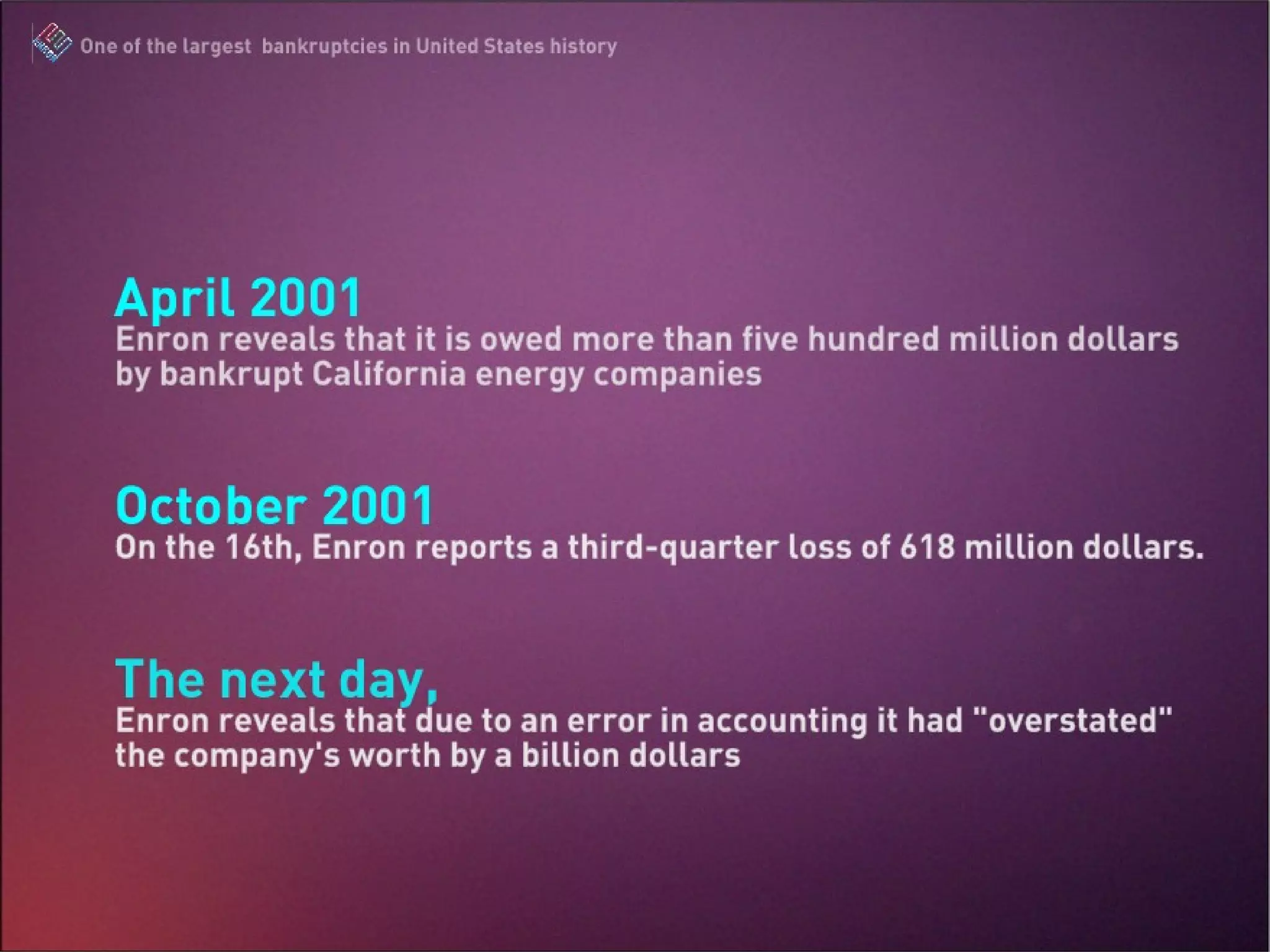

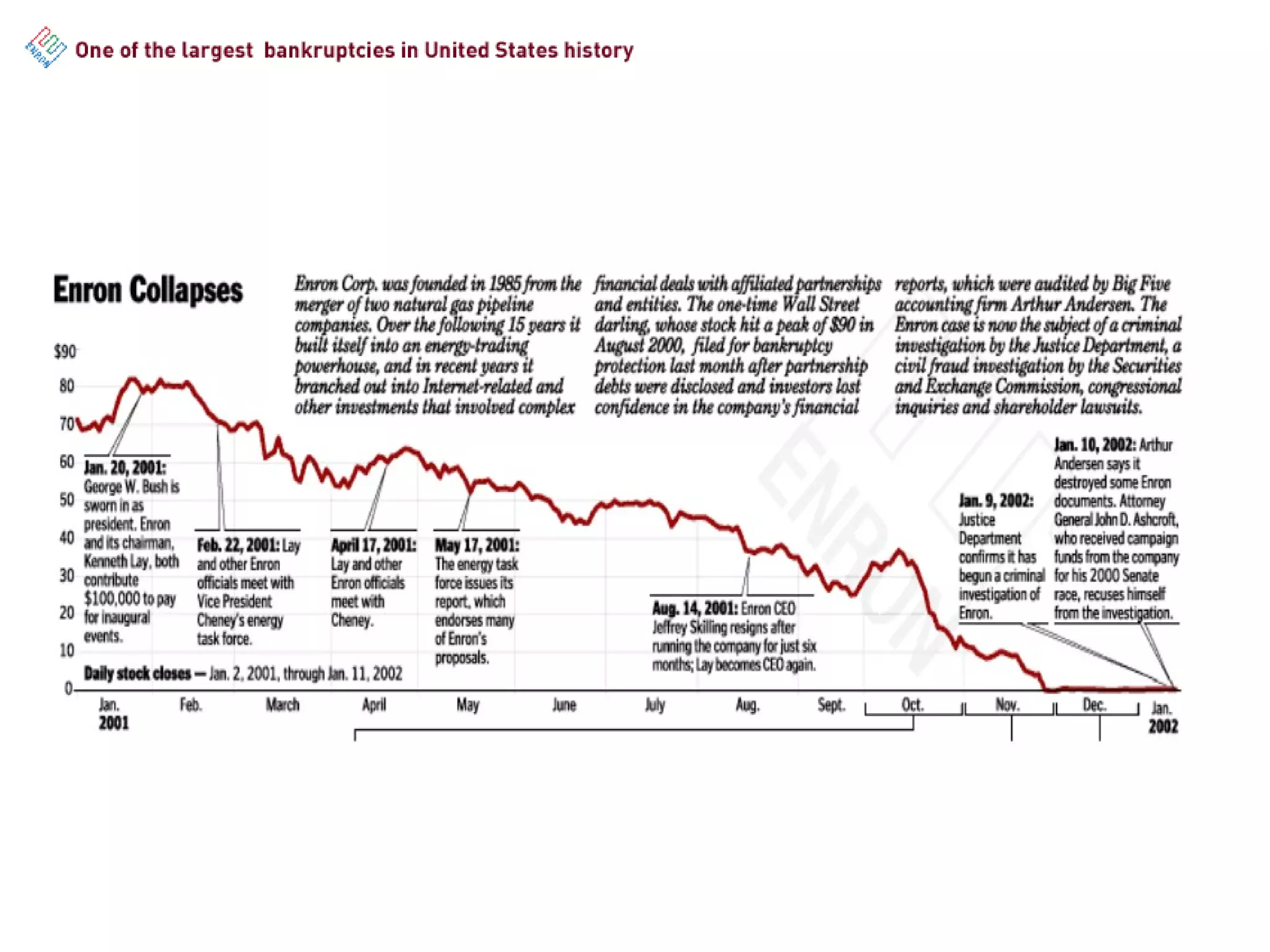

