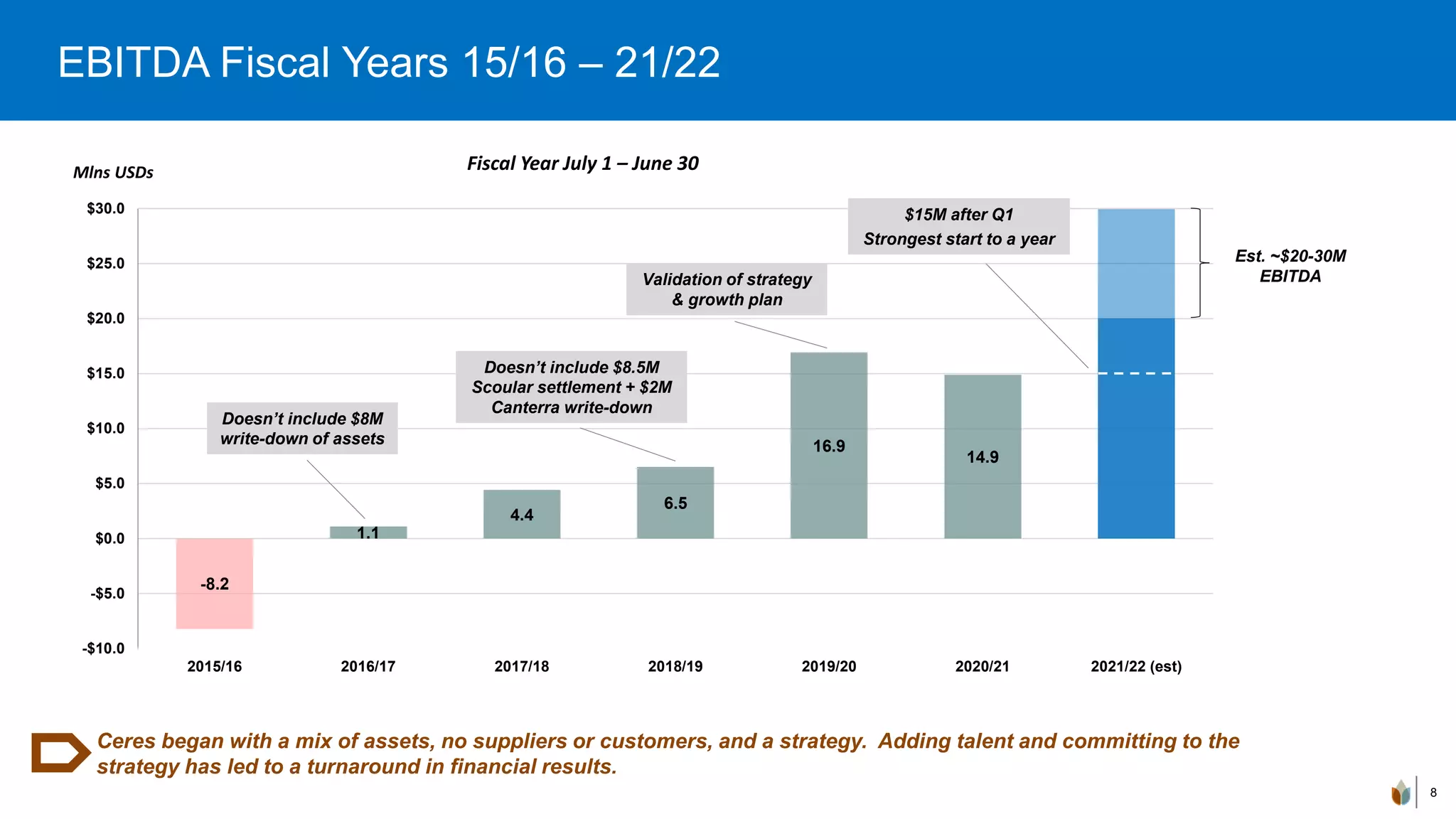

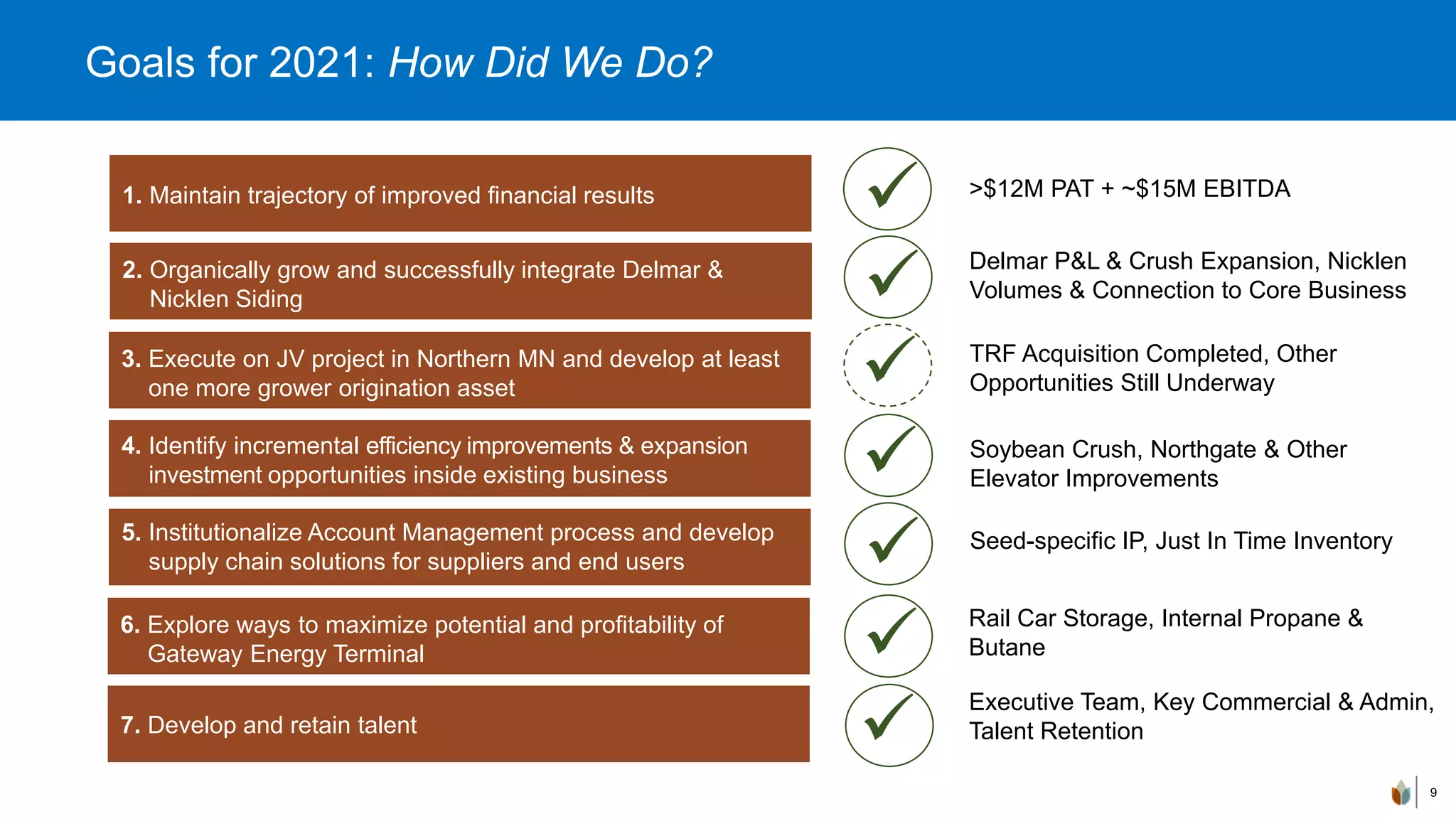

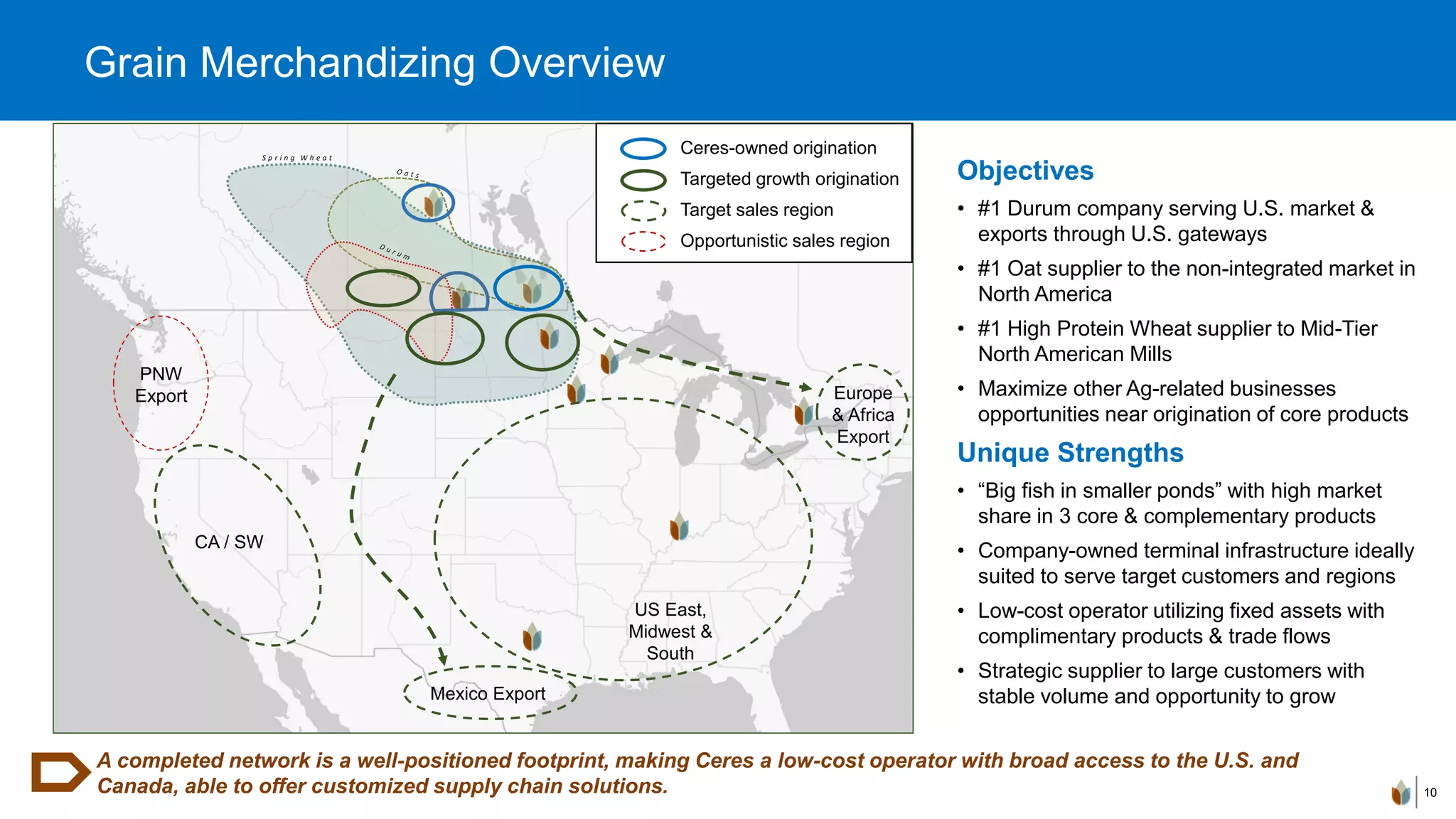

