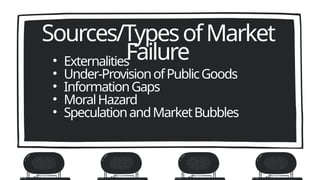

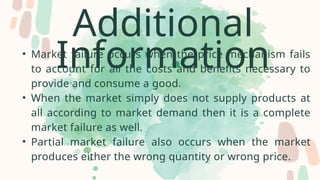

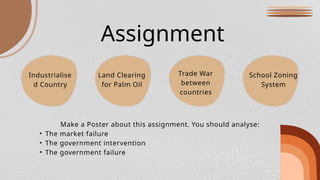

The document discusses market failure in economics, detailing its sources, types, and impacts on resource allocation. It explains concepts such as externalities, public goods, and the role of government intervention to correct inefficiencies. Additionally, it outlines how imperfect markets can lead to market failure and the potential consequences of government actions that may result in government failure.