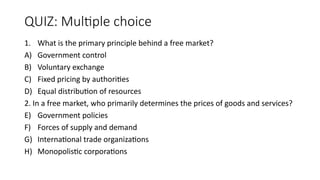

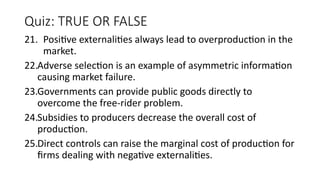

The document outlines the characteristics and principles of a free market, where prices are determined by supply and demand with minimal government intervention. It discusses market failures, including demand-side and supply-side failures due to externalities and public goods, and indicates that government intervention can correct these failures through subsidies or regulations. Additionally, it covers concepts like voluntary exchange, competition, and information asymmetry, along with providing quiz items to assess understanding of these economic concepts.