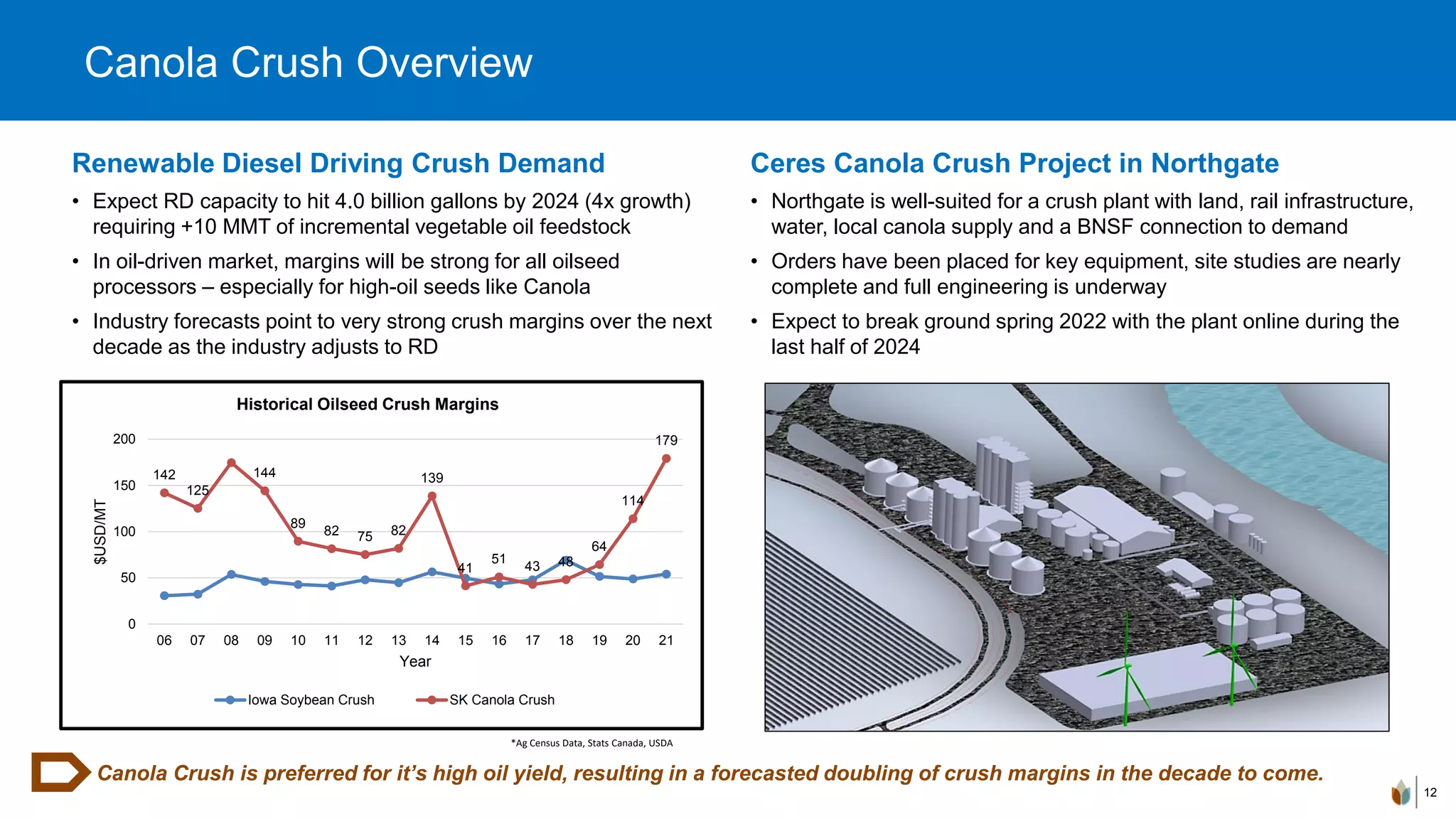

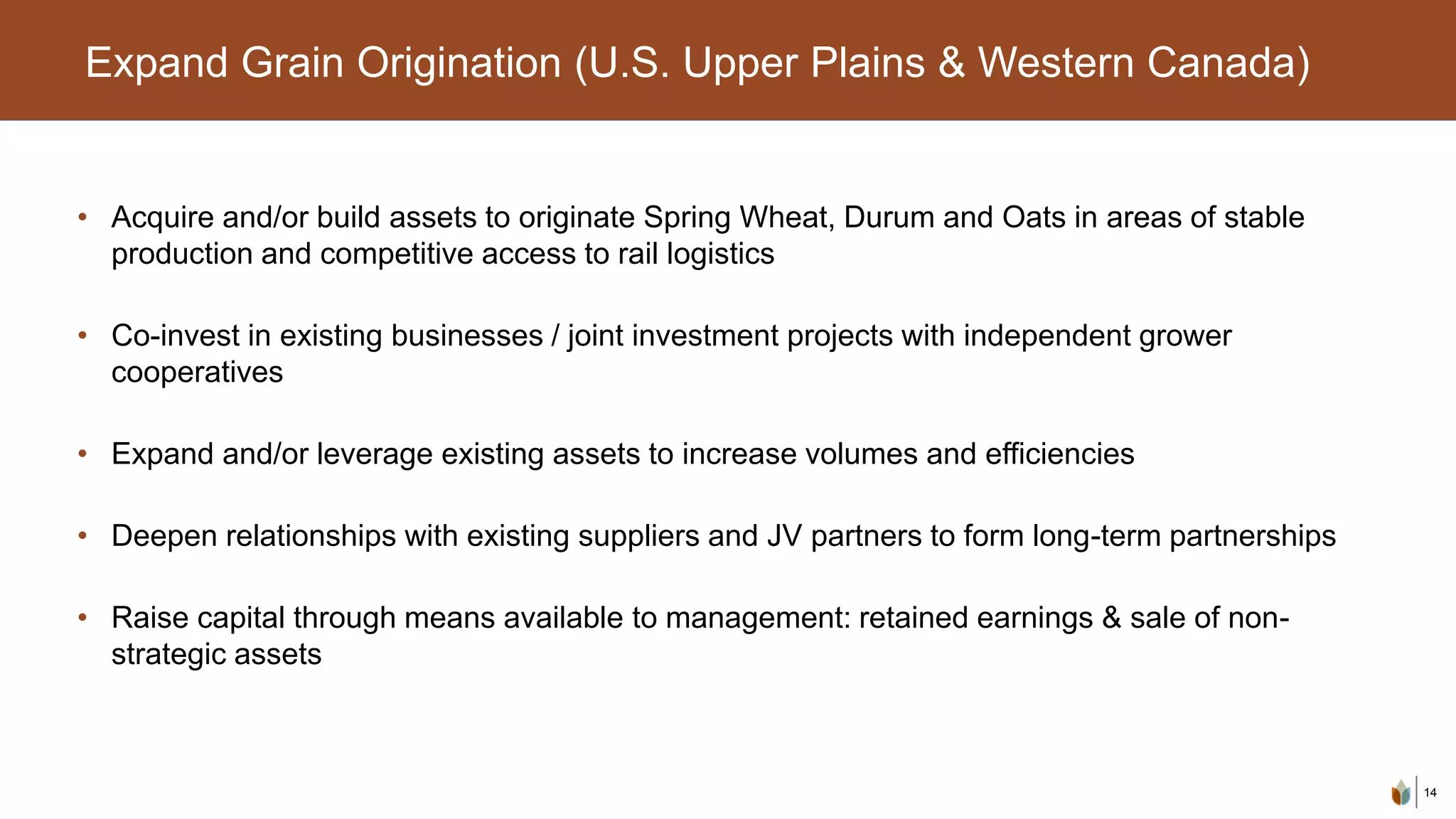

