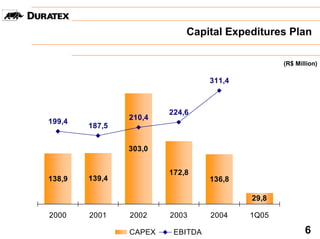

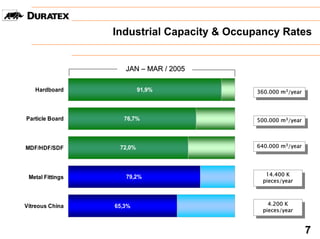

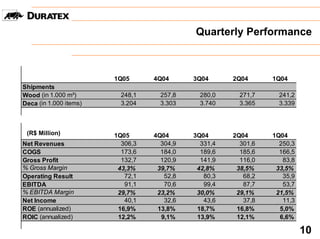

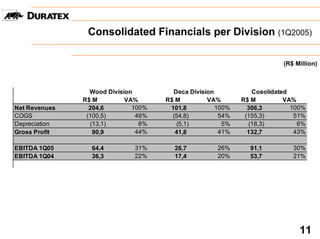

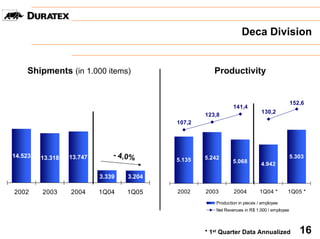

Duratex reported its first quarter 2005 results. Net revenues increased 22% to R$306 million compared to the first quarter of 2004. EBITDA grew 70% to R$91 million, with an EBITDA margin of 30%. Shipments increased slightly for wood products but decreased 4% for Deca division products compared to the first quarter of 2004. Dividends increased significantly to R$58 million, up 28% compared to 2004.