The key points from the document are:

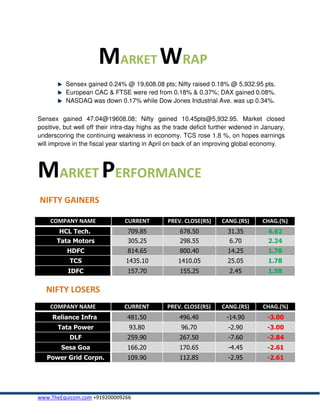

- The Sensex gained 0.24% while the Nifty rose 0.18% as the market closed positive but below intraday highs due to widening trade deficit.

- TCS rose 1.8% on hopes of improving earnings in the new fiscal year from an improving global economy.

- The IT and banking sectors performed well while real estate and metal stocks declined.