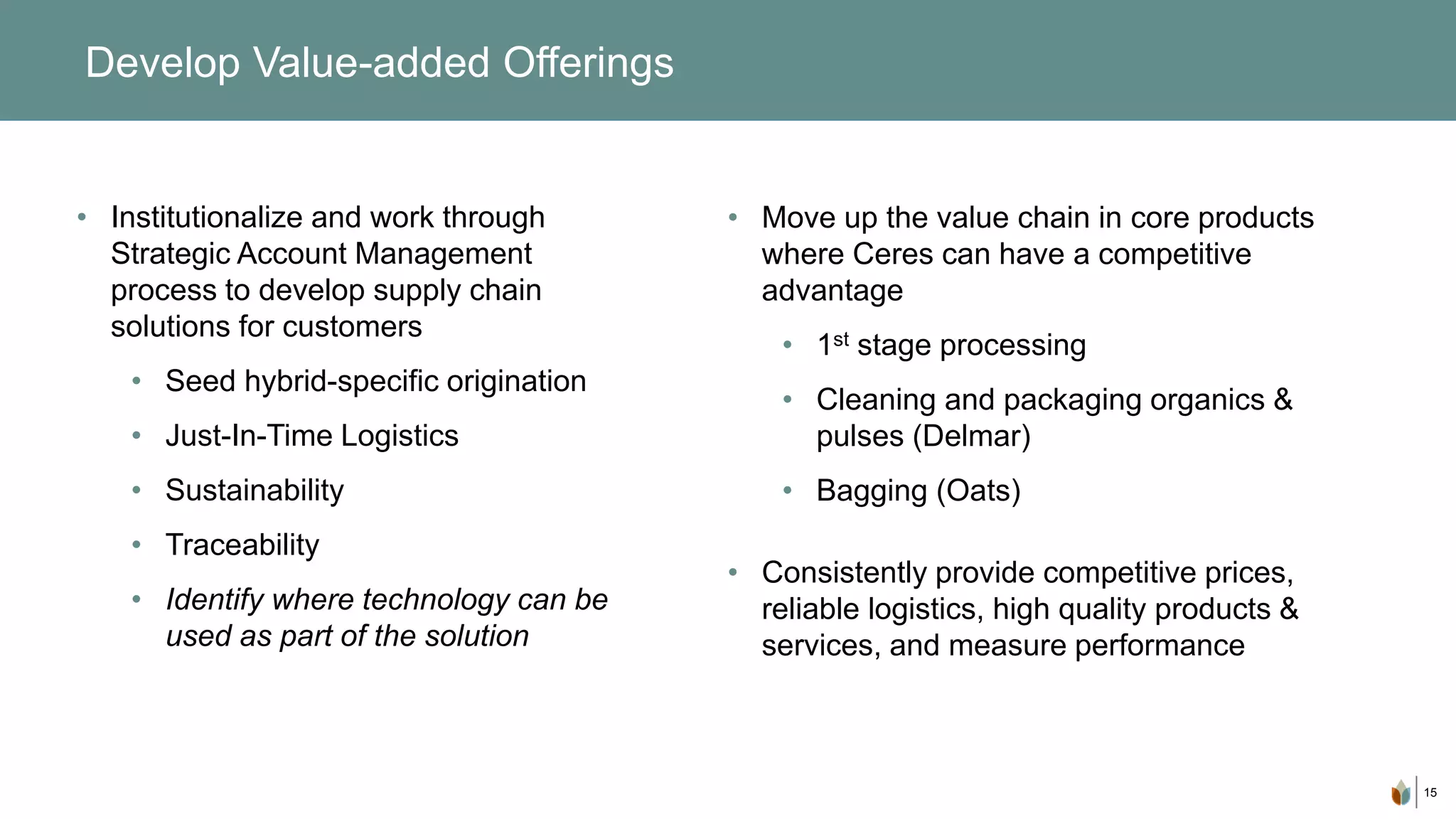

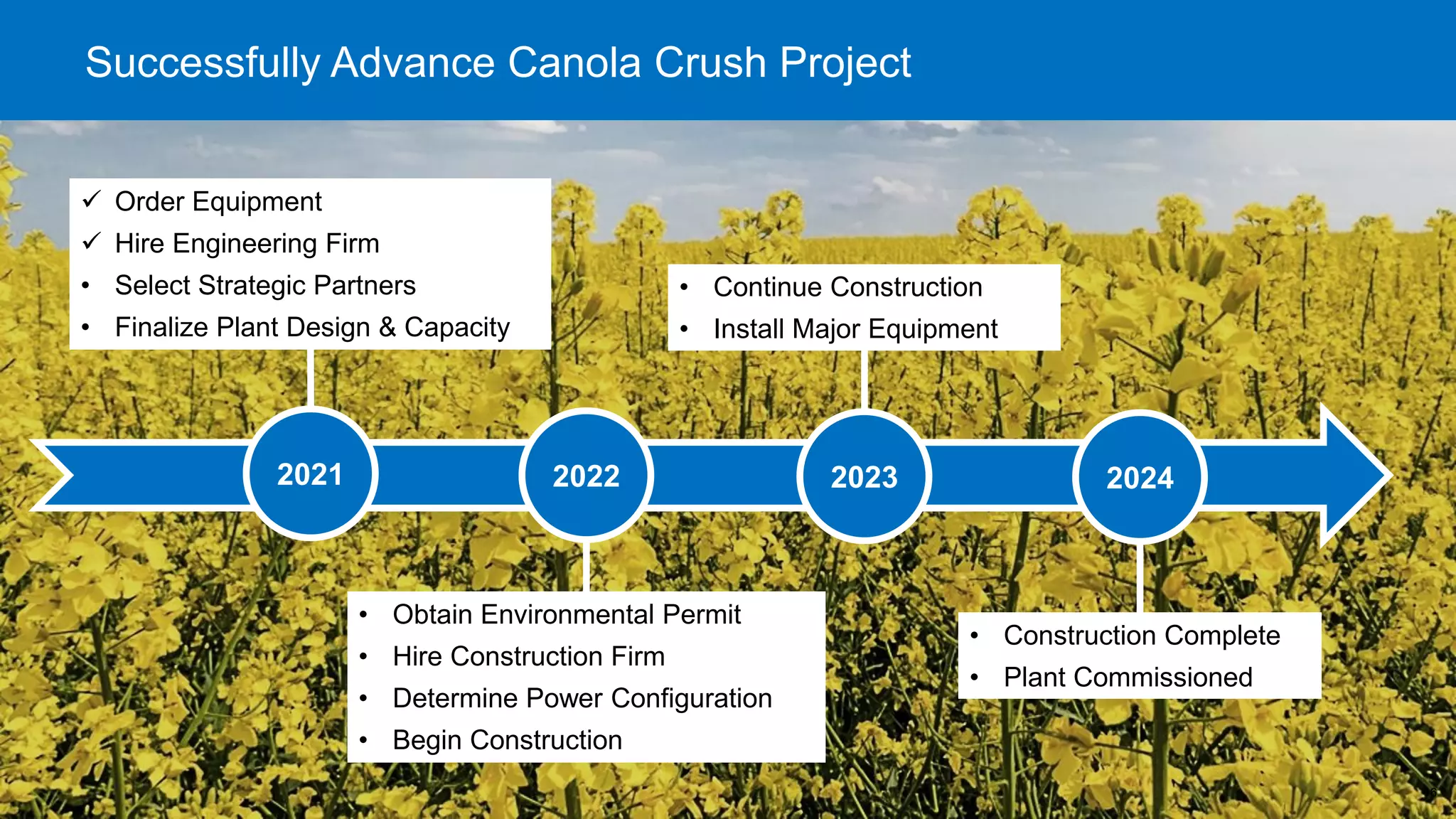

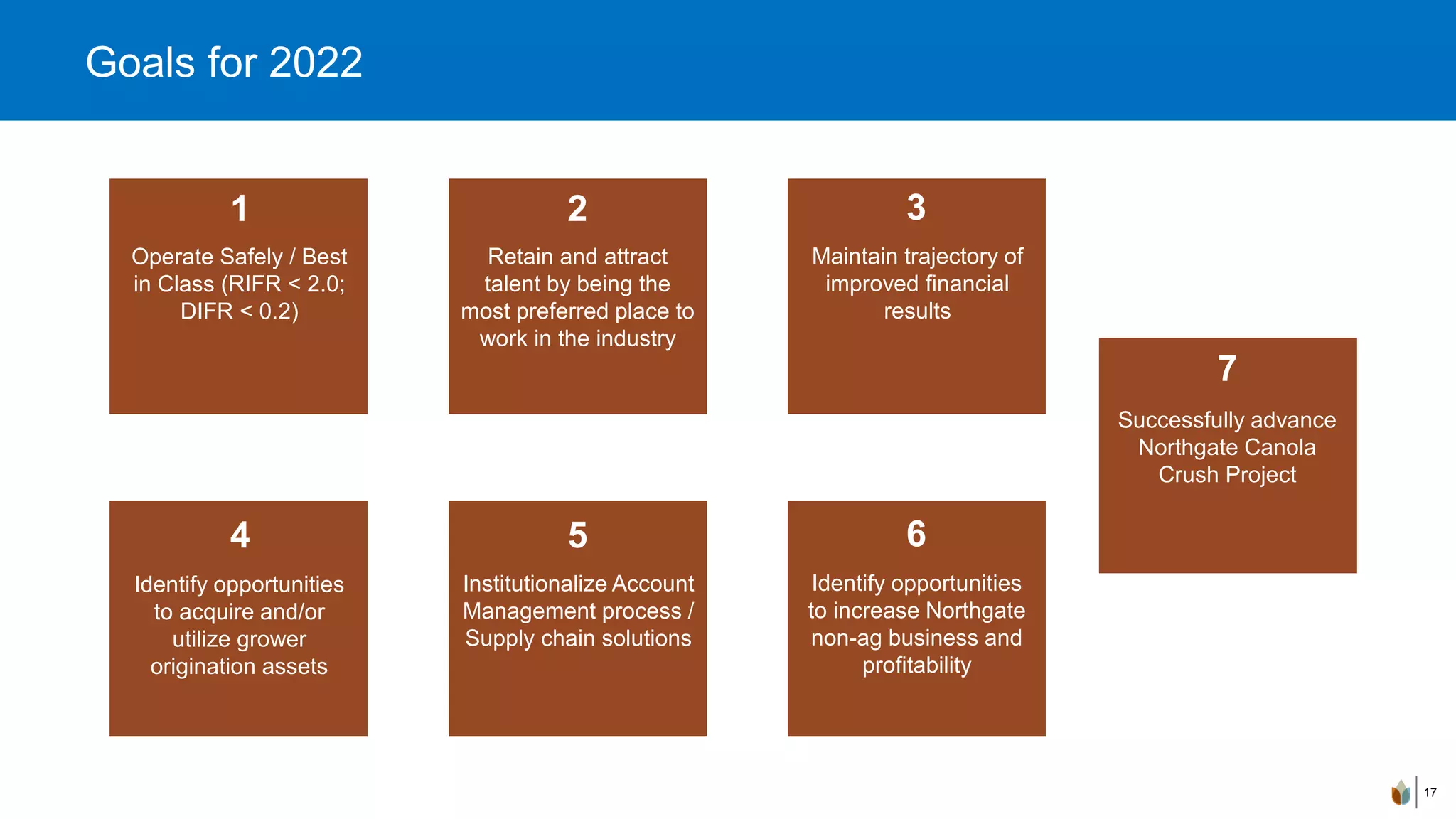

The document is a management presentation by Ceres, presented at their annual general meeting, outlining their forward-looking information regarding business operations, financial performance, and strategic goals. It highlights Ceres' strong market position in the agricultural sector, expected growth from new projects, and various risks associated with forward-looking statements. Additionally, it includes details on financial targets, operational priorities, and strategic initiatives for future development.