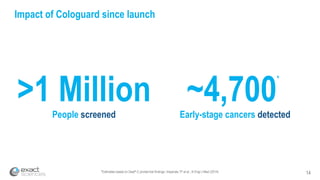

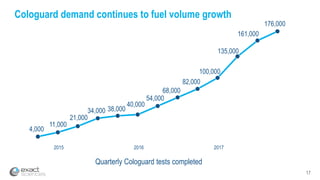

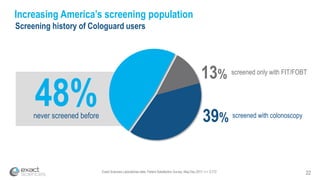

This presentation provides an overview of Exact Sciences' first quarter 2018 performance. It discusses the company's vision of helping win the war on cancer through early detection. Key points include that Cologuard continues to drive strong revenue and test volume growth, with over 1 million people screened and increasing average reimbursement per test. Customer satisfaction with Cologuard also remains high among both providers and patients.