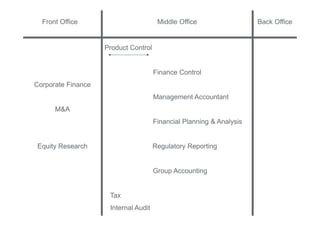

The document provides an overview of various roles available for newly qualified accountants in the front office, middle office, and back office of a bank, including product control, finance control, management accounting, financial planning and analysis, regulatory reporting, group accounting, internal audit, and more. It describes the key responsibilities, skills, and typical career progression paths for each role. The roles offer opportunities to gain experience and exposure in different areas of banking in order to take on more senior positions over time.