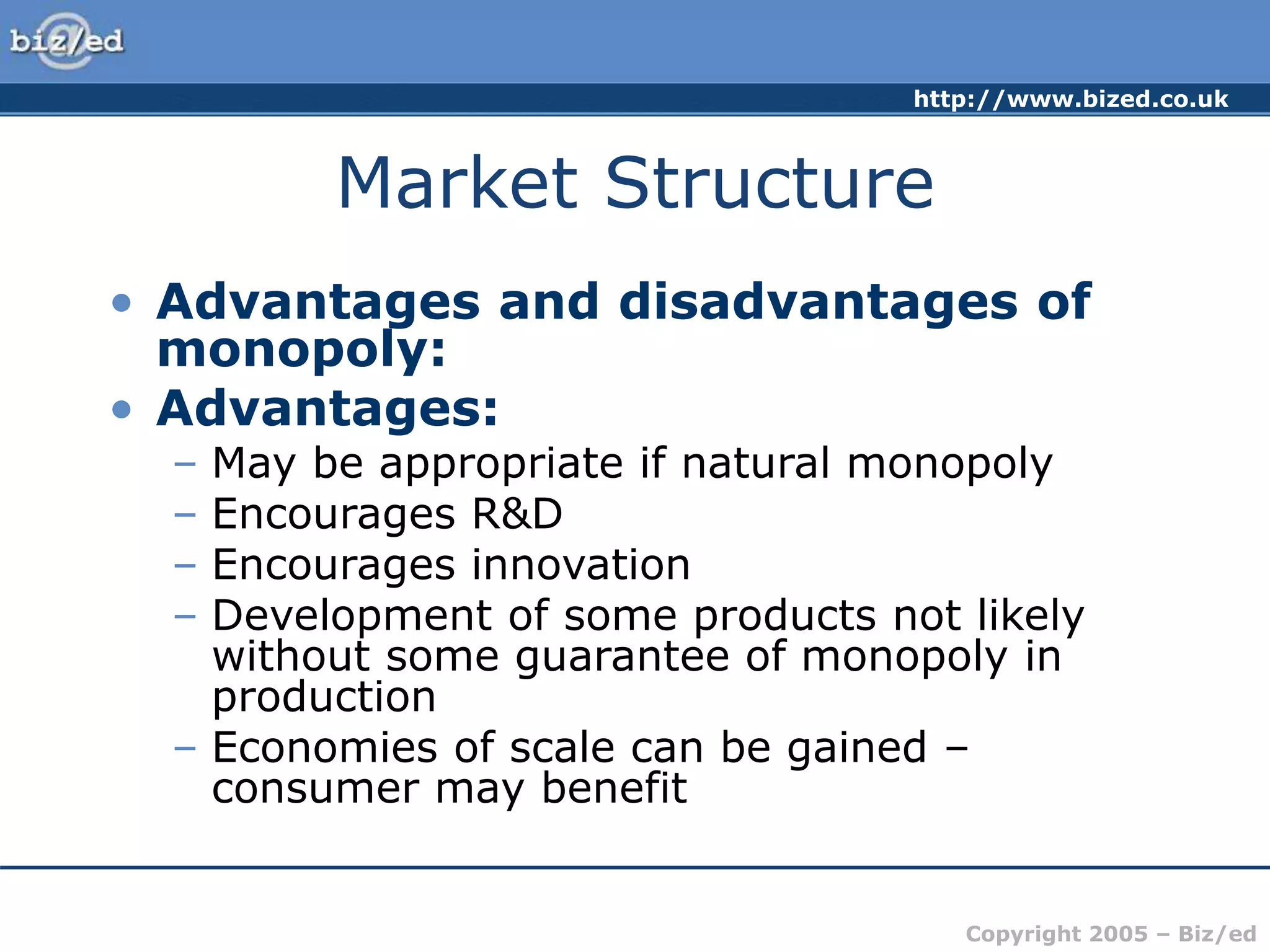

The document discusses different market structures: perfect competition, monopolistic competition, oligopoly, and monopoly. It describes the characteristics of each market structure, including the number of sellers, degree of product differentiation, barriers to entry, and firms' control over pricing and output decisions. The types of market structures influence firm behavior and market outcomes like prices, profits, efficiency, and consumer choice.