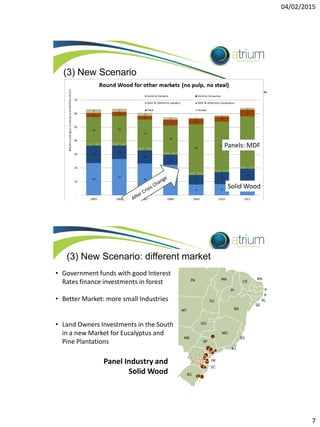

The document discusses the economic sustainability of industrial plantations in Brazil, highlighting the definitions, history, and current scenario of the forest industry. It notes that institutional investors have increasingly invested in timberland, driven by a need for diversification and the industry's demand for resources. The report also outlines the challenges and opportunities within the market, emphasizing the importance of efficient resource use and the impact of new regulations on investments.