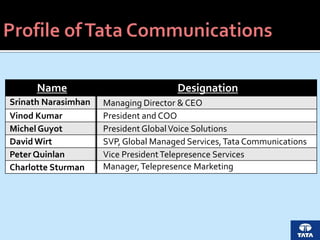

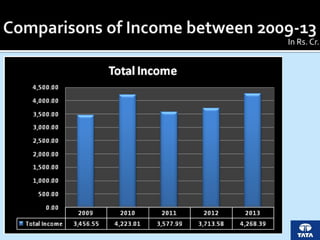

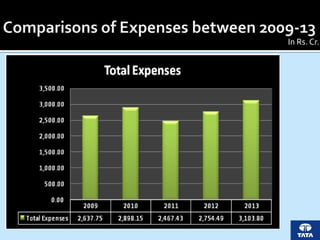

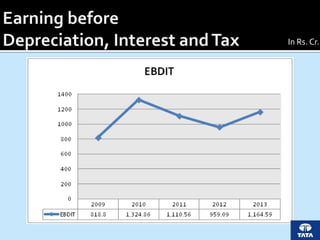

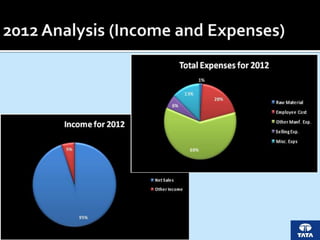

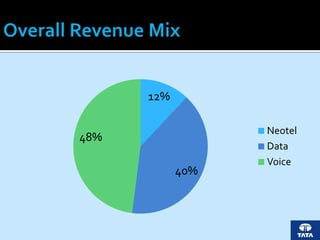

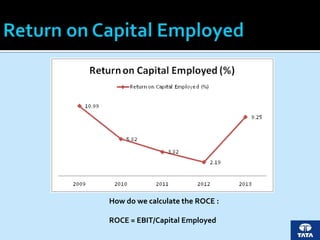

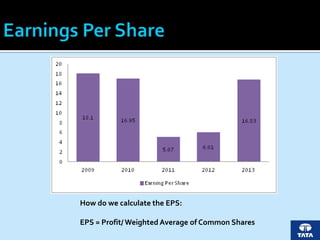

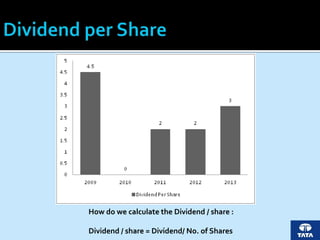

Tata Communications is an Indian multinational telecommunications company headquartered in Mumbai, India. It provides a range of network services and managed services including tele-presence, hosting, data centers, security, enterprise voice, and publicly available tele-presence. Key partners include Telefonica, Cisco, Dimension Data, Glowpoint, Starwood Hotels, Rendezvous Hotel Group, Neotel, and Taj Hotels. The presentation provides information on Tata Communication's mission, subsidiaries, leadership team, services provided to consumers and companies, new developments, awards received, and future outlook. Financial information from 2009-2013 shows increasing annual net sales. Voice services account for 48% of revenues, data for