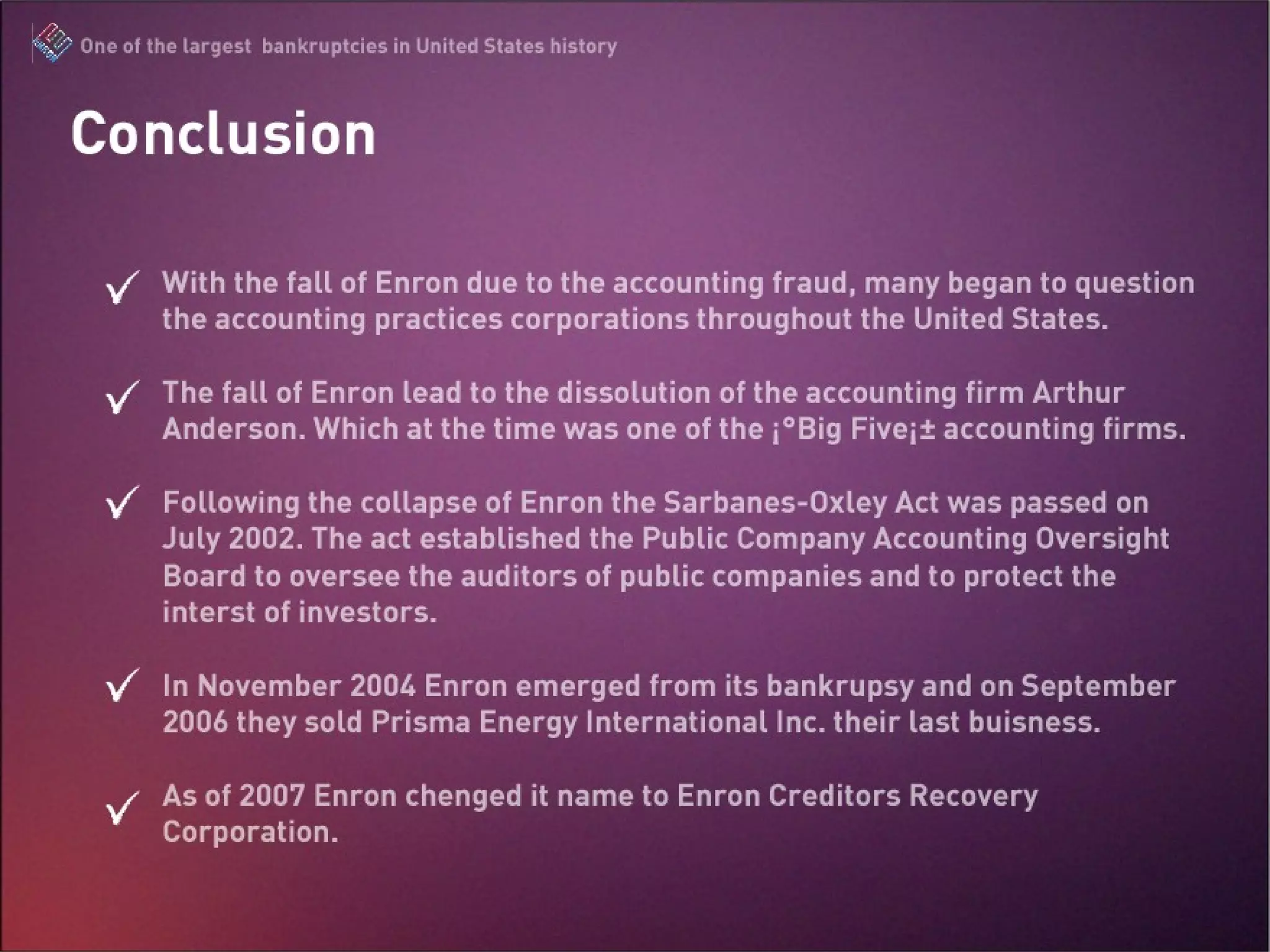

1) Enron began as a natural gas company in 1985 and grew to become an energy and commodities trading company, but collapsed in 2001 due to accounting fraud.

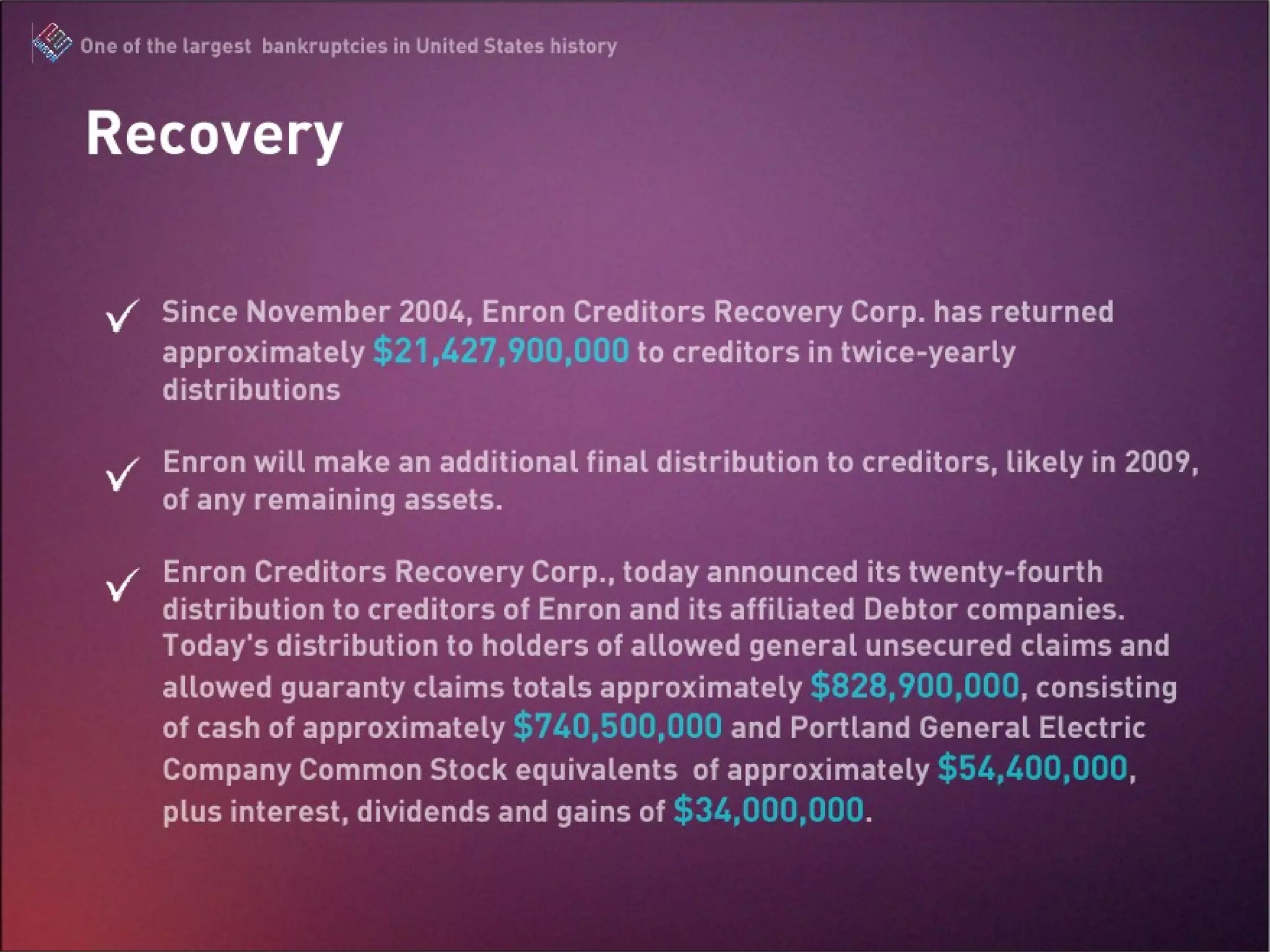

2) The scandal resulted in legislative reforms like the Sarbanes-Oxley Act and saw over $21 billion recovered for creditors through bankruptcy proceedings by 2008.

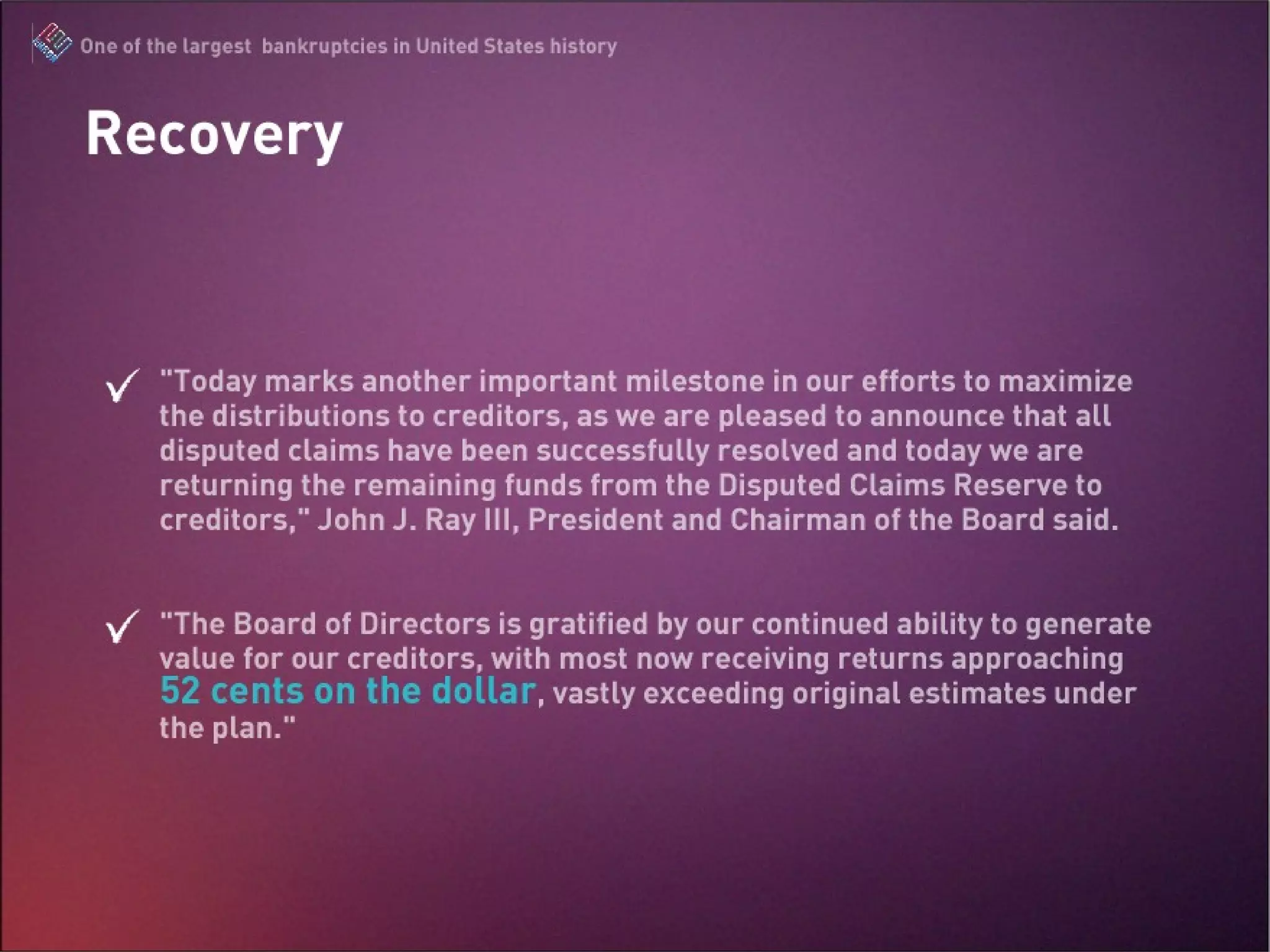

3) While the collapse of Enron damaged investor trust, recovery efforts saw most creditors receive returns approaching 52 cents on the dollar, exceeding original bankruptcy estimates.