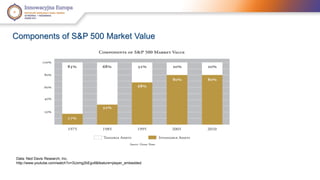

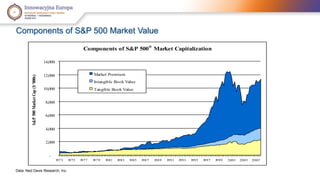

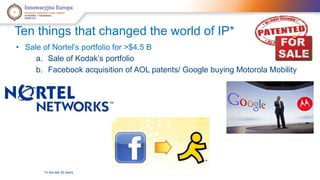

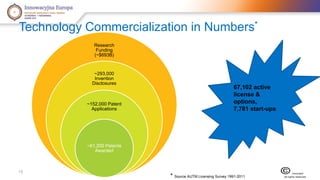

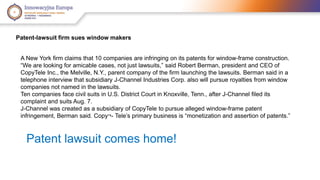

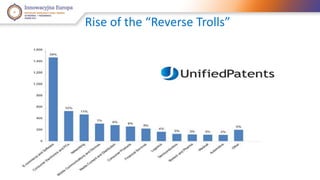

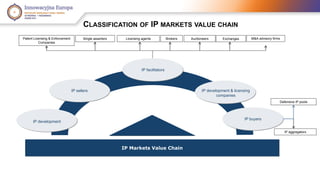

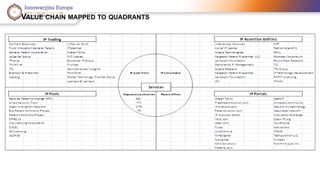

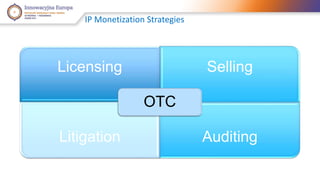

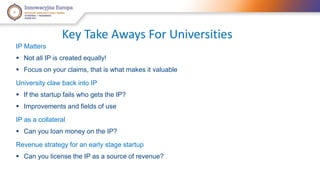

The document discusses the evolving landscape of intellectual property (IP), highlighting significant events, trends, and strategies in the IP market. It emphasizes the economic importance of IP, particularly for startups, and examines the impact of legislation like the America Invents Act. The document also explores various IP monetization strategies and risk management for early-stage companies.