Embed presentation

Download to read offline

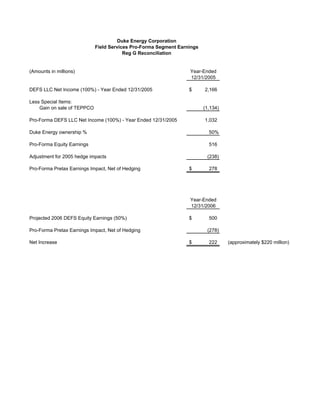

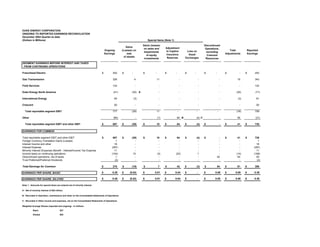

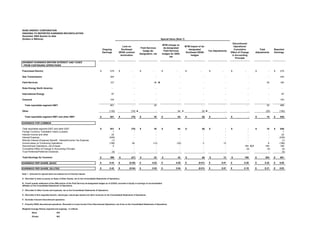

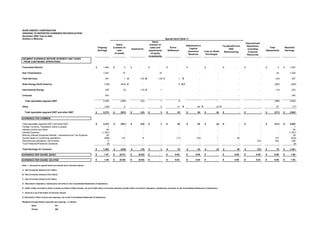

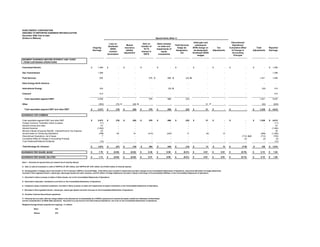

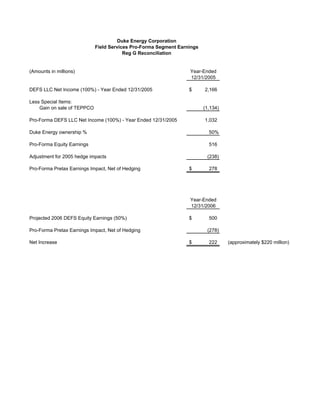

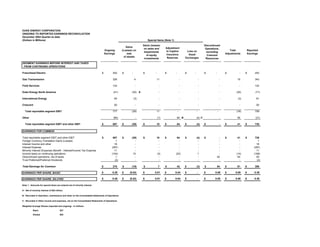

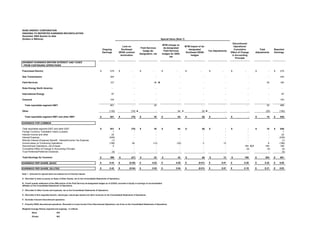

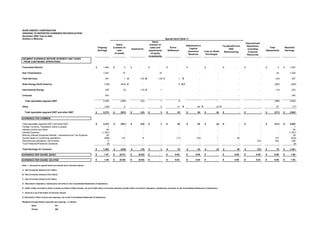

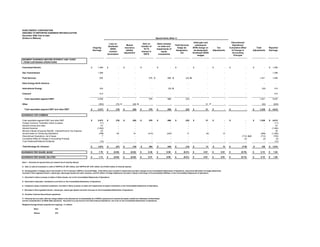

The document discusses Duke Energy Corporation's use of non-GAAP financial measures in its earnings presentations and forecasts. It provides reconciliations for several measures from 2006-2007, including ongoing EPS, segment EBIT, equity earnings, and funds from operations. The measures exclude special items that are non-recurring in order to provide a more accurate comparison of ongoing performance across periods. However, reconciliations to GAAP measures cannot be provided for forward-looking periods since special items cannot be predicted.