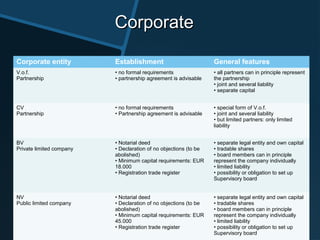

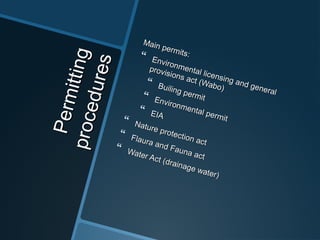

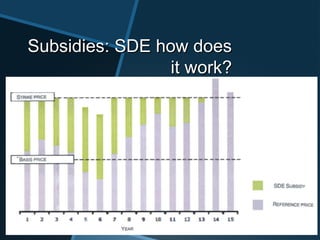

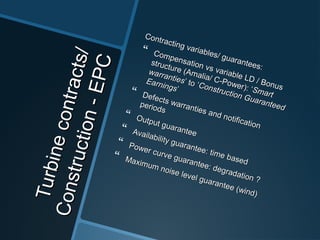

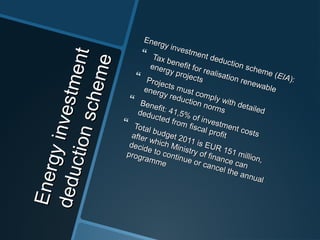

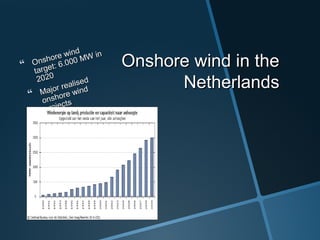

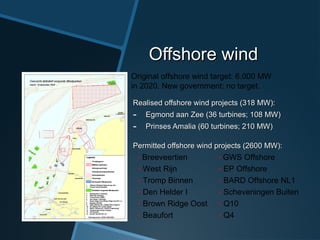

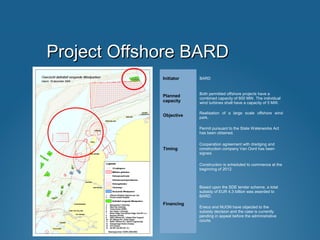

This document summarizes NortonRose's experience advising on various renewable energy and energy infrastructure projects in the Netherlands. It discusses solar, wind and other energy projects the firm has advised on, as well as M&A transactions, trading activities, and regulatory advice provided. It also summarizes the general corporate structures, land rights, grid connection issues, permitting procedures, subsidies available, turbine contracting considerations, and the investment deduction scheme for renewable energy projects in the Netherlands.