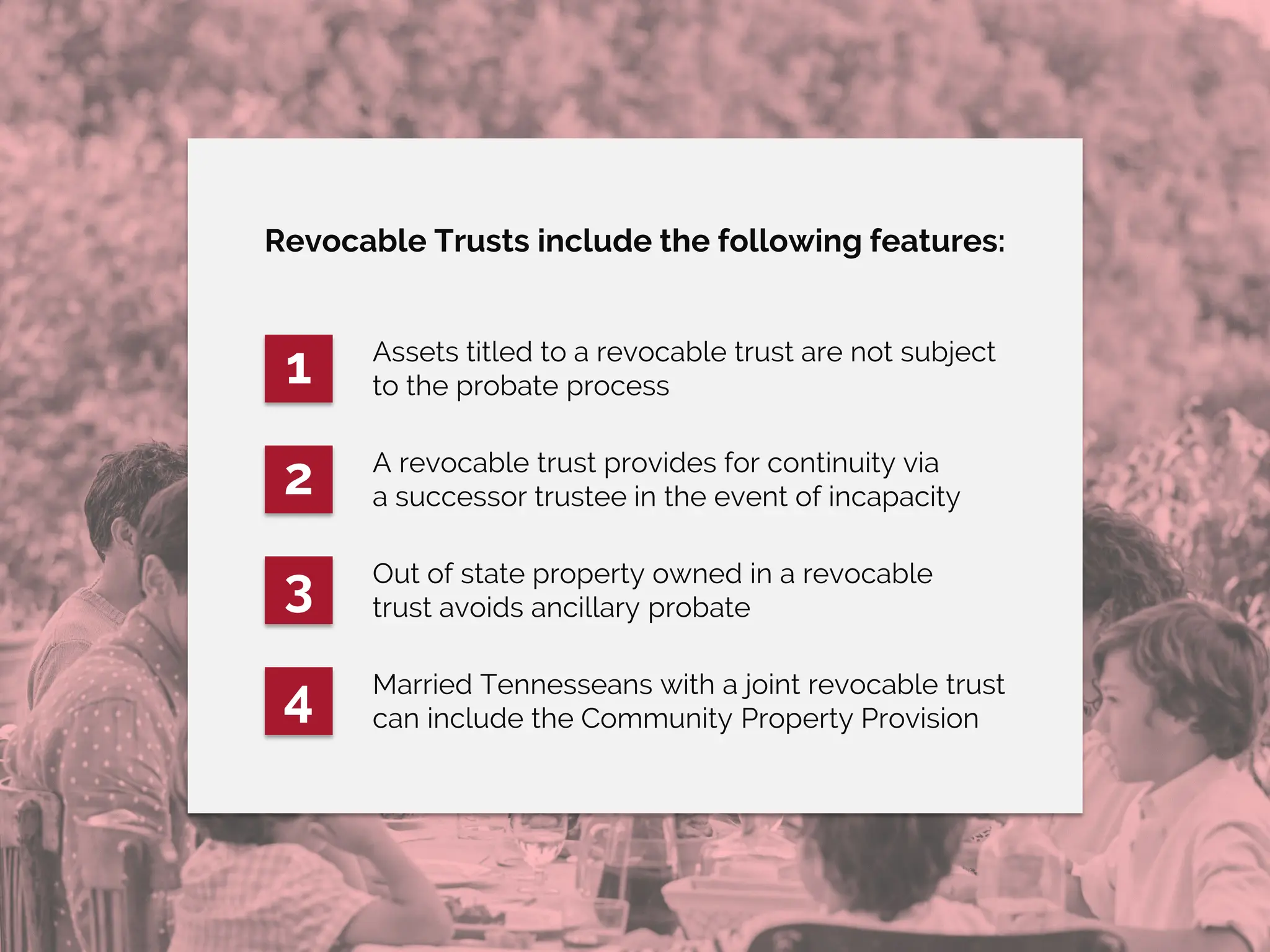

The document discusses estate planning, highlighting the advantages of using revocable trusts as an alternative to traditional wills. A revocable trust is a flexible, amendable trust created during the grantor's lifetime to manage and distribute assets without going through probate. It offers benefits such as privacy, simplification of estate administration, and continuity in case of the grantor's incapacity.