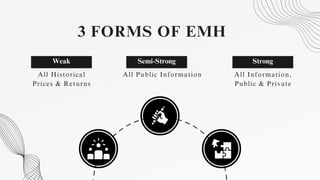

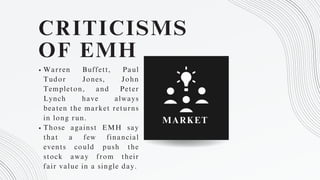

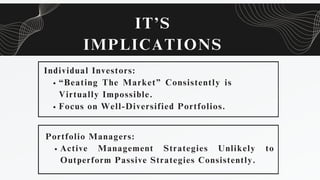

The efficient-market hypothesis proposes that financial markets are informationally efficient and that the prices of stocks and bonds reflect all available information at any given time. Eugene Fama first outlined this theory in 1970, stating that asset prices reflect all available information and it is impossible to consistently outperform the market on a risk-adjusted basis. The EMH comes in three forms - weak, semi-strong, and strong - based on what information is reflected in market prices. While the EMH is influential, some critics argue that certain investors like Warren Buffett have been able to consistently beat market returns over the